Usually we are inclined to sell the shares in our portfolio that are performing well and hold onto those performing poorly. Why our risk-taking tendencies vary considerably, depending on whether our investment portfolio is out-performing or under-performing? Why is it significant that the recent credit crisis, the worst economic recession that the US has seen since the 1930s, took place 75 years after the Great Depression?

Behavioral finance is a relatively new school of thought that addresses and provides insight into questions like these. All of us have innate psychological biases that can lead to predictable “errors” in making critical financial decisions. Behavioral finance catalogs these errors and helps us to anticipate, and hopefully avoid, these decision-making “traps.”

Understanding Behavioral Finance

Behavioral finance can be studied from various perspectives. Stock markets are one area of finance where psychological behaviors are assumed to influence market returns, but there are also many different considerations. With the help of behavioral finance classification, one can understand why people make certain financial choices and how those choices can affect markets. It is assumed within behavioral finance that financial participants are not perfectly rational and self-controlled but rather prone to psychological influence with somewhat normal and self-controlling tendencies.

The Normal Behavior V/S Rational Behavior

To understand irrational behavior and errors we first need to understand how rational people are expected to behave when making financial decisions. People may commonly use the term “Rational” for sensible or normal people. However, in financial economics, it is used a little more narrowly. Rational investors in financial economics are always known to have preferred more wealth to less. They are also indifferent about whether a given increment to their wealth takes the form of cash payments or an increase in the market value of their holdings of shares, as described by Merton Miller and Franco Modigliani in their article about dividends.

These rational investors can also be described as immune to all cognitive and emotional errors. They are distinguished from their roles as investors and their roles as consumers. As investors, rational people care only about the benefits of wealth. As consumers, they also care about the expressive and emotional benefits of keeping that wealth or spending it.

The Wedding Planner Example

For instance, when choosing a wedding planner, a rational couple will rank all wedding planners by the complete set of benefits and costs quickly and accurately and then choose the best. But, the normal couple may find ranking all wedding planners by the complete set of benefits and costs too complicated. Instead, they will begin with a cognitive shortcut that simplifies the problem by excluding planners from outside their city or the wedding location and setting a maximum price they are willing to pay.

They might add an emotional shortcut, accounting for their feelings of ease in interactions with the planner. Normal couples may choose good planners, even if not the best, such as medium-cost working in their city, ones who seem easy to interact with.

Investors often use shortcuts by a similar method, whether excluding from consideration mutual funds with fewer than four stars or choosing mutual funds from a “top 10” list in a newspaper or magazine.

Good shortcuts enable normal couples and investors to get close to the best choices, solutions, and answers. A wedding planner from a neighboring city might have been the best choice if the couple did not limit their search to planners from their city. A fund just short of $100 million in assets under management might have been the best choice if the investor did not limit their search to funds with assets under management exceeding $100 million. But the choice of wedding planners from their city or funds with assets under management above $100 million might come close enough to their best choice, solution, and answer.

Cognitive and emotional shortcuts turn into cognitive and emotional errors when they take normal people far from their best choices, solutions, and answers. Cognitive shortcuts that simplify choices turn into cognitive errors when they induce such couples to save time and effort by failing to check the track record of the weddings planned by the company. And cognitive shortcuts that simplify choices turn into cognitive errors when they induce investors to save time by failing to examine whether a fund’s recent good performance indicates anything more than good luck.

Emotional shortcuts stirred by feelings of affinity turn into emotional errors when they induce normal couples to hire a company skilled at manipulating potential customers. And emotional shortcuts stirred by feelings of affinity turn into emotional errors when they induce investors to choose a poorly managed fund whose manager graduated from the same school as they did.

