Introduction

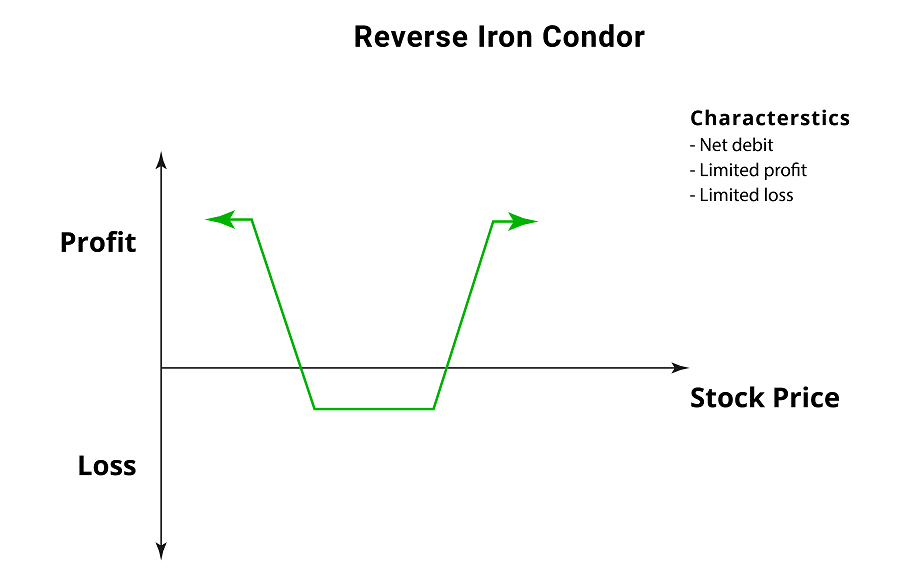

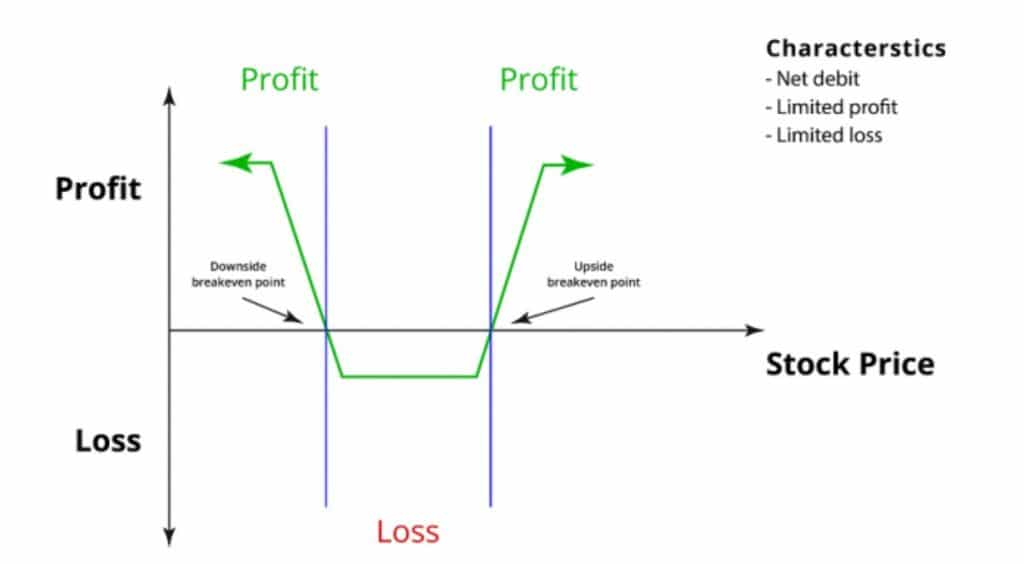

Reverse Iron Condor strategy is an advanced Option Strategy. It is primarily used in volatile market conditions. The Reverse Iron Condor is a limited profit, limited risk trading strategy that is designed to make some profit when the underlying stock price makes a sharp move in either direction.

