Table of Contents

- Introduction

- What is piotroski score?

- How do you calculate the Piotroski score for a company?

- How do you calculate the Piotroski score for a company in Excel with MarketXLS?

- What is a good Piotroski score?

- How accurate is the Piotroski score?

- What does a Piotroski score of 6 mean?

- Are there any limitations or drawbacks to the Piotroski score?

- What are other screening formulas in MarketXLS just like Piotroski score?

- Can the Piotroski score be used for industries other than manufacturing or retail?

- What historical performance trends are associated with high Piotroski scores?

- What are some real-world examples of stocks with high Piotroski scores?

- Summary

Introduction

When it comes to evaluating a company’s financial health, the Piotroski Score stands out as a trusted tool. Created by Stanford Professor Joseph Piotroski, this score ranges from 0 to 9, offering a snapshot of a firm’s financial stability. But what exactly is the Piotroski Score, and why do investors consider it indispensable? Let’s dive into its components and application, making stock analysis simpler and more effective.

What is piotroski score?

The Piotroski Score is a financial metric used to evaluate the financial strength of a company’s stock. Developed by Joseph Piotroski, a professor at Stanford, this score ranges from 0 to 9. It is based on nine criteria assessing profitability, leverage, liquidity, and operating efficiency. The score helps to identify the strongest value stocks by focusing on firms with solid financial health and high returns. Investors use it to screen for potentially high-performing stocks out of a broader set. A higher Piotroski Score indicates a stronger financial position and better stock stability.

How do you calculate the Piotroski score for a company?

The Piotroski score assesses a company’s financial strength based on nine criteria. First, check profitability by evaluating net income, return on assets, and operating cash flow. Positive net income, higher return on assets, and operating cash flow greater than net income each earn one point. Next, assess leverage, liquidity, and source of funds by examining changes in long-term debt, current ratio, and shares outstanding. Reductions in debt, an increased current ratio, and no new shares issued each earn one point. Finally, analyze operating efficiency by looking at changes in gross margin and asset turnover ratio. Improving margins and increasing asset turnover also earn points. Sum the points to get the final score. A score closer to nine indicates stronger financial health.

How do you calculate the Piotroski score for a company in Excel with MarketXLS?

To calculate the Piotroski F-Score using MarketXLS in Excel, you can use the =PitrioskiFScore("TICKER_SYMBOL") function. This function evaluates the financial strength of a company based on nine criteria related to profitability, leverage, liquidity, and operating efficiency, producing a score between 0 and 9. A higher score indicates a stronger financial position.

Here’s a step-by-step guide:

1. Open Excel and load the MarketXLS add-in.

2. Enter the Ticker Symbol: For example, let’s assume you want to calculate the Piotroski F-Score for Microsoft (ticker symbol: MSFT).

3. Use the Function: In any cell, you can type =PitrioskiFScore("MSFT").

4. Press Enter: The function will return the Piotroski F-Score for Microsoft.

Here’s how this can be displayed in Excel:

=A1: Ticker=A2: MSFT=B1: Piotroski F-Score=B2: =PitrioskiFScore(A2)To further break down how the Piotroski F-Score is calculated, it typically includes the following criteria:

– Profitability

– Positive return on assets (ROA)

– Positive operating cash flow

– Higher ROA in the current year compared to the previous year

– Cash flow from operations greater than ROA

– Leverage, Liquidity, and Source of Funds

– Lower ratio of long-term debt to assets compared to the previous year

– Higher current ratio (current assets/current liabilities) compared to the previous year

– No new shares issued in the last year

– Operating Efficiency

– Higher gross margin compared to the previous year

– Higher asset turnover ratio compared to the previous year

To execute this with MarketXLS:

– Install and set up MarketXLS.

– Ensure you have an active license and data feed connected properly.

– Utilize the provided function and confirm the results are displayed as per the financial metrics of the specified stock.

For more details on MarketXLS functions, consult the provided documentation or the MarketXLS website. If you face any issues, check the help section or contact support.

