Option Trading With Ms Excel-Protective Puts Strategy

Meet The Ultimate Excel Solution for Investors

- Live Streaming Prices Prices in your Excel

- All historical (intraday) data in your Excel

- Real time option greeks and analytics in your Excel

- Leading data in Excel service for Investment Managers, RIAs, Asset Managers, Financial Analysts, and Individual Investors.

- Easy to use with formulas and pre-made sheets

Protective puts

As the name itself suggests, the Protective Put strategy is used by investors to protect their capital gains from a decline in the stock price. Investors buy put options for a given premium to hedge their positions. In this strategy, investors buy put option contracts to hedge against a potential fall in stock price. This strategy is generally used when investors have made profits from stock price appreciation and want to hold stock further but do not want to risk their earnings from a decline in stock price again. This strategy is similar to the most widely used covered call strategy. The objective is the same in both the strategy; however, the significant difference lies in the execution. In a covered call, you write call option contracts while protective puts you buy put option contracts. From a profit/loss standpoint, a trader gets paid to open a covered call; there is a net cash outflow in case of protective puts.

Trading with MS excel

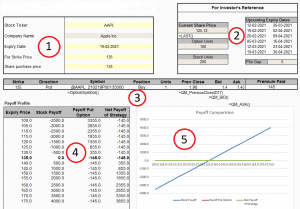

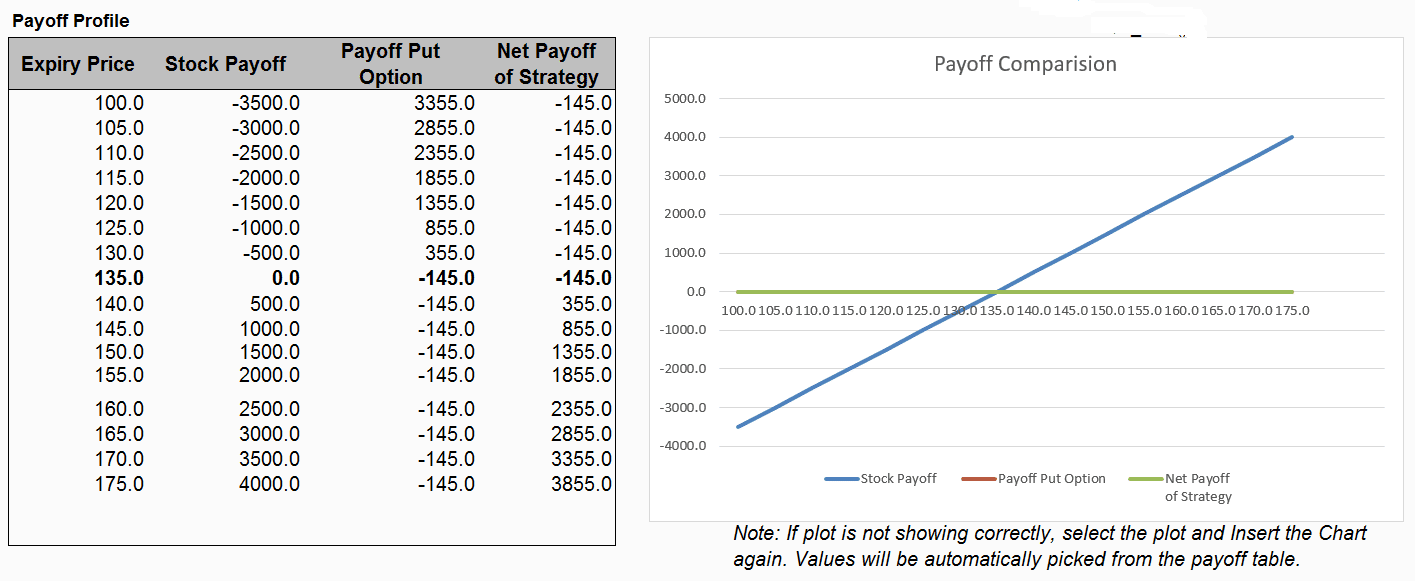

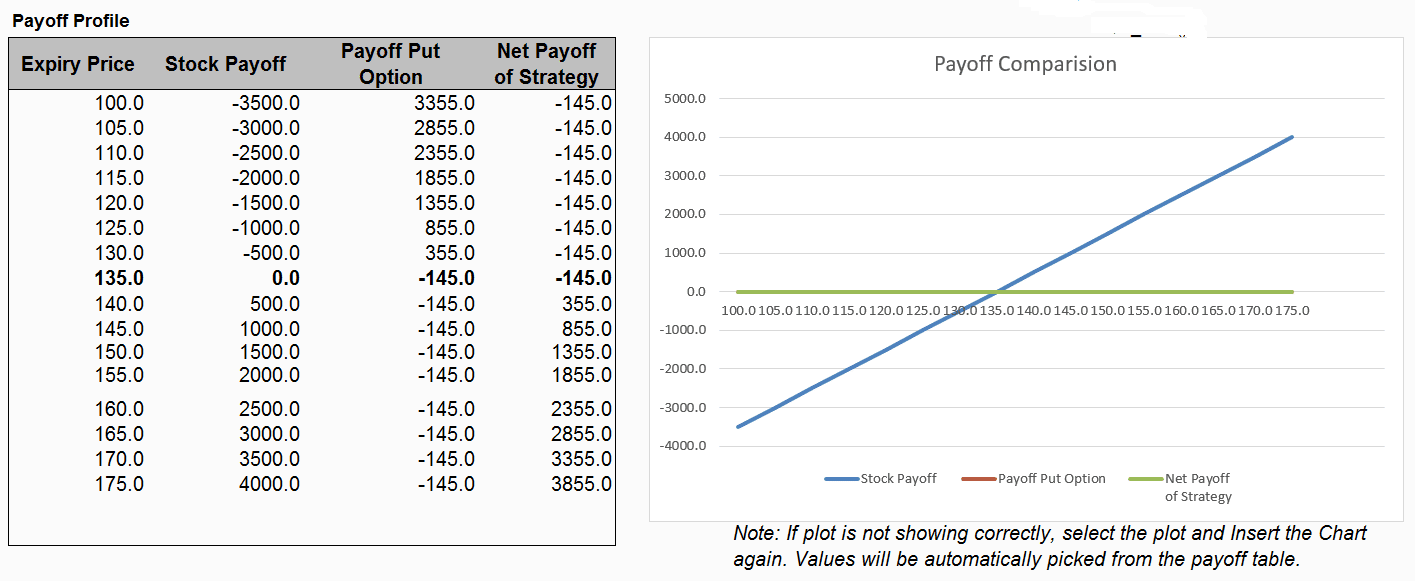

Below is a screenshot of the complete excel template that marketXLS provides for this strategy. This template has five major components. Let’s break them down one by one.

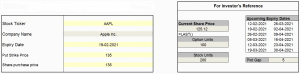

Input by user

In this section, you put the stock ticker and the expiry for the option of that underlying. You can select the expiry from section 2. Here, we have taken the example of AAPL (Apple Inc.) with an expiry of 19 Feb 2021.

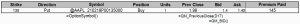

Execution

A protective put is one of the most straightforward strategies in options trading as it involves only one leg of buying an OTM put option contract. As I am writing this article, AAPL shares are trading at $125. Therefore, an investor would buy a put option out-the-money, say $135. The investor pays a premium of $145 to the writer. This is the maximum loss he would incur in this trade.

