Liquidation value is an estimation of the ultimate value which can be received by the holder of monetary instruments when an asset is sold, typically under a rapid sale process. The liquidation value is the cashable value of company land, fixtures, equipment, and inventory. Intangible assets are excluded from a company’s liquidation value like intellectual property, goodwill, and brand recognition.

Example

Liquidation is the difference between value of tangible assets and liabilities. As an example, assume liabilities for company Z are $300,000. Also, assume the book value of assets found on the balance sheet is $1 million, the salvage value is $50,000, and the estimated value of selling all assets at auction is $800,000, or 80 cents on the dollar. The liquidation value is calculated by subtracting the liabilities from the auction value, which is $800,000 minus $300,000, or $500,000.

▪ Liquidation Value vs Market Value

Market value essentially provides the highest valuation of assets although the measure can be lower than book value if the value of the assets has reduced due to market demand rather than business use.

▪ Liquidation Value vs Book Value

The book value is the value of the asset as recorded on the balance sheet. The balance sheet lists assets at the historical cost, so the value of assets may be different from the market prices. In an economic environment where prices rise, the book value of assets is lower than the market value.

Liquidation value is normally lower than book value. The Book Value of a firm’s common stock is found by deducting the value of the firm’s liabilities, and preferred stock, if any, as recorded on the balance sheet, from the value of its assets.

▪ Liquidation Value vs Salvage Value

The salvage value is the value given to an asset at the end of its useful life i.e. scrap value. Liquidation value is generally greater than salvage value. This is because the assets continue to have value, but they are sold at a loss because they must be sold quickly.

Types of Liquidation

▪ Voluntary Liquidation

A Voluntary Liquidation is started by resolution of the company’s Directors and then its Shareholders. A Voluntary Liquidation takes one among two forms looking at the solvency of the corporation (if it pays its debts once they fall due). Solvent companies require a Members Voluntary Liquidation (MVL). Insolvent companies require a Creditors Voluntary Liquidation (CVL).

▪ Members Voluntary Liquidation

A Members Voluntary Liquidation (MVL) may be a formal way to finish up a solvent company. An MVL requires the corporate to be ready to pay all of its debts and that all tax lodgements are up so far . So in MVL, a corporation is in a position to pay its debts fully , alongside interest. This procedure is typically used when the shareholders of a corporation wish to retire, realise their investment or where the corporation is surplus to requirements.

▪ Creditors Voluntary Liquidation

If your company is insolvent (can’t pay its debts when they fall due) then it needs a Creditors Voluntary Liquidation (CVL). Don’t get confused by the name – a CVL is also initiated by the shareholders of a company.

▪ Official Liquidation

Sometimes it’s also called a Court Liquidation. During this variety, a creditor of the corporation applies to court to force the debtor company into liquidation. Finally, a court can make a winding-up order on the petition of an unpaid creditor or the corporation itself, its director or shareholders. The method to do so is lengthy and may be relatively expensive for the creditor. If the corporation fails to pay the cash demanded within the Statutory Demand the creditor then makes an application to the Court to possess the corporate wound up.

▪ Provisional Liquidation

In urgent cases involving assets which will be in danger an applicant can move to the Courts and request a Provisional Liquidator be appointed to guard those assets. So during a Provisional Liquidation the Liquidator safeguards the assets, and assesses the position of the corporate , then usually recommends to the Court an appropriate outcome or resolution.

Calculating Liquidation Value of a Company

Step 1 – Prepare the Balance Sheet of the company

Step 2 – Find the Market value of Tangible Assets

Step 3 – Find the Liquidation Value of Liabilities

Step 4 – Calculate Net Liquidation Value

Using Liquidation Valuation Analysis Template With MarketXLS:

Liquidation Value gives a good insight into the worth of the company, and how much it would be after selling its assets. It also tells about how much money will be distributed to all its investors once it liquidates. A firm having more market price per share than its Liquidation value per share, will not be able to return the full amount to its shareholders.