The strategy involves entering into four different transactions i.e. 2 Call (one long & one short) and 2 Put (one long & one short) options, and is used when the investor is not sure of the direction in which the price of the security may move.

Reverse Iron Condor Construction

To implement and execute this strategy, the investor will trade in four different contracts. The investor can decide whether to carry out all the trades at the same time or not.

The four trading contracts will be:

- Buying an OTM (out of the money) Put option

- Selling an OTM Put option at a lower strike price

- Buying an OTM Call option

- Selling an OTM Call option at a higher strike price

To set up a reverse iron condor, the options trader buys an OTM put with a strike price below the current stock price, sells an even lower strike OTM put, buys an OTM call with a strike price above the current stock price and sells another even higher strike OTM call. A net debit is taken to enter this trade.

Limited Profit

Maximum profit for the reverse iron condor strategy is limited but considerably higher than the maximum possible loss. It is attained when the underlying stock price drops below the strike price of the Short Put or rises above the higher strike price of the Short Call. In either situation, maximum profit is equal to the difference in strike prices between the puts (or calls) minus the net debit taken when initiating the trade.

Maximum Profit can be calculated with the formula:

Max Profit = Strike Price of Short Call – Strike Price of Long Call (or) Strike Price of Long Put – Strike price of Short Put – Net Premium Paid – Commissions Paid

Max Profit is achieved when Price of Underlying < Strike Price of Short Put

(OR)

Max Profit is achieved when Price of Underlying > Strike Price of Short Call

Limited Loss

Maximum loss for the Reverse Iron Condor strategy is also limited and is equal to the net debit (net cash outflow) taken when entering the trade. Maximum loss occurs when the underlying stock price at expiration is between the strikes of the Long Put and the Long Call. At this level, all the options expire worthless and the trader is left with nothing except a loss equal to the initial debit taken.

Maximum Loss can be calculated with the formula:

Max Loss = Net Premium Paid + Commissions Paid

Max Loss Occurs When Price of Underlying is in between the Strike Prices of the Long Put and the Long Call

Breakeven Points

The reverse iron condor position has 2 break-even points:

- Upper Breakeven Point = Strike Price of Long Call + Net Premium Paid

- Lower Breakeven Point = Strike Price of Long Put – Net Premium Paid

Applying Reverse Iron Condor Strategy Using MarketXLS Template With an Example:

MarketXLS software is a one-stop solution for the analysis of your entire investments. It provides a host of functions like eps, various ratios, key fundamentals, historical data, options pricing and much more to assess the value of your investments. It provides a variety of templates for various options trading strategies and also to compare your portfolio stocks for doing a better analysis of your investments.