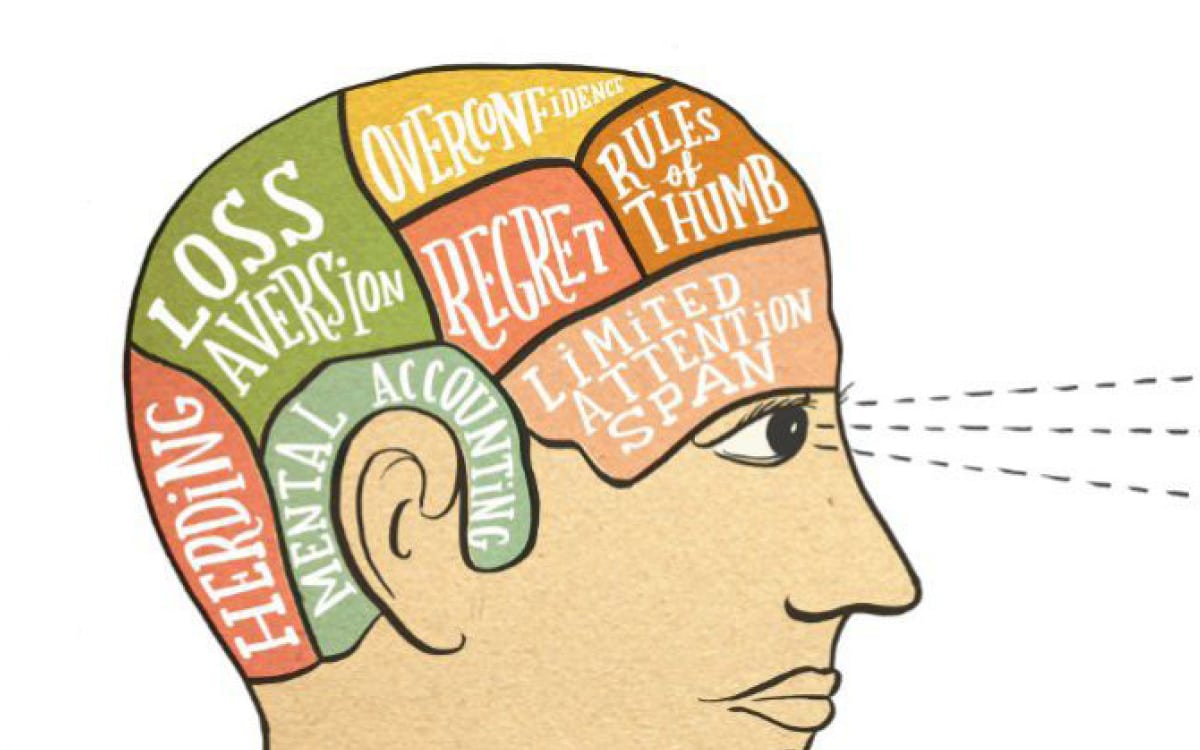

Concepts in Behavioral Finance

- Mental accounting

It is a concept in behavioral finance introduced by Richard Thaler, which notes that people place the value of money differently, and it exposes them to irrational decision-making. Such behaviors can be observed when we make large expenditures, such as on a house or a car; we will more readily add on expensive optional items that we would never usually purchase on our own. Next to a $300,000 home, a few thousand dollars on furniture feels minimal.

- Herd behavior

Many times investors are anxious of the Fear Of Missing Out (FOMO) caused by not being invested in certain stocks that are quite in trend among other investors.

This leads them to believe and copy what other investors usually do. These behaviors are largely influenced by emotion and instinct rather than by their independent analysis.

- Anchoring

It’s a bias where a particular view or ‘anchor’ influences an individual’s decisions. If they take action based on an initial view, they are very reluctant to change that view, as it spotlights the earlier error in decision-making.

- Self Attribution

Self-attribution bias tends to generate increased over-confidence, as individuals give greater weight to outcomes that support their original hypothesis. Overconfidence increases over time as a function of past investment success.

- Loss Aversion

The negative response to losses is greater than our positive feelings about gains; even if the size of the gain is greater than the size of the loss. It means the positive feeling experienced from a gain of $2,000 and the negative feeling from a loss of just half that amount (i.e., $1,000), are equivalent in size.

The Bottom Line

Even when we believe that we are making decisions very rationally, it may so happen that these decisions are taken with a predetermined bias that we may have unknowingly. Sometimes, these biases can help get quick and efficient outcomes. However, it may not always happen. Many times these shortcuts may prove to be a significant error and cause us great loss. Investing behaviors should not be affected by these biases, and investors should always think about “rational” decision-making.

Disclaimer

None of the content published on marketxls.com constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person.

References

Behavioral Finance – Duke University.docx – BEHAVIORAL …. https://www.coursehero.com/file/87880168/Behavioral-Finance-Duke-Universitydocx/

CFA INSTITUTE RESEARCH FOUNDATION- MEIR STATMAN BEHAVIORAL FINANCE