Meaning

The Strip strangle is a long strangle strategy that buys more put options than call options having a bearish inclination. As a Volatile Options Strategy, it is useful when the direction of a breakout is uncertain but more inclined towards the downside. Strip strangles can also be used to balance strangles into delta neutral positions. Strip strangles make a higher profit when the underlying stock breaks downwards but will make a lesser profit when the underlying stock breaks upwards. Thus it will profit from a big movement in either direction.

Strip Strangle Construction

Execution of the Strip Strangle strategy involves buying out of the money puts and out of the money calls, just like the Long Strangle strategy. The only difference is one needs to buy a higher number of puts than calls:

- Buy 1 OTM Call

- Buy 2 OTM Puts

The main choice one needs to make is what ratio of puts to calls to use. As a starting point, a 2 to 1 ratio is suggested but one can adjust this as he finds it suitable. This ensures that the premium cost of the options purchased by the trader remains at a bare minimum.

Profit Potential

Strip strangles have unlimited profit potential as long as the stock continues moving in one direction. Large profit is achievable with this strategy when the underlying asset price makes a strong movement either downwards or upwards at expiration, with greater gains to be realized with a downward move.

The formula for calculating profit is:

- Profit = Difference between underlying stock price and OTM strike price x number of call options (if stock is higher) or Difference between OTM strike price and underlying stock price x number of put options (if stock is lower) – net debit for premium

- Maximum Profit = Unlimited

Limited Loss

Maximum loss is limited to the initial investment and occurs when “Price of Underlying Security < Strike of Leg A and > Strike of Leg B ”

The maximum loss for the strip strangle is limited and occurs when the underlying asset price on the expiration date is trading between the strike prices of the Put and Call options bought. At this level, all the options expire worthless and the trader loses the entire premium paid to enter the trade.

The formula for calculating maximum loss is given below:

- Max Loss = Net Premium Paid + Commissions Paid

- Max Loss occurs when Price of Underlying Security < Strike price of Leg 1 (Call option) and > Strike price of Leg 2 (Put option)

- Maximum Loss = Limited

Breakeven Points

There are 2 breakeven points for the Strip Strangle position:

- Upper Breakeven Point = Strike Price of Call option + Net Premium Paid

- Lower Breakeven Point = Strike Price of Put options – (Net Premium Paid/2)

Applying Strip Strangle Strategy Using MarketXLS Template With an Example:

MarketXLS software is a one-stop solution for the analysis of your entire investments. It provides a host of functions like EPS, various ratios, key fundamentals, historical data, options pricing and much more to assess the value of your investments. It provides a variety of templates for various options trading strategies and also to compare your portfolio stocks for doing a better analysis of your investments.

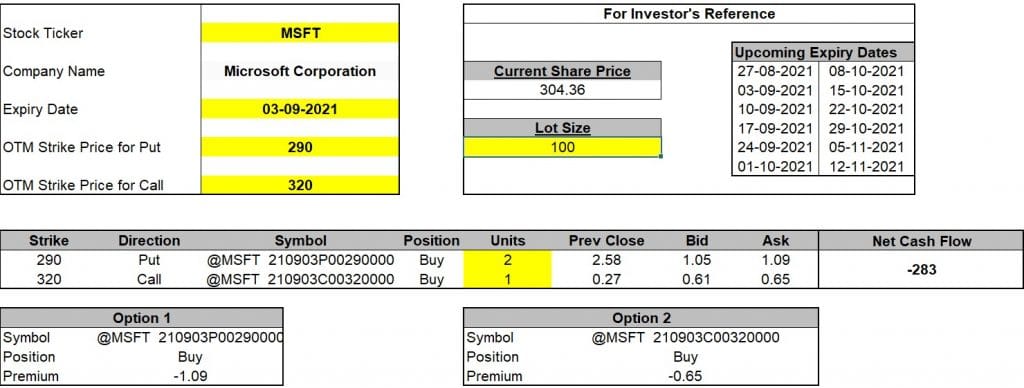

Step 1: Enter the stock ticker in cell D6 and press enter. The template will provide the upcoming expiry dates for the stock, current market price and lot size. Select any one of the expiry dates and change the lot size according to your preference. Note that the template uses the DD-MM-YYYY date format.