Link to the Template: https://marketxls.com/template/reverse-iron-condor-spread/

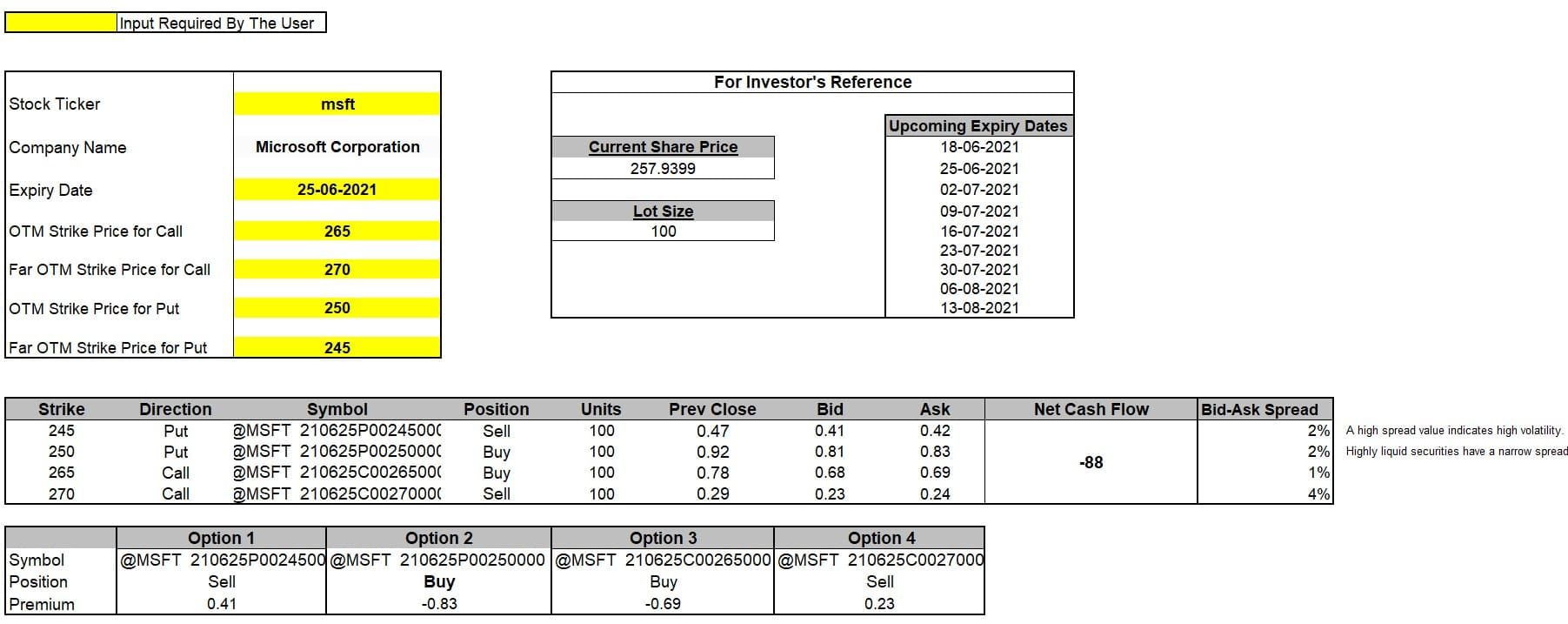

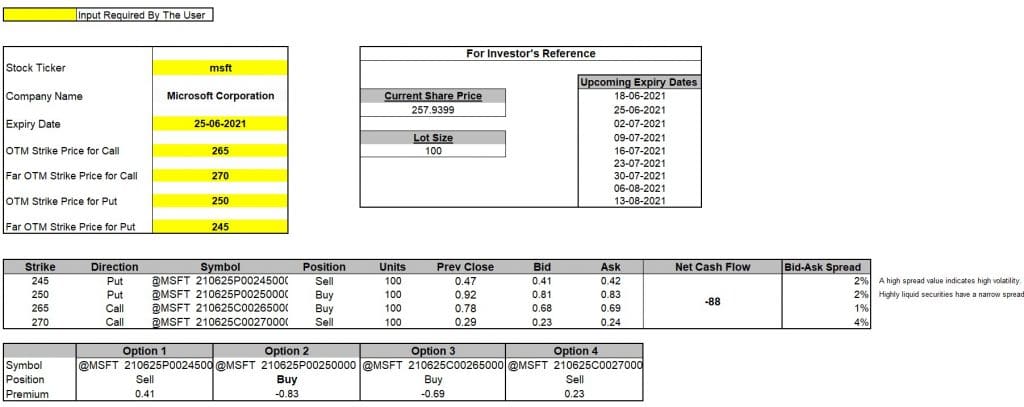

Step 1: Enter the stock ticker in cell D6 and press enter. The template will provide the upcoming expiry dates for the stock, current market price and lot size. Select any one of the expiry dates and change the lot size according to your preference.

Step 2: Enter the 4 strike prices i.e. OTM Strike Price for Call, Far OTM Strike Price for Call, OTM Strike Price for Put and Far OTM Strike Price for Put in the respective yellow cells. Press enter.

Step 3: The template might ask you to refresh. Go to the MarketXLS tab in the ribbon > Refresh All. Click on Refresh All.