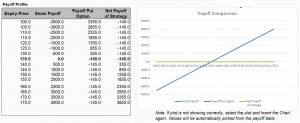

Profit, loss, and breakeven

The table and the graph below show how the trade will pan out at various AAPL stock prices. As you can see, had the investor not bought put options, the loss would have been significant on the bearish side and it only increases with the stock price. The execution of a protective put helped the investor to limit his losses to a mere $145. However, the profits are unlimited on the bullish side. The breakeven point is at the strike price, which is $135.

Key takeaways

• A protective put is a high volatility strategy as the losses are limited on the bearish side, and the profits are unlimited on the bullish side.

• Since protective put is pretty straightforward, it is also suitable for beginners.

• Loss is limited to just the premium, while profit is unlimited on the bullish side.

• An investor pays a premium upfront to open a trade with this strategy.

Disclaimer

None of the content published on marketxls.com constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person.

The author is not offering any professional advice of any kind. The reader should consult a professional financial advisor to determine their suitability for any strategies discussed herein.

the article is written for helping users collect the required information from various sources deemed to be an authority in their content. The trademarks if any are the property of their owners and no representations are made.

References

Learn more about protective put here.

Get Market data in Excel easy to use formulas

- Real-time Live Streaming Option Prices & Greeks in your Excel

- Historical (intraday) Options data in your Excel

- All US Stocks and Index options are included

- Real-time Option Order Flow

- Real-time prices and data on underlying stocks and indices

- Works on Windows, MAC or even online

- Implement MarketXLS formulas in your Excel sheets and make them come alive

- Save hours of time, streamline your option trading workflows

- Easy to use with formulas and pre-made templates

I invite you to book a demo with me or my team to save time, enhance your investment research, and streamline your workflows.