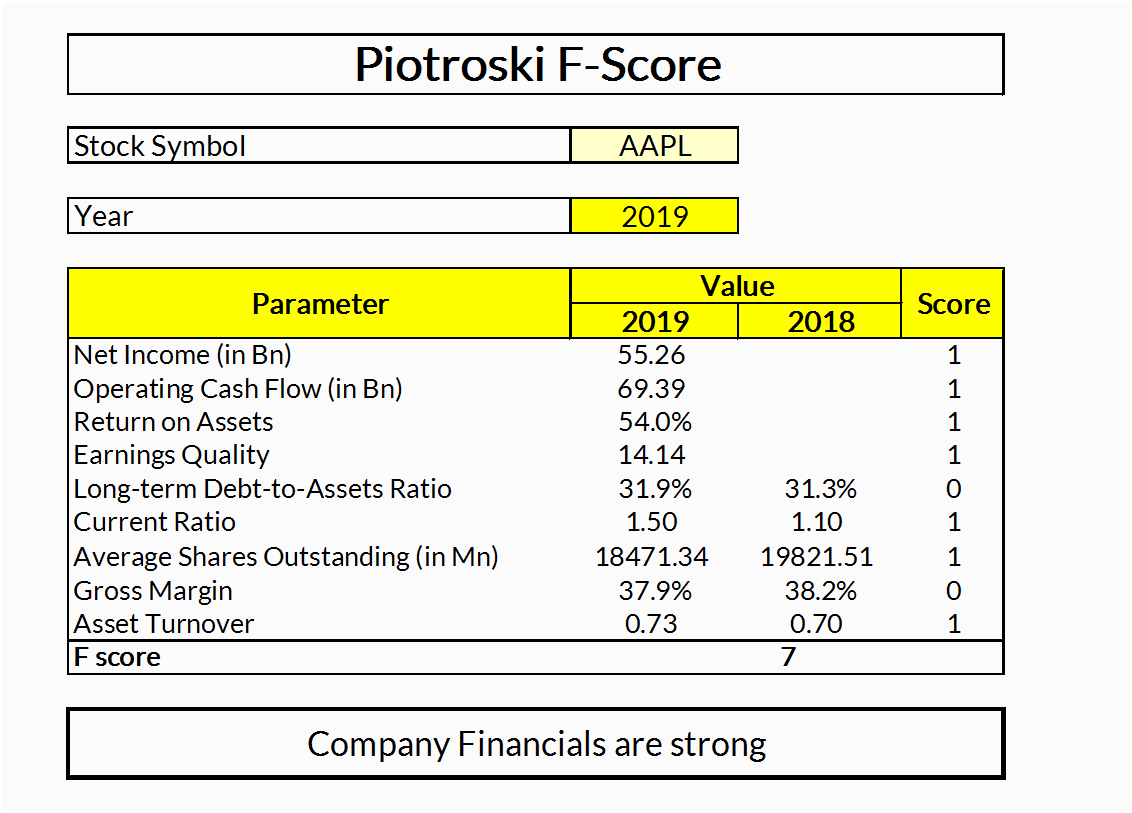

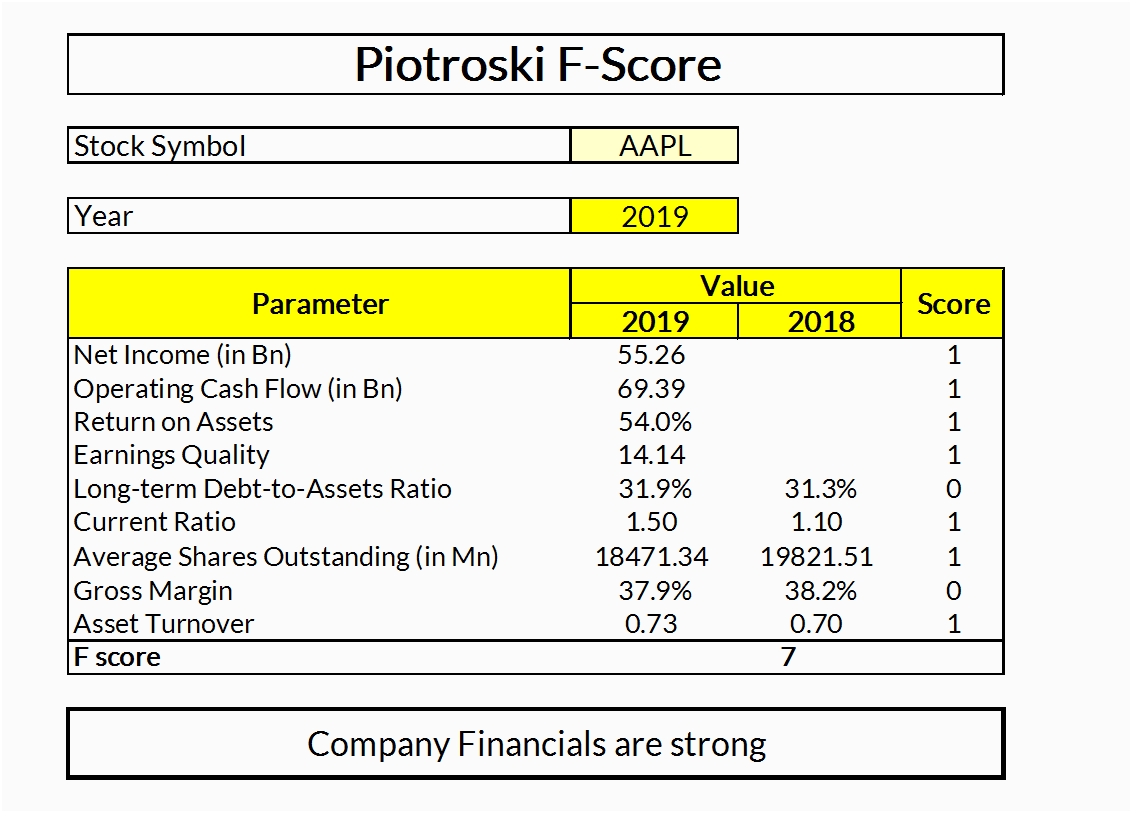

Here is the template you might want to checkout and marketxls has 100s of templates to get you started easily and save you time.

What is a good Piotroski score?

A Piotroski score ranges from 0 to 9, with 9 being the best possible score. A score of 8 or 9 is generally considered excellent. It suggests the company is fundamentally strong. Scores between 7 and 9 indicate good financial health. A score of 8 or higher is often seen as a signal to buy. Investors use this score to identify value stocks. Lower scores indicate potential financial issues. The Piotroski score helps filter out bad investments. It’s a quick way to assess a company’s performance. This makes it a valuable tool for investors.

How accurate is the Piotroski score?

The Piotroski score is a well-regarded metric for evaluating the financial health of a company. Developed by Joseph Piotroski, it uses nine criteria based on profitability, leverage, liquidity, and operating efficiency. Research shows that stocks with high Piotroski scores tend to outperform the market over time. However, it’s not foolproof. It relies on historical financial data, which doesn’t always predict future performance. Moreover, the score may not consider the nuances of certain industries. Investors often use it in combination with other tools for a more comprehensive analysis.

What does a Piotroski score of 6 mean?

A Piotroski score of 6 indicates a moderately positive financial health for a company. This score falls within the mid-range of the 0 to 9 scale, where higher numbers signify stronger financial performance. A score of 6 suggests the company has achieved some, but not all, of the nine criteria set by the Piotroski F-Score. These criteria include