The template uses the bid price for sells and ask price for buys and related premiums to calculate the net cash flow (net debit to be paid) for you.

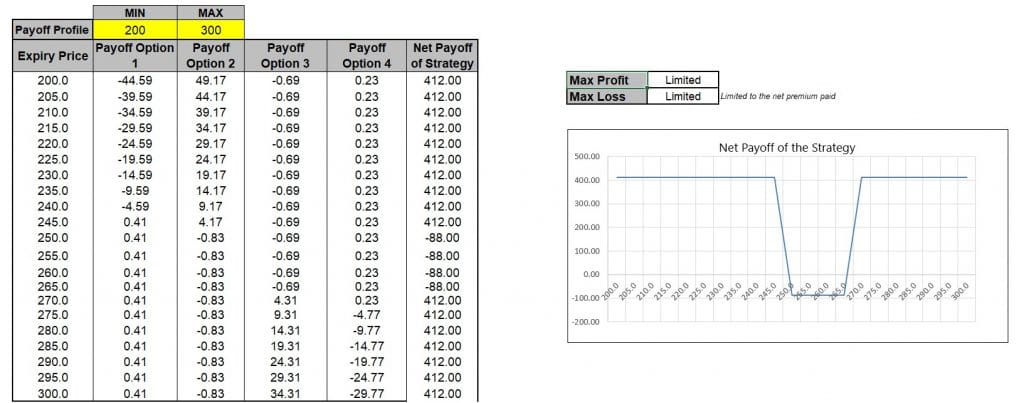

Step 4: The template also provides the Net Payoff Profile of the strategy. You need to enter the minimum and maximum expiry prices for the period. It will calculate the net profit or net loss for all the levels of expiry prices and present it graphically.

Microsoft Corporation (MSFT) as an example in the above template:

MSFT stock is trading at levels of $257 on 14th June 2021. I have selected the upcoming expiry of 25/06/21 to enter the trade. I want to execute a reverse iron condor by buying a Call @$265, selling a Call @$270, buying a Put @$250 and selling another Put @$245.

The template will calculate the premium amounts for all the options and thus calculate the net cash flow for entering the trade, which is $88 in this case.

[ 0.41*100 ($245 strike) – 0.83*100 ($250 strike) – 0.69*100 ($265 strike) + 0.23*100 ($270 strike) = -$88 ]

Suppose if the stock keeps trading at $257 till expiration, all 4 options will expire worthless. Since a net debit of $88 is being taken to enter the trade, I will suffer a loss of $88. This is also my maximum possible loss.

If the stock trades at $245 on the expiration date, only the Long Put option at $250 expires in the money. This Put option will be worth $500 ( a lot of 100 shares ) and therefore my net profit will be $412 after deducting the initial $88 debit. This profit can be easily determined by looking at the net payoff table within the template (4.12*100). A similar situation occurs when the stock trades at $270 at expiration. In this case, only the Long Call option at $265 expires in the money and it is also worth $412 after deducting the premium paid.

Here is a video explaining the Reverse Iron Condor Strategy using MarketXLS: https://youtu.be/bqKAEYpVGIs

Bottom Line

If one is expecting a security to move significantly but is not sure in which direction it will move, this is a good strategy to implement. The maximum loss and the maximum profit are both predictable, and one can adjust the strikes to determine how much they wish to make and how much they need the price of the security to move by.

The main downside is that it is a complicated strategy to use. The fact that there are four transactions involved also means that you will pay a fair amount in commission charges.

Disclaimer

All trademarks referenced are the property of their respective owners. Other trademarks and trade names may be used in this document to refer to either the entity claiming the marks and names or their products. MarketXLS disclaims any proprietary interest in trademarks and trade names other than its own, or affiliation with the trademark owners.

Reference

https://www.theoptionsguide.com/reverse-iron-condor.aspx

https://top10stockbroker.com/option-trading/reverse-iron-condor-spread/