Short Call Put- Managing And Tracking

Meet The Ultimate Excel Solution for Investors

- Live Streaming Prices Prices in your Excel

- All historical (intraday) data in your Excel

- Real time option greeks and analytics in your Excel

- Leading data in Excel service for Investment Managers, RIAs, Asset Managers, Financial Analysts, and Individual Investors.

- Easy to use with formulas and pre-made sheets

What is it?

Most beginner options strategies are named by juggling the four words- long, short, call, and put. Understand these four basic terminologies, and half the job is done. Here is what each one of these means-

Long: Long is when you buy an option contract (100 shares).

Short: Short is when you sell an option contract.

Call: Call is when you want to buy a certain amount of shares in the future with the contract’s help.

Put: Put is when you want to sell a certain amount of shares in the future with the contract’s help.

There is someone who wants to write a contract, and then there is someone who wants to buy that contract. Also, the traders may be bullish or bearish on a particular underlying. Combining these four terminologies, we get four strategies- Long-call, long-put, short-call, and short- put.

In a short call, the shareowner writes call contracts on his shares, and the buyer of the contracts gets an opportunity to buy them at a specific price, which is also called the strike price. The shareowner does this for a short term benefit on his share in the form of a premium. One important thing to notice here is that though the writer sells call options, he is bearish on the stock so that the options expire worthlessly, and he gets to keep his shares along with the premium.

Similarly, in the short-put strategy, when a shareowner is bullish on a stock, he will write off-put options to earn short-term profits as premium, and the buyer gets to short-sell that stock at a particular price in the future. There is a separate article for long-put, where it is explained very well.

This is a low volatility strategy because no matter how much the stock moves, the only profit a writer earns is the premium. It is a beginner strategy as it usually involves only one step.

Trading with marketXLS

I will be explaining the short-call with the help of a template from marketXLS. MarketXLS is an add-on to MS Excel, which helps a user procure livestock data and import it directly to excel. Apart from this, it also provides templates to manage and track options trades for different strategies. Here, I have used Microsoft(MSFT) options as an example. This trade is not taken in real, and it is just for explaining. As I am writing this article, the MSFT shares are trading at $242.

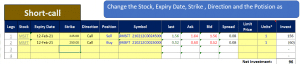

Let’s assume that the trend will be bearish in the next couple of days. Therefore, I wrote off a call option at $245, which will expire on 12-Feb-2021. But there is one more leg in which I bought a contract in the same underlying at $250. That’s because I want to place a safety net if at all the share starts trading above $245. Suppose the shares get closer to $245, and there is a high chance that it will surpass the strike, so you place a buy contract at $250, that’s it. This is mainly done to retain the shares. The net investment for the two agreements, as you can see, is $112. See, this is the beauty of marketXLS. You can include as many legs as you like, and you don’t have to play by rules and forge your strategies along the way. Below is a screenshot of how it is done.

Profits, losses, and breakeven

We have sold an out of the money contract (100 shares) of MSFT with a strike price of $245 at a premium of $1.56 and bought another contract with a strike of $250 at a premium of $0.52. Let’s have a look at the possible scenarios:

1. Let’s say the shares trade below the first strike of $245. The contract will be deemed worthless, and you get to keep your shares along with the premium of $96. This is the best-case scenario in this trade.

2. The worst case will be when it surpasses $245 but not $250. But, only if you want your shares back. If you are comfortable letting go of your shares, you are still profitable with all your earned premiums.

3. When the share surpasses the strike of $250, you get to buy back your shares at $250. There will be a net loss in this case. $500-$96= ($404). However, there is no such obligation to buy back the shares.