profitability, leverage, liquidity, and operating efficiency. Investors might see this score as a sign that the company is relatively stable but has areas needing improvement. It is neither poor nor excellent but indicates an average level of fiscal prudence and efficiency. Generally, such a score encourages a deeper look into the specifics of the company’s financial statements before making investment decisions.

Are there any limitations or drawbacks to the Piotroski score?

The Piotroski score is a useful tool for evaluating the financial health of a company, but it has some limitations. One drawback is that it relies solely on historical financial data, which may not always predict future performance accurately. Additionally, the Piotroski score does not consider industry-specific factors or qualitative aspects of a company, like management quality or brand strength. Its focus on past financials means it might miss emerging trends or disruptions in the market. Moreover, companies can sometimes manipulate financial metrics to appear healthier than they are. Lastly, the score is most effective for small-cap value stocks, limiting its applicability across various market segments.

What are other screening formulas in MarketXLS just like Piotroski score?

In MarketXLS, there are several screening formulas available that are similar to the Piotroski score. These are often referred to as “Guru Screens” and represent various investment strategies. Here is a list of some of these screening formulas:

1. Buffettology EPS Growth Screen: Returns stocks based on the investment strategy of Warren Buffett, focusing on companies with consistent earnings per share (EPS) growth .

2. Foolish Small Cap 8 Screen: Identifies profitable small-cap stocks based on eight specific parameters designed by the Motley Fool .

