Meaning

Strip Straddle is one of the market-neutral trading strategies with profit potential on both sides of the underlying price movement. It is basically a slightly altered version of the Long Straddle strategy. The Strip Straddle is in fact a “bearish” market neutral strategy providing double the profits on downside price movement as compared to equivalent upside price movement. (a “Strap Straddle” in contrast, is a bullish market-neutral strategy).

This strategy consists of buying a number of at-the-money calls and twice the number of at-the-money puts of the same underlying asset, expiration date and strike price.

Therefore, one can use it when he is expecting a big movement in the price of the underlying stock, although not completely sure in which direction, but predicts a downward movement is more likely than an upward one. It will profit from a big movement in either direction, but will make higher profits in a downside movement.

Strip Straddle Construction

Execution of the Strip Straddle strategy involves buying at the money calls and at the money puts, just like the Long Straddle strategy. The only difference is one needs to buy a higher number of puts than calls:

- Buy 1 ATM Call

- Buy 2 ATM Puts

The main choice one needs to make is what ratio of puts to calls to use. As a starting point, a 2 to 1 ratio is suggested but one can adjust this as he finds it suitable.

Profit Potential

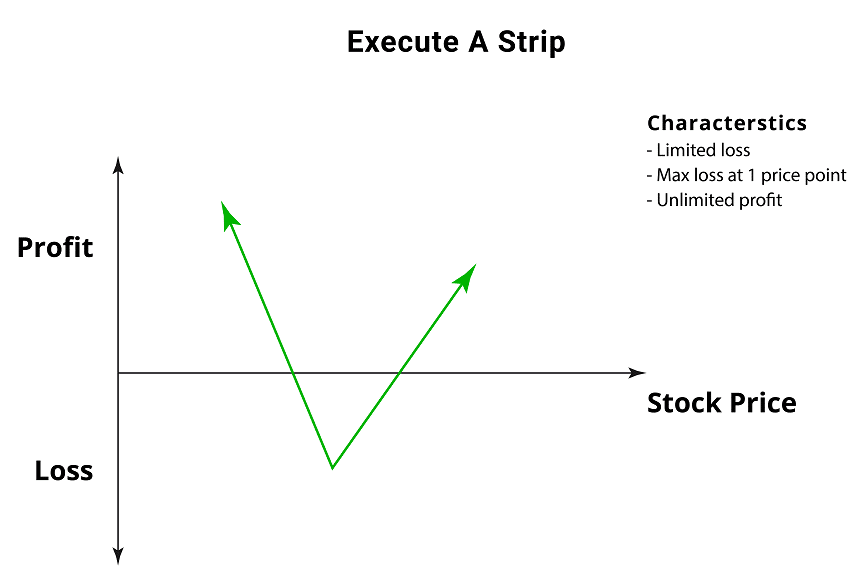

Large profit is achievable with this strategy when the underlying asset price makes a strong movement either downwards or upwards at expiration, with greater gains to be realized with a downward move.

The formula for calculating profit is:

- Profit Achieved when Price of Underlying < Strike Price of Puts/Calls – (Net Premium Paid/2) or when Price of Underlying > Strike Price of Calls/Puts + Net Premium Paid

- Profit = 2 x (Strike Price of Puts – Price of Underlying) – Net Premium Paid or Price of Underlying – Strike Price of Calls – Net Premium Paid

- Maximum Profit = Unlimited

Limited Loss

The maximum loss for the strip straddle is limited and occurs when the underlying asset price on the expiration date is trading at the strike price of the Put and Call options bought. At this level, all the options expire worthless and the trader loses the entire premium paid to enter the trade.

The formula for calculating maximum loss is given below:

- Max Loss = Net Premium Paid + Commissions Paid

- Max Loss occurs when Strike Price of Puts/Calls = Price of Underlying at expiration

- Maximum Loss = Limited

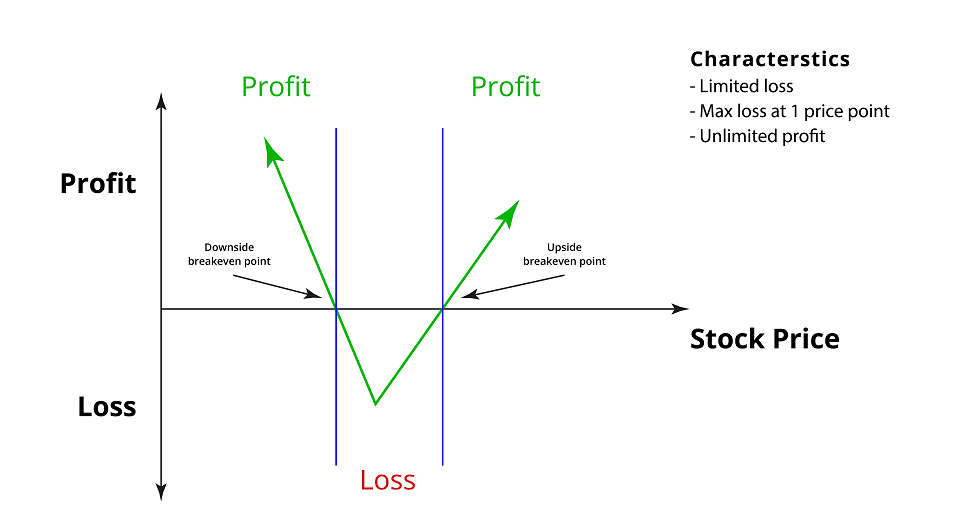

Breakeven Points

There are 2 breakeven points for the Strip Straddle position:

