While there are many methods to arrive at the intrinsic value of the stock for value investing, one approach is the Earnings Power Value, or EPV. A Columbia University Professor Bruce Greenwald developed this approach. In this article we will learn about the Earnings power Value method to value investing and we will also build an Earnings Power Value Spreadsheet using MarketXLS that you can use to check intrinsic value of any stock.

When it comes to stock markets, there are many approaches to investing and you should choose one that suits your beliefs and style. One such style of investing commonly referred to as value investing is a long-term investing approach where an investor aims to buy stocks that have a low market price compared to the fundamental value that the investor thinks the stock is worth. Since the investor thinks that the market price is lower than its fundamental value, te expects the price of the stock to rise and therefore buys the stock. This perceived difference between market price and intrinsic value of the stock is referred to as margin of safety. Generally, the discount should to be atleast 30-50% for investors interest in the stock.

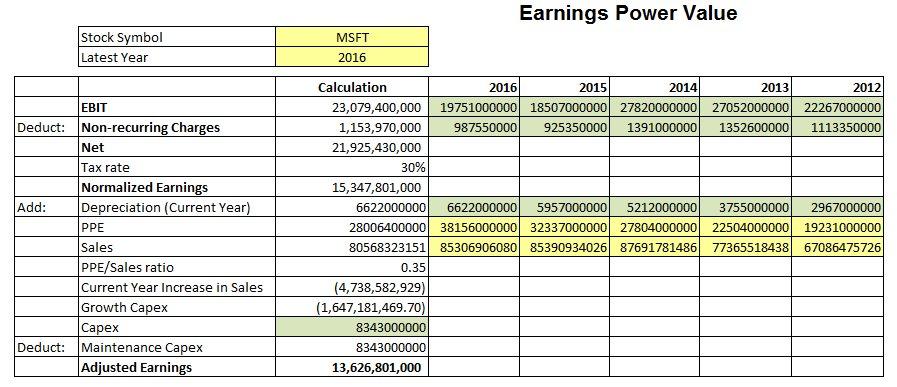

Earnings Power Value

**Earnings Power Value Formula **The formula for Earnings Power Value is based on the assumption that the current earnings of the firm are sustainable under a no growth scenario. EPV estimates the enterprise value by dividing an earnings measure with the weighted average cost of capital.EPV = Adjusted Earnings / rr is the cost of capital. We arrive at the adjusted earnings by adjusting the earnings for one time charges, depreciation, capital expenditures, taxation adjustments, and more adjustments based on the business cycle and other details. Finding the adjusted earnings can be difficult.

Let’s look at it in a bit more detail:

####**1. Adjusted Operating Earnings **We start with the adjusted operating earnings, i.e., EBIT. We take an average of adjusted operating earnings over the past 5-7 years. This is done to normalize the operating earnings in order to remove the effects of business cycles.

####**2. Deduct for Non-recurring Charges **We then deduct the long-term average of non-recurring charges from the normalized operating earnings.

####**3. Taxation Adjustment **We can either use an average tax rate of the company over the 5-7 year period or use the general corporate tax rate and apply it to the figure we get in step 2.

####**4. Depreciation Adjustment **We now add back the after-tax depreciation of the most recent year as it may not reflect the true economic cost of depreciation. Some analysts may deduct the entire depreciation while other may deduct only a percentage (such as 20%) of the depreciation value.

####**5. Subtract Maintenance Capital Expenditure **The next step is to deduct the maintenance capex which reflects the economic depreciation. We can calculate this by deducting growth capex from the capex in the cash flow statement. We calculate growth capex by taking an average of Gross Property Plant and Equipment (PPE)/ sales ratio over a long-term period and multiplying this by the current year’s increase in sales.**5. Adjusted After-tax EBIT **We now have the adjusted after-tax EBIT of the firm. We divide this by cost of capital to arrive at the earnings power value of the firm.

After deriving the EPV, we can compare it with the reproduction value. If the EPV is higher than the reproduction value, then the management is adding value and the firm is earning more that it’s cost of capital.

We can also compare EPV per share with the market price. If market price is below EPV per share, then the stock may be undervalued. For a fair comparison, we must first subtract any corporate debt from the EPV, and add back any cash in excess of operating requirements. This number is then divided by the number of shares to arrive at EPV per share.

Note that there are no hard rules for arriving at the EPV or reproduction value. What Greenwald provides is a method along with his recommendations of how to evaluate each item. Each analyst will come up with a different valuation based on their understanding of the financial statements and the business.

###** Earnings Power Value Spreadsheet (Example)**To demonstrate how we can calculate the Earnings Power Value, we have created a spreadsheet. This spreadsheet showcases the entire calculation using the Microsoft (MSFT) stock. It starts from the operating earnings and then make all the adjustments to calculate the EPV per share of the company. Users need to input some data in cells marked in Yellow. Furthermore, we can fetch some important data using the MarketXLS ‘hf’ functions. We have marked these cells in Green. As you can see in spreadsheet, the EPV per share of Microsoft stock is much lower than its market value. This indicates that the stock is overvalued. Note that EPV is an estimate and can differ based on an analyst’s interpretation of the adjusted earnings and cost of capital.

#Buy the EPV Template These template is open and have no password. Please feel free to modify as per your needs and extend it for your needs

-** MarketXLS EPV Template Template**

Instant Delivery

Secure Processing