3. Graham Defensive Investor Utility Screen: Focuses on utility sector companies with consistent financial performance and positive growth outlook, based on Benjamin Graham’s defensive investor principles.

4. Graham Defensive Investor Non-Utility Screen: Focuses on non-utility companies with solid financial conditions and consistent profitability.

5. Kirkpatrick Value Screen: Focuses on well-performing but currently undervalued stocks based on Charles Kirkpatrick’s investment criteria.

6. Lynch Screen: Identifies stocks that are consistently profitable, relatively unknown, and have low debt, based on Peter Lynch’s investment philosophy .

7. Murphy Technology Screen: Recognizes technology stocks with high R&D spending, high pre-tax margins, and strong equity return.

8. O’Shaughnessy Growth Market Leaders Screen: Returns stocks based on Jim O’Shaughnessy’s growth market leaders strategy .

9. O’Shaughnessy Tiny Titans Screen: Focuses on micro-cap stocks meeting value, size, and momentum criteria.

10. Oberweis Octagon Screen: Identifies rapidly growing small and mid-sized companies based on value, growth, and momentum criteria.

11. Templeton Screen: Identifies undervalued stocks with a positive long-term outlook, based on Sir John Templeton’s value investing principles.

12. Walter Schloss ‘New Lows’ Screen: Identifies stocks trading below their book value, based on Walter Schloss’s strategy of buying undervalued stocks at new lows.

13. Zweig Screen: Identifies companies with strong growth in earnings and sales combined with a reasonable price-earnings ratio, based on Martin Zweig’s investment criteria.

These screening formulas can be accessed using their respective functions in MarketXLS, making it easier for investors to identify stocks that fit specific investment strategies .

Here is the template you might want to check out and MarketXLS has 100s of templates to get you started easily and save you time:

– Template: Beneish M Score

– Link: Beneish M Score – MarketXLS

Can the Piotroski score be used for industries other than manufacturing or retail?

The Piotroski score can indeed be applied to industries beyond manufacturing or retail. It evaluates financial health through various metrics, like profitability, leverage, and liquidity. These metrics are relevant to multiple sectors. However, certain industries may require adjustments. For example, financial companies have unique accounting practices. Standard Piotroski score metrics might not capture their performance accurately. Adapting the score could improve its applicability across different industries. Overall, the Piotroski score provides a versatile framework that, with some modifications, can be useful for evaluating various sectors.

What historical performance trends are associated with high Piotroski scores?

High Piotroski scores are generally associated with positive historical performance trends. Companies with strong financial health often score well on this measure. These firms typically demonstrate strong profitability and efficiency. Historical data indicates they tend to outperform the market. Stocks with high Piotroski scores often have less financial distress and robust asset quality. Additionally, they usually show improving margins and solid cash flow. These trends can attract investor confidence. As a result, such companies frequently see higher stock returns. Notably, investors use high Piotroski scores to identify value stocks with good fundamentals. This scoring system provides a useful benchmark for evaluating financial robustness.

What are some real-world examples of stocks with high Piotroski scores?

The Piotroski score is a financial metric used to evaluate a company’s financial strength based on nine criteria. Some real-world examples of stocks with high Piotroski scores include Apple, Facebook, and Intel. These companies demonstrate strong profitability, robust liquidity, and operational efficiency. Apple’s solid balance sheet and consistent profit margins contribute to its high score. Facebook’s growth in revenues and earnings alongside minimal debt levels also boosts its Piotroski score. Similarly, Intel’s efficient asset utilization and healthy cash flow position it favorably. These examples show how established tech companies can achieve high Piotroski scores.

Summary

The Piotroski Score assesses a company’s financial health, with a range from 0 to 9. Developed by Stanford Professor Joseph Piotroski, it uses nine criteria focused on profitability, leverage, liquidity, and operating efficiency. A higher score indicates better financial stability. Calculating the score involves evaluating net income, return on assets, cash flow, debt, current ratio, shares issued, gross margin, and asset turnover. Excel users can calculate this score using MarketXLS. A score of 8-9 is excellent, signaling strong financial health. While accurate, it relies on historical data, which might not always predict future performance. Stocks like Apple, Facebook, and Intel typically have high scores. The Piotroski Score, although versatile, may need adjustments for certain industries.