- Upper Breakeven Point = Strike Price of Puts/Calls + Net Premium Paid

- Lower Breakeven Point = Strike Price of Puts/Calls – (Net Premium Paid/2)

Applying Strip Straddle Strategy Using MarketXLS Template With an Example:

MarketXLS software is a one-stop solution for the analysis of your entire investments. It provides a host of functions like EPS, various ratios, key fundamentals, historical data, options pricing and much more to assess the value of your investments. It provides a variety of templates for various options trading strategies and also to compare your portfolio stocks for better analysis of your investments.

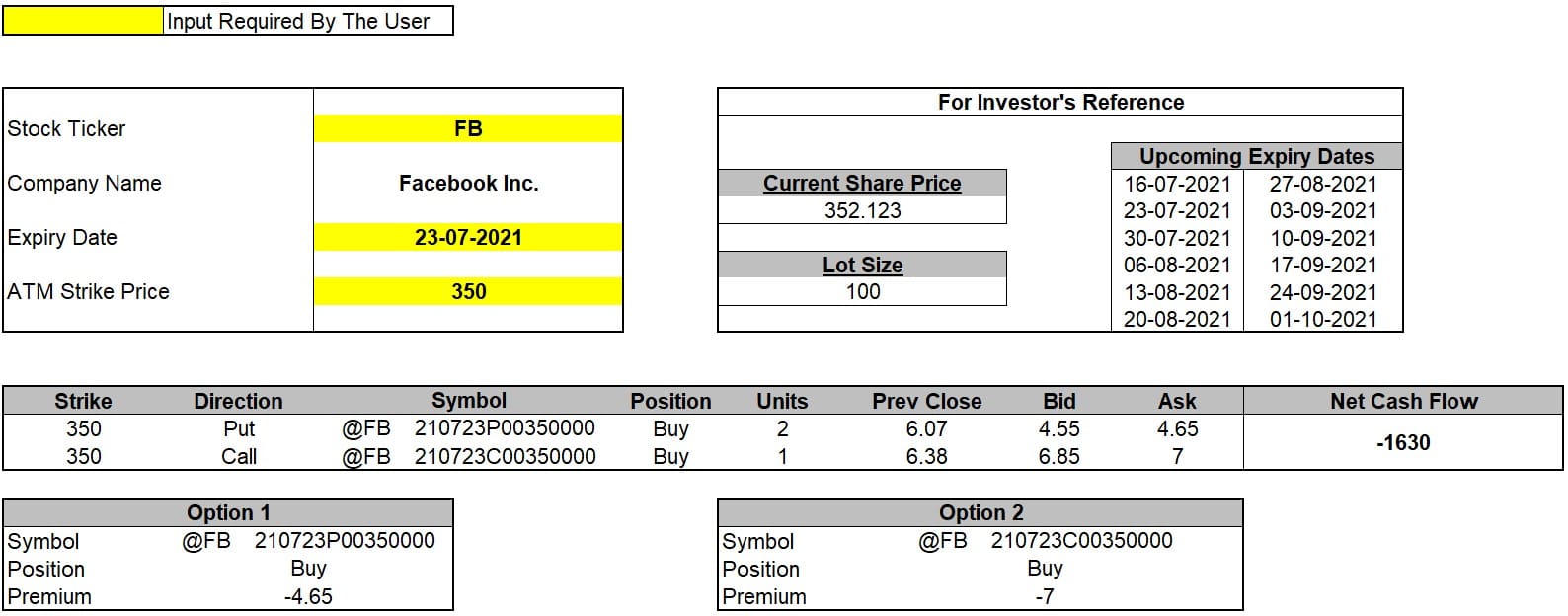

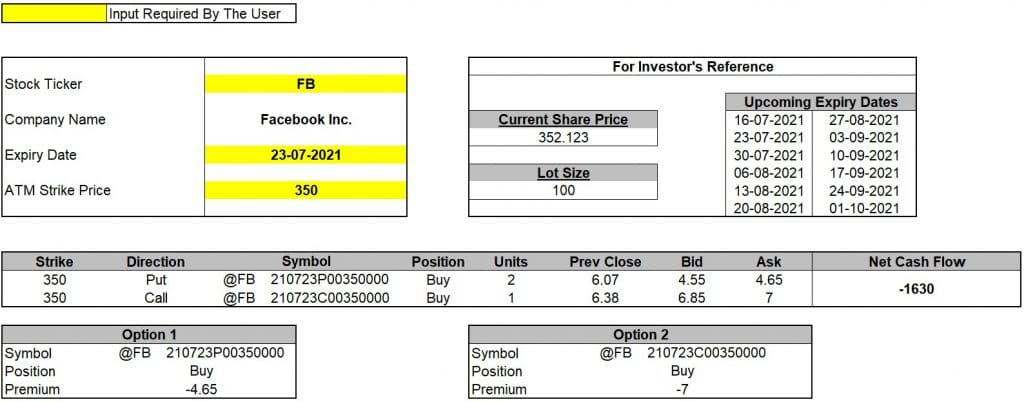

Step 1: Enter the stock ticker in cell D6 and press enter. The template will provide the upcoming expiry dates for the stock, current market price and lot size. Select any one of the expiry dates and change the lot size according to your preference.