Link to the Template: https://marketxls.com/template/strip-strangle/

Step 2: Enter the OTM Strike Price for Put in cell D12 and OTM Strike Price for Call in cell D14 and press Enter. You can adjust the Put to Call ratio in cells G18 and G19.

Step 3: The template might ask you to refresh. Go to the MarketXLS tab in the ribbon > Refresh All. Click on Refresh All.

The template uses the ask price for options to calculate the related premium to be paid (net cash flow) by you.

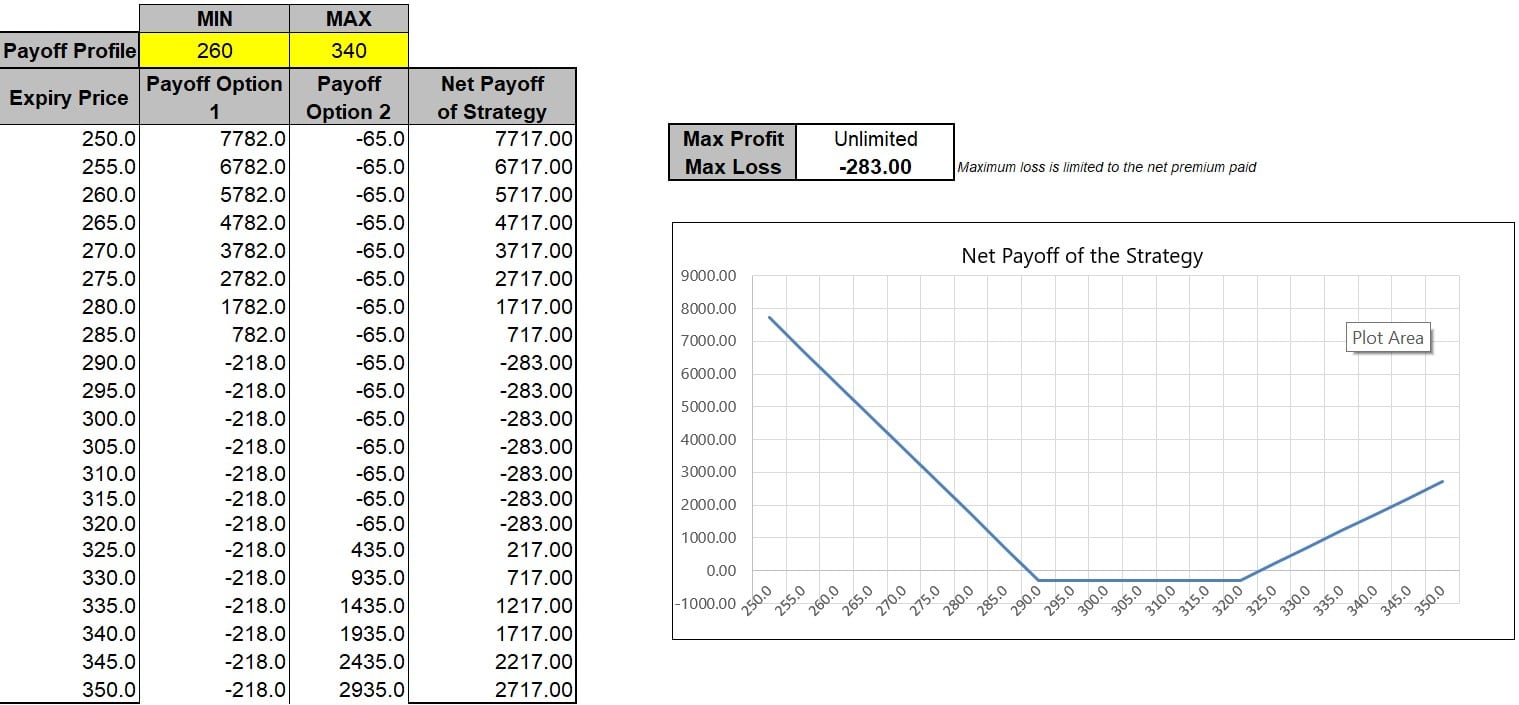

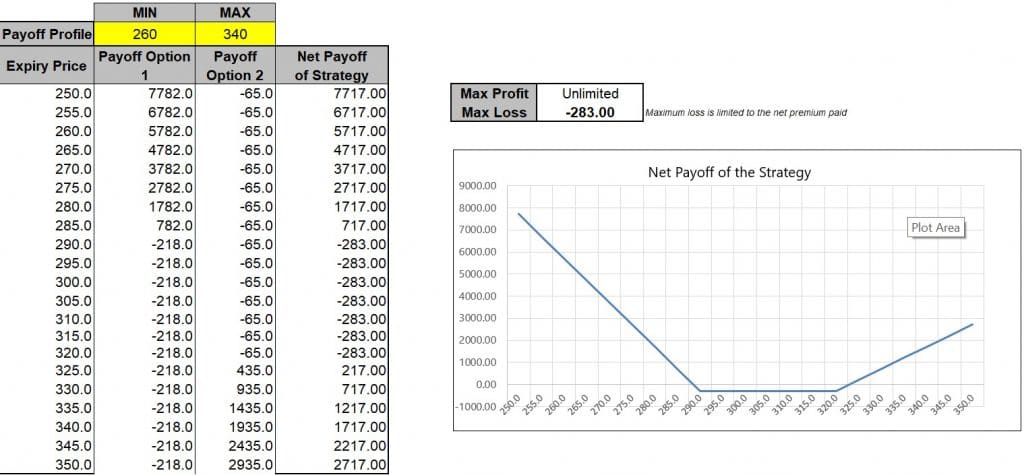

Step 4: The template also provides the Net Payoff Profile of the strategy. You need to enter the expected minimum and maximum expiry prices for the period. It will calculate the net profit or net loss for all the levels of expiry prices and present it graphically.

Microsoft Corporation (MSFT“>MSFT) as an example in the above template:

MSFT“>MSFT stock is trading at levels of $304 on 23rd August, 2021. I have selected the upcoming expiry of 3rd September, 2021 to enter the trade. I want to execute a Strip Strangle options strategy from the current level by buying an OTM Call @$320 and also buying 2 OTM Puts @$290 as I believe that the stock will witness bearish trends in the near future.

The template will calculate the premium amounts for all the options and thus calculate the net cash flow for entering the trade, which is $283 debit in this case.

[ -1.09*100*2($290 Put) – 0.65*100($320 Call) = -$283 ]

Suppose if the stock keeps trading between $290 and $320 on the expiration date, both the Puts and Call option expire worthless and I will suffer the maximum loss which is equal to the initial debit of $283 taken to enter the trade.

Suppose the stock rallies to $340 at expiration, the Put options will expire worthless but the Call option expires in the money and has an intrinsic value of $2000. Subtracting the initial debit of $283, the profit comes to $1717.

