Esg Investing- Meaning, History, Strategies

Meet The Ultimate Excel Solution for Investors

- Live Streaming Prices Prices in your Excel

- All historical (intraday) data in your Excel

- Real time option greeks and analytics in your Excel

- Leading data in Excel service for Investment Managers, RIAs, Asset Managers, Financial Analysts, and Individual Investors.

- Easy to use with formulas and pre-made sheets

Meaning

Environmental, social and governance (ESG) investing is a strategy you can use to invest in companies that aim to make the world a better place. ESG investing relies on a company’s behaviour and policies when it comes to environmental performance, social impact and governance issues.

Here is a look at the three criteria used to evaluate companies for ESG investing:

- Environment– How does a company impact the environment? This includes companies’ toxic chemicals used in its manufacturing processes, carbon footprint and sustainability efforts that make up its supply chain.

- Social– What kind of social impact a company has, both on the company and on the broader community? Social factors include everything from racial diversity in both the executive suite and staff overall, LGBTQ+ equality, and inclusion programs and hiring practices. It even considers how a company strives for social good in the wider world, its responsibilities towards society and also beyond its limited sphere of operations.

- Governance– How does the company’s management and board drive positive change? It includes everything from issues surrounding diversity in leadership, executive pay, as well as how well that leadership responds to and interacts with stakeholders.

For many people, ESG investing addresses how a company serves all its stakeholders: customers, shareholders, workers, communities and the environment.

History of ESG Investing

Over decades, many management teams and investors have adhered to the shareholder value theory popularized in 1970 by Milton Friedman. Friedman argued that companies’ only responsibility is to maximise shareholder value i.e. to create money for the people holding their shares. The toxic focus of only concentrating on profit maximisation goal pervades in a company’s culture and it’s more likely that employees will engage in dangerous, risky decisions, or maybe illegal dealings to appease management’s demands for immediate profit.

For decades, Friedman’s shareholder value theory has been supported because investors are enjoying hefty returns, but modern investors are increasingly realizing that making other stakeholders suffer is just too high a price for society to pay. A company’s stakeholders aren’t just its shareholders and employees, but they also include its suppliers, customers, communities, neighbours, distributors, and also the environment. Shoddy treatment of stakeholders who also are shareholders presents financial risk since those poorly treated stakeholders have the ability to damage the corporation by selling their shares. This collective realization helps to clarify why ESG and other ethically focused investing strategies have grown in popularity.

ESG- In Broader Sense

ESG investors consider a company’s record in these three areas, along with its financial performance, when making investment decisions.

E is for Environmental

- Greenhouse gas emission goals and transparency about how the company is meeting those goals.

- Climate change plans, disclosures, and plans.

- Carbon footprint and intensity (emissions and pollution).

- Green technologies, products, and infrastructure.

- Water-related goals and issues, such as conservation, usage, waste disposal, and overfishing.

- Recycling and safe disposal practices.

- Using renewable energy, like wind and solar.

S is for Social

- Employee benefits, pay, treatment, and perks.

- Employee development and training.

- Employee turnover and engagement.

- Employee safety policies, especially related to sexual harassment prevention.

- Inclusion of diversity in hiring and in awarding advancement raises and opportunities.

- Customer service responsiveness and friendliness.

- Ethical sourcing of supply chains, such as conflict-free minerals and responsibly sourced coffee and food.

- Maintaining community parks, partnering with NGOs, doing charitable donations for the underprivileged sections of the society.

- Performance history for consumer protection issues, including recalls, lawsuits, and regulatory penalties.

G is for Corporate Governance

- Executive bonuses, compensation, and perks, including whether executives receive large bonuses when they decide to leave the company.

- Diversity of the management team and board of directors.

- Compensation linked to metrics that cause long-term enterprise value.

- Chance for conflicts of interest among the board of directors.

- Whether a company has a classified board of directors, which implies whether term lengths among board members differ.

- Proxy access i.e. shareholders’ ability to present board of director candidates.

- Whether the company’s CEO and chairman roles are separate.

- The outcome and nature of lawsuits brought by stakeholders.

- Transparency of information with stakeholders.

Strategies Related to ESG Investing

- Impact Investing

Impact investing is more focused on intent and less focused on returns. With impact investing, investors make investments in market sectors dedicated to solving persistent problems around the globe. These sectors could include those making advancements in housing equity, green and renewable energy, affordability, healthcare access and more.

The Global Impact Investing Network (GINN) has four published guidelines for impact investments:

- Investment with return expectations- Obviously, investments should generate a return on capital invested.

- Impact measurement- Investments should have a level of transparency so investors can assess how their money helps to bring meaningful change.

- Intentionality- Investments are made with the intention to bring positive environmental or social change.

- Range of return expectations and asset classes- Different investment areas should have aligned expectations about returns. Sometimes these returns are below market rate.

For example, An impact investor may choose to focus on supporting a highly impactful sector, such as sustainable fashion. Impact investors give their money to companies that have demonstrably positive environmental and social impacts.

