Tracking And Managing Income From Options Trading (In Excel)

Meet The Ultimate Excel Solution for Investors

- Live Streaming Prices Prices in your Excel

- All historical (intraday) data in your Excel

- Real time option greeks and analytics in your Excel

- Leading data in Excel service for Investment Managers, RIAs, Asset Managers, Financial Analysts, and Individual Investors.

- Easy to use with formulas and pre-made sheets

What are the Options?

Options are derivative financial instruments that derived their value from underlying assets. Nowadays, trading in options has become very popular. People trade options mainly because of leverage. With little margin of capital, you can create a substantial amount of wealth. But one must not forget the risk-reward ratio associated with options.

Trading in options requires regular monitoring of the position. Various factors affect the prices of the options contract. Hence one must enter and exit a trade at the right time. To succeed in options trading, tracking and managing income from options trading, you should track and manage your risk and income.

Let’s see how to track and manage income from options trading in Excel

Excel is an excellent analytical tool to track the risk and income from options trading. Recording your past trades helps you to analyze your performance, Thus increases the success rate. Besides, you can keep track of your incomes and losses.

You can create an options trading journal to record your past transactions. It will help you to evaluate your performance. Besides, you can write notes for future reference.

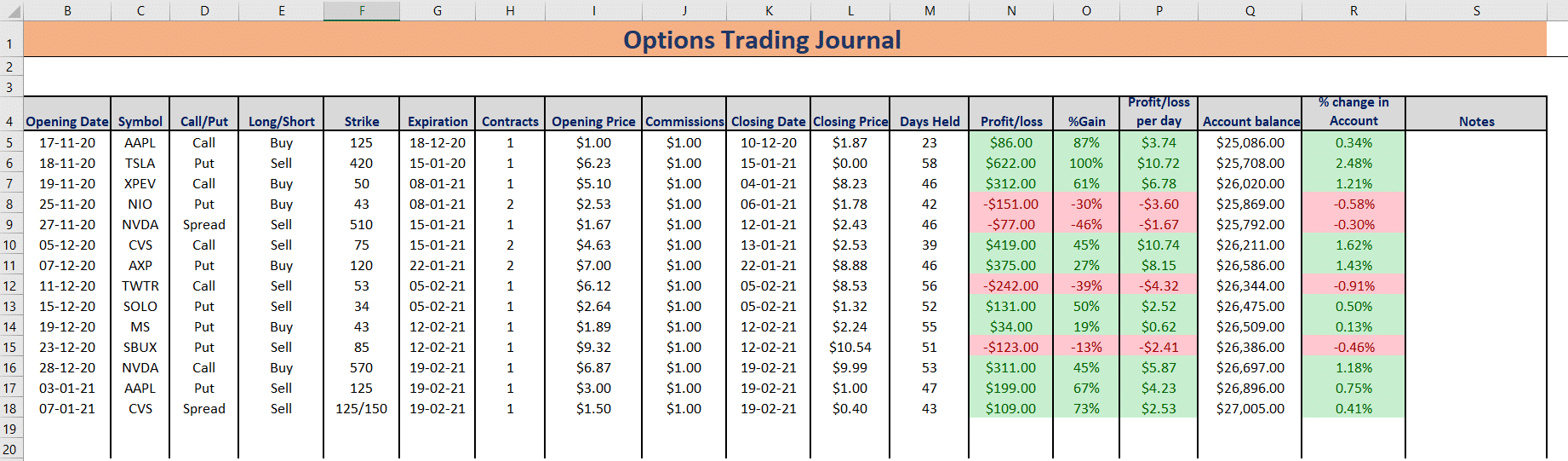

An options trading journal like this helps you to keep track of your transactions. You get information regarding the number of trades you have entered, entry date, exit date, Profits or losses incurred, % gain, Change in the account balance, Profit/loss per day, etc. All this information helps you to analyze the performance of your trade.