Link to the template: https://marketxls.com/template/strip-straddle/

Step 2: Enter the ATM strike price in cell D12.

Step 3: The template might ask you to refresh. Go to the MarketXLS tab in the ribbon > Refresh All. Click on Refresh All.

The template uses the ask price for options to calculate the related premium to be paid (net cash flow) by you.

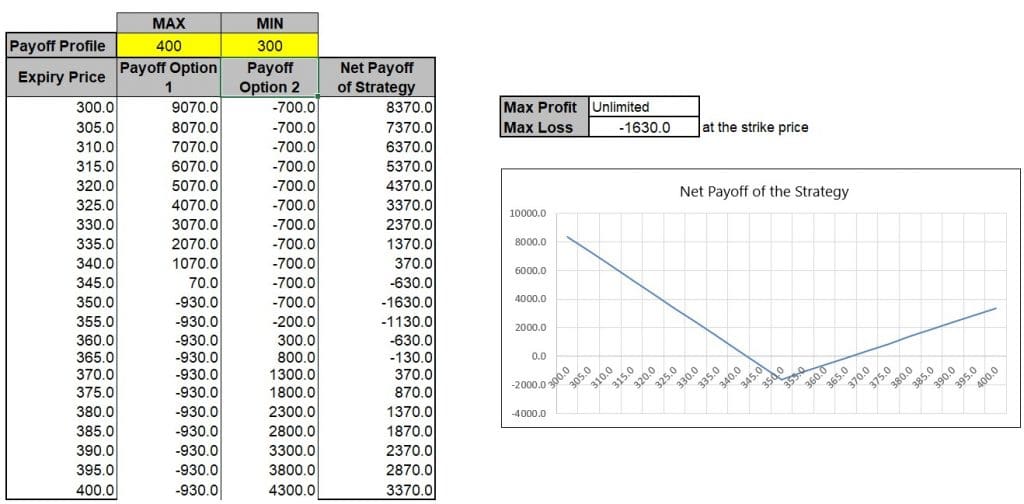

Step 4: The template also provides the Net Payoff Profile of the strategy. You need to enter the expected minimum and maximum expiry prices for the period. It will calculate the net profit or net loss for all the levels of expiry prices and present it graphically.

Facebook Inc. (FB) as an example in the above template:

FB stock is trading at levels of $352 on 12th July, 2021. I have selected the upcoming expiry of 23rd July, 2021 to enter the trade. I want to execute a Strip Straddle options strategy at the current level by buying an ATM Call @$350 and also buying 2 ATM Puts @$350 as I believe there is more potential for the stock to go downwards.

The template will calculate the premium amounts for all the options and thus calculate the net cash flow for entering the trade, which is $1630 debit in this case.

[ -4.65*100*2($350 Put) – 7*100($350 Call) = -$1630 ]

Suppose if the stock keeps trading @$350 on the expiration date, both the Puts and Call option expire worthless and I will suffer the maximum loss which is equal to the initial debit of $1630 taken to enter the trade.

Suppose the stock rallies to $380 at expiration, the Put options will expire worthless but the Call option expires in the money and has an intrinsic value of $3000. Subtracting the initial debit of $1630, the profit comes to $1370.

Suppose the stock crashes down to $320 at expiration, now the Call option will expire worthless but both the Put options will expire in money with an intrinsic value of $6000. Subtracting the initial debit of $1630, the profit comes to $4370, thus giving greater profits with the same margin in expiry prices. This profit will even be greater if the stock price dives below $320. The net profit can easily be determined by looking at the net payoff table within the template.

Here is a video explaining the Short Put Ladder Strategy using MarketXLS:

Bottom Line

The Strip Straddle strategy is simple enough to make it suitable for beginners who do not have a thorough knowledge of the stock markets. It is a great alternative to the long straddle if you believe that the price of the underlying security is more likely to break out to the downside than the upside. This might be a good strategy to try just before earnings reports if you’re expecting some huge revelation or bad news.

One would probably want to choose an expiry date in the very near future, otherwise, he will have to pay a lot of time premium on the contracts with longer dates.

There are only two transactions involved, so the commissions aren’t particularly high, and there are no margin requirements.

Disclaimer

All trademarks referenced are the property of their respective owners. Other trademarks and trade names may be used in this document to refer to either the entity claiming the marks and names or their products. MarketXLS disclaims any proprietary interest in trademarks and trade names other than its own, or affiliation with the trademark owners.

Reference

https://www.theoptionsguide.com/strip.aspx