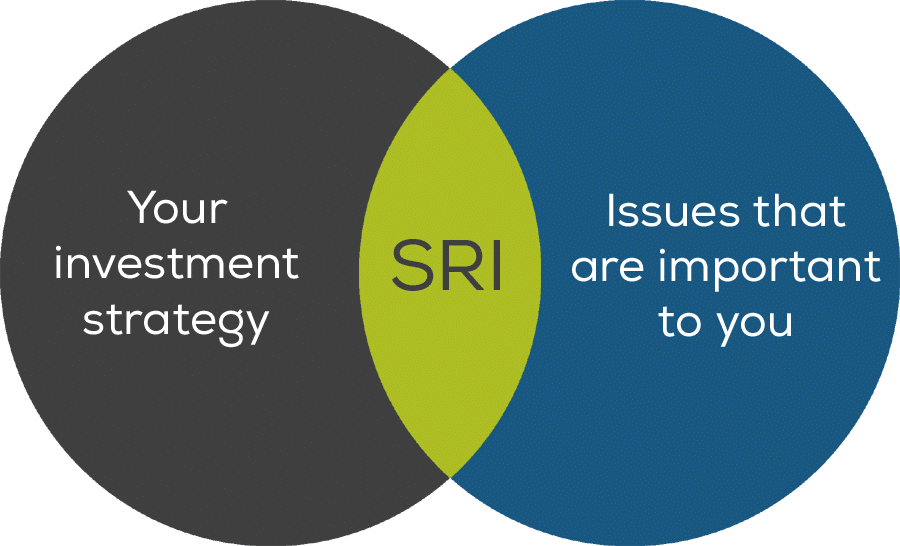

2. Socially Responsible Investing (SRI)

Socially responsible investing (SRI) is a strategy that helps investors align their choices with their personal values. SRI presents a framework for investing in companies that agree with your social and environmental values. ESG focuses on corporate performance while SRI only focuses on the investor’s values. SRI generally uses filters, or screens, to eliminate those industries and companies that don’t meet an SRI investor’s particular value criteria.

For example, if peace and harmony are key factors for you, one possible SRI strategy would be to completely avoid investment in companies that make weaponry, arms, and ammunition stuff i.e. McMillan stocks. An ESG strategy might be fine with investing in McMillan stocks so long as the companies environmental record was strong, and their social and management policies met high standards.

3. Conscious capitalism

Conscious capitalism is the belief that companies should act with the utmost ethics while they chase profits. It is a business management strategy that seeks to align the priorities of a business with those of its stakeholders for shared growth and success.

The four guiding principles of the movement, as defined by Conscious Capitalism, are:

- Stakeholder orientation- A company’s leaders should cultivate an ecosystem that balances the wants of all stakeholders equally, not overweighting shareholder returns at the cost of other stakeholders.

- Higher purpose- Profit for such companies is a reward for a well-built-conscious company. They move toward a larger impact on the world and higher purpose beyond money and market share.

- Conscious culture- Companies should purposely create a culture within their businesses that promote their vision and values.

- Conscious leadership- Leaders should try to develop an inclusive culture and give equal importance to the interests of all stakeholders in the business—from employees to customers to shareholders.

Should you consider ESG Investing?

While justifying ESG from a purely financial perspective, it is important to remember that ESG is a stakeholder centric approach. If you believe that considering the priorities of all stakeholders is a dependable way to generate above-market returns, then you may even treat ESG investing as a responsibility.

According to US SIF‘s 2018 Report on Sustainable, Responsible, and Impact Investing Trends, the value of the U.S. assets under management that have SRI or ESG-related mandates has jumped 38% since 2016 to $12 trillion. There are a variety of reasons why ESG-focused investing is becoming more mainstream. A frequently observed reason is that millennials consistently show a tendency to support social responsibility, whether it’s through the products they purchase, the organizations they work for, or their investment portfolios.

ESG investing isn’t all that puzzling, but it is something to get and remain excited about. If you’re attracted to the more traditional SRI and want your portfolio to perform well in the long run, then ESG investing may be the strategy for you.

Disclaimer

All trademarks referenced are the property of their respective owners. Other trademarks and trade names may be used in this document to refer to either the entity claiming the marks and names or their products. MarketXLS disclaims any proprietary interest in trademarks and trade names other than its own, or affiliation with the trademark owners.

None of the content published on marketxls.com constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The author is not offering any professional advice of any kind. The reader should consult a professional financial advisor to determine their suitability for any strategies discussed herein. The article is written for helping users collect the required information from various sources deemed to be an authority in their content. The trademarks if any are the property of their owners and no representations are made.

Reference

https://www.forbes.com/advisor/investing/esg-investing/

https://www.fool.com/investing/stock-market/types-of-stocks/esg-investing/

If you want to know about Investing in ESG Stocks, click here.

For more such Informative content, visit https://marketxls.com/blog/

Image Source

https://sustainability-academy.org/the-power-of-esg-sustainable-investing/

I invite you to book a demo with me or my team to save time, enhance your investment research, and streamline your workflows.