Short Condor Spread

The Short Condor Spread strategy is to profit from a stock moving up or down beyond the highest or the lowest strike price. The trader expects the price of the stock to be volatile i.e. massive price movement in any direction to take place.

The Short Condor Spread strategy is a direction neutral strategy with limited risk and a limited profit. The strategy involves buying OTM and ITM call options and selling ITM call option of a lower strike price and OTM call option of a higher strike price of the same underlying stock.

All options must have:

> Same Expiry Date

> Same underlying

> Legs must have the number of contracts in the ratio 1:1:1:1.

Created by: Nikita

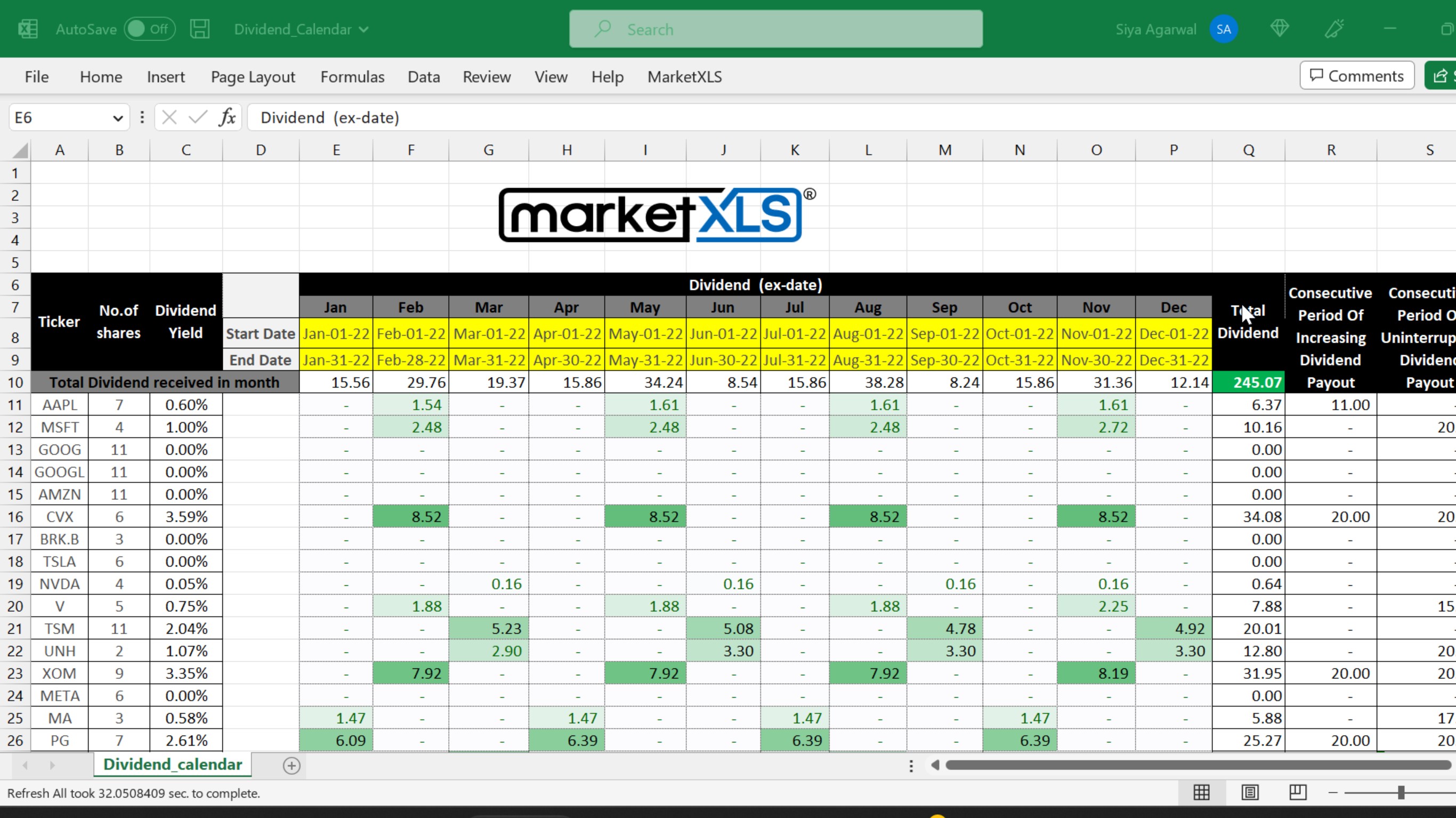

Interested in building, analyzing and managing Portfolios in Excel?

Download our Free Portfolio Template

Call: 1-877-778-8358

Welcome! I'm Ankur, the founder and CEO of MarketXLS. With more than ten years of experience, I have assisted over 2,500 customers in developing personalized investment research strategies and monitoring systems using Excel.

I invite you to book a demo with me or my team to save time, enhance your investment research, and streamline your workflows.

I invite you to book a demo with me or my team to save time, enhance your investment research, and streamline your workflows.

Implement "your own" investment strategies in Excel with thousands of MarketXLS functions and templates.

MarketXLS provides all the tools I need for in-depth stock analysis. It's user-friendly and constantly improving. A must-have for serious investors.

I have been using MarketXLS for the last 6+ years and they really enhanced the product every year and now in the journey of bringing in AI...

MarketXLS is a powerful tool for financial modeling. It integrates seamlessly with Excel and provides real-time data.

I have used lots of stock and option information services. This is the only one which gives me what I need inside Excel.

Meet The Ultimate Excel Solution for Investors

Live Streaming Prices in your Excel

All historical (intraday) data in your Excel

Real time option greeks and analytics in your Excel

Leading data service for Investment Managers, RIAs, Asset Managers

Easy to use with formulas and pre-made sheets