Analysis of your options trading performance

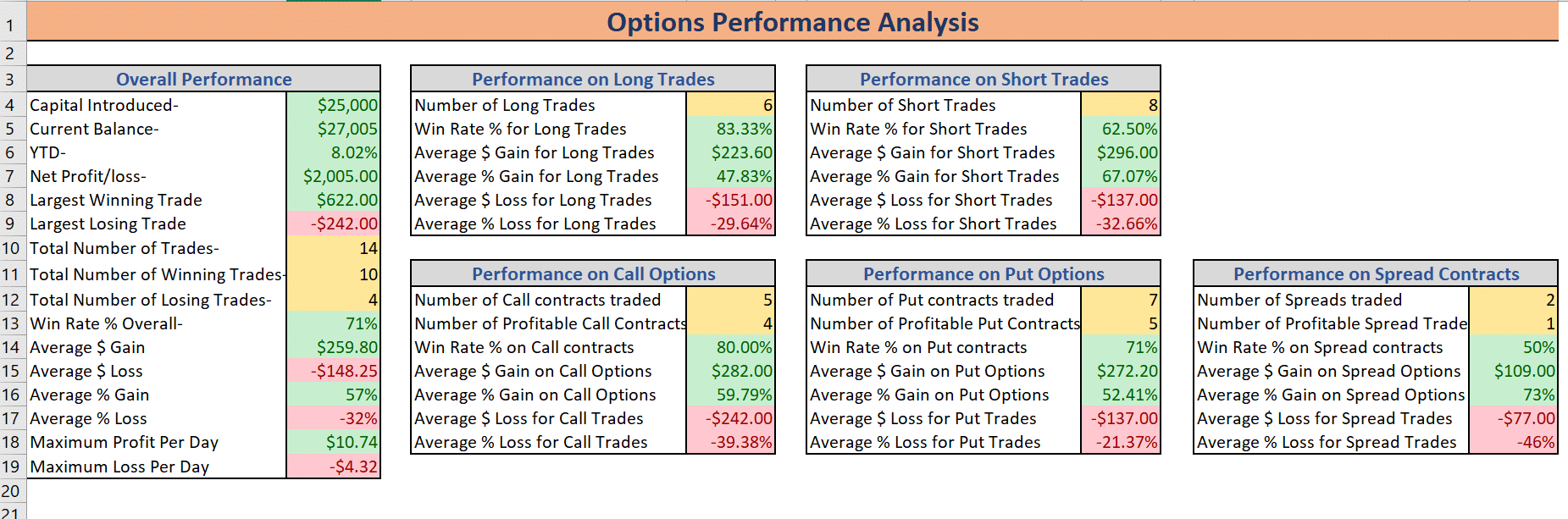

Recording the trades in the journal enables you to analyze your performance. You can evaluate the execution of your long, short transactions, calls, puts, spread, etc. You can get information on Win rate, Yield-to-date (YTD), average amount gain, Average % gain, Average amount loss, average % loss, highest profit, the highest loss, etc. All this facilitates the realization of the mistakes while executing the trades.

Managing the open options positions in Excel

You can manage your open positions in Excel with the MarketXLS. With MarketXLS, you get real-time options data in excel. You can keep a watch on the stock price, premium, volatility, volume, ask/bid price, and options Greeks. Various built-in functional tools help to undertake day trading, long-term investment, options trading, investment in penny stocks, etc. Advanced analytical tools help in technical and fundamental analysis.

Risk Management in Options Trading

Options are a precarious investment; they can blow away the entire account balance. So one must carefully trade options following specific measures to control or limit the risk. Whenever you entered any trade, always considered the amount of risk associate with it.

- The risk-reward ratio should be a minimum of 1:1.

- You should not invest more than 2% of your account size in any of your trades.

- Set the proper stop loss level and target price.

- Diversification of the portfolio helps to reduce the risk.

- Hedge your position with debit/ credit spreads instead of selling naked puts and calls.

- Position sizing can help to limit the risk. Position sizing is the number of units/ contracts an investor should invest in any stock. It is calculated as total account risk divided by the risk per share.

Disclaimer

None of the content published on marketxls.com constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The author is not offering any professional advice of any kind. The reader should consult a professional financial advisor to determine their suitability for any strategies discussed here.

Reference

To know more about risk management, click here.

Get Market data in Excel easy to use formulas

- Real-time Live Streaming Option Prices & Greeks in your Excel

- Historical (intraday) Options data in your Excel

- All US Stocks and Index options are included

- Real-time Option Order Flow

- Real-time prices and data on underlying stocks and indices

- Works on Windows, MAC or even online

- Implement MarketXLS formulas in your Excel sheets and make them come alive

- Save hours of time, streamline your option trading workflows

- Easy to use with formulas and pre-made templates

I invite you to book a demo with me or my team to save time, enhance your investment research, and streamline your workflows.