Suppose the stock crashes down to $270 at expiration, now the Call option will expire worthless but both the Put options will expire in money with an intrinsic value of $4000. Subtracting the initial debit of $283, the profit comes to $3717, thus giving greater profits with the same margin in expiry prices. This profit will even be greater if the stock price dives below $270. The net profit can easily be determined by looking at the net payoff table within the template.

Here is a video explaining the Strip Strangle Strategy using MarketXLS:

MCxFMAqYYM” target=”_blank” rel=”noreferrer noopener”>https://youtu.be/pMCxFMAqYYM

Bottom Line

The design of the strategy is simple making it suitable for a beginner. As such, there is no major planning involved, except deciding the strike prices of the options. It provides a higher profit than a regular Strangle if the stock breaks out to the downside. The investor needs to use their estimate and assumption about the movement of the stock price to enter this strategy. It also requires a lower net debit than a Strip Straddle because of the OTM strike prices involved.

It’s slightly more complicated than the long strangle, but it’s an excellent alternative if your expectation is that the price of the underlying security is more likely to drop significantly than rise significantly.

If you want to learn more about different option strategies, visit https://marketxls.com/blog

Disclaimer

All trademarks referenced are the property of their respective owners. Other trademarks and trade names may be used in this document to refer to either the entity claiming the marks and names or their products. MarketXLS disclaims any proprietary interest in trademarks and trade names other than its own, or affiliation with the trademark owners.

Reference

http://www.optiontradingpedia.com/strip_strangle.htm