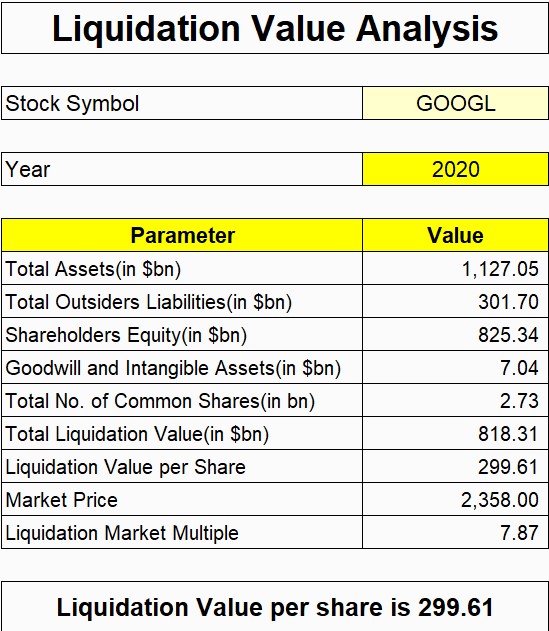

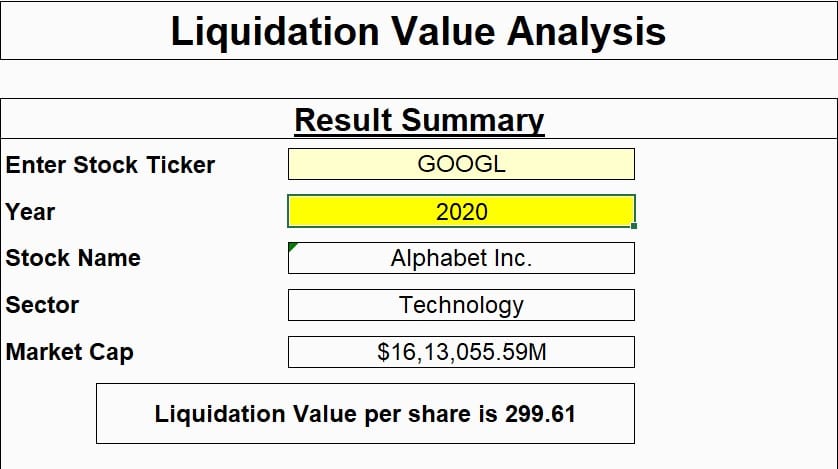

Step 1: Enter Stock Ticker in cell E7 and year in cell E9 of the sheet and press enter to get the result. Here I have used Google’s stock (NASDAQ:GOOGL) for the year 2020 as an example to calculate its liquidation value. The result summary will also provide with the sector and market capitalization of the company.

Link to the Template: https://marketxls.com/template/liquidation-value-analysis/

Step 2: For deeper analysis, switch to the Calculation sheet and look at the detailed working of the Liquidation Value Analysis. This sheet gives us the total assets, total liabilities, liquidation value and other important data about the company.

Liquidation value is calculated with the following formulas : –

With the help of MarketXLS, you can stream market data for stocks, ETFs, options, mutual funds, currencies refreshed, or refresh on-demand. You can also get all the historical data (EOD, Intraday) you may need with MarketXLS functions in a few clicks. Update the Excel tables dynamically and save your time in formatting those tables. Also get access to a variety of templates like this and compare your portfolio stocks to get better analysis of your investments.

Advantages of Liquidation

▪ It takes matters at the end of an insolvent business that was struggling to cope up in an organized legal manner.

Disadvantages of Liquidation

▪ Prohibition on business from using the same company name in future.

Distribution of Assets During Liquidation

Assets are distributed based on the priority of varied parties’ claims, with a trustee appointed by the U.S. Department of Justice overlooking the method. The foremost senior claims belong to secured creditors who have collateral on loans to the business. These lenders will seize the collateral and sell it—often at a big discount, thanks to the short time frames involved. If that doesn’t cover the debt, they’re going to recoup the balance from the company’s remaining quick assets, if any.

Next in line are unsecured creditors. These include bondholders, the govt. (if it’s owed taxes) and employees (if they’re owed unpaid wages or other obligations).

Finally, shareholders receive any remaining assets, in the unlikely event that there are any. In such cases, investors in preferred shares have priority over holders of common shares.

Disclaimer

All trademarks referenced are the property of their respective owners. Other trademarks and trade names may be used in this document to refer to either the entity claiming the marks and names or their products. MarketXLS disclaims any proprietary interest in trademarks and trade names other than its own, or affiliation with the trademark owners.

None of the content published on marketxls.com constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The author is not offering any professional advice of any kind. The reader should consult a professional financial advisor to determine their suitability for any strategies discussed herein. The article is written for helping users collect the required information from various sources deemed to be an authority in their content. The trademarks if any are the property of their owners and no representations are made.

Reference

https://www.investopedia.com/terms/l/liquidation-value.asp