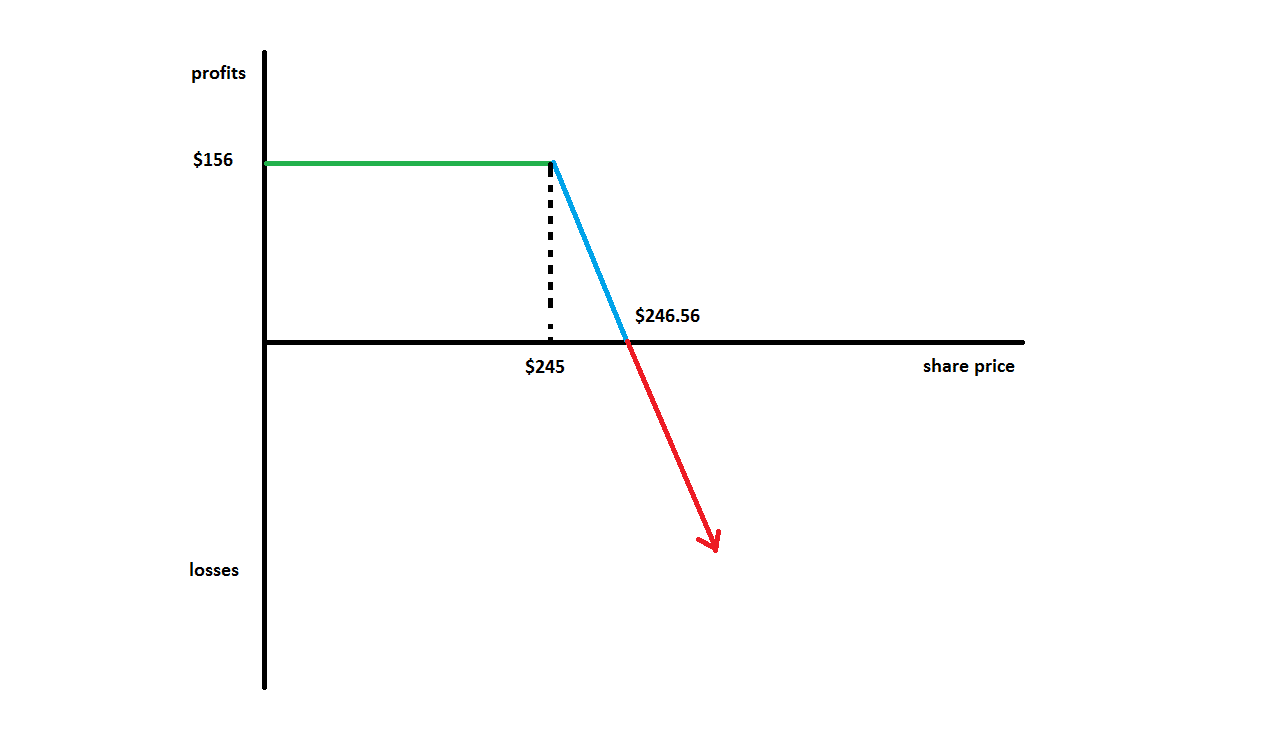

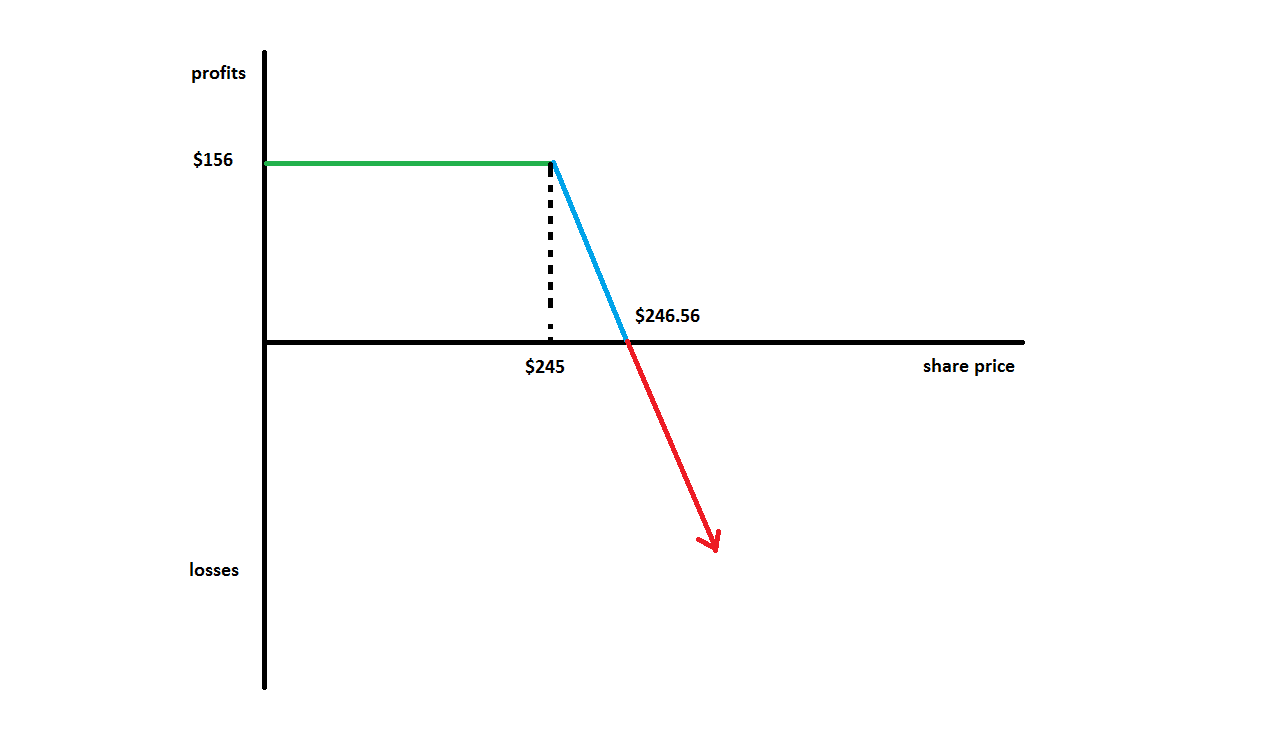

Therefore, it mostly depends on what a trader wants from a particular trade. Below is a graphical representation of how the trade will look like.

The green line depicts the profits, the blue line when the yields decline, and the red line shows the losses following the share price. The breakeven point is at $246.56.

Conclusion

In a nutshell, short-call or put is a low volatility beginner trading strategy. Owning shares is not always mandatory to carry out this trade. One can always buy shares in a multiple of 100 and write off contracts on them. Though this is a one-step strategy, one can always play around with different strikes and expiry to gain the most out of it. And marketXLS helps a trader manage and track trades in real-time at a low price.

Disclaimer

None of the content published on marketxls.com constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person.

The author is not offering any professional advice of any kind. The reader should consult a professional financial advisor to determine their suitability for any strategies discussed herein.

the article is written to help users collect the required information from various sources deemed an authority in their content. The trademarks, if any, are the property of their owners, and no representations are made.

References

Learn more about options here.

Learn more about short call/put here.

Get Market data in Excel easy to use formulas

- Real-time Live Streaming Option Prices & Greeks in your Excel

- Historical (intraday) Options data in your Excel

- All US Stocks and Index options are included

- Real-time Option Order Flow

- Real-time prices and data on underlying stocks and indices

- Works on Windows, MAC or even online

- Implement MarketXLS formulas in your Excel sheets and make them come alive

- Save hours of time, streamline your option trading workflows

- Easy to use with formulas and pre-made templates

I invite you to book a demo with me or my team to save time, enhance your investment research, and streamline your workflows.