What is the Synthetic Long Stock Option Strategy?

The synthetic long stock is a two-legged strategy. It consists of buying an at-the-money (ATM) call option and selling ATM put options of the same underlying asset. Both the contracts should have the same strike price and expiration date. There must be an equal quantity of call and put contracts.

The strategy is designed to replicate the long stock position. Traders build this strategy when they are bullish on the stock. The profit and loss also depict the same pattern as in the long stock position. It means that there is unlimited profit potential on the upside and absolute risk on the downside.

Aim of the Synthetic Long Stock Option Strategy

The strategy’s motive is to enjoy the same benefits of a long position on the stock with approximately 1/4th of the capital requirement. Because of unlimited risk in the strategy, your broker will block certain capital. But still, it is far less than actually buying the 100 shares of the underlying asset. That is the power of leverage that options provide.

By selecting the same ATM strike of the call and the put contract, the aim is to get a 100 delta for the trade. Therefore, the profit or loss will move proportionately in the same direction as the underlying moves.

Let’s built the Synthetic Long Stock Option strategy in Excel using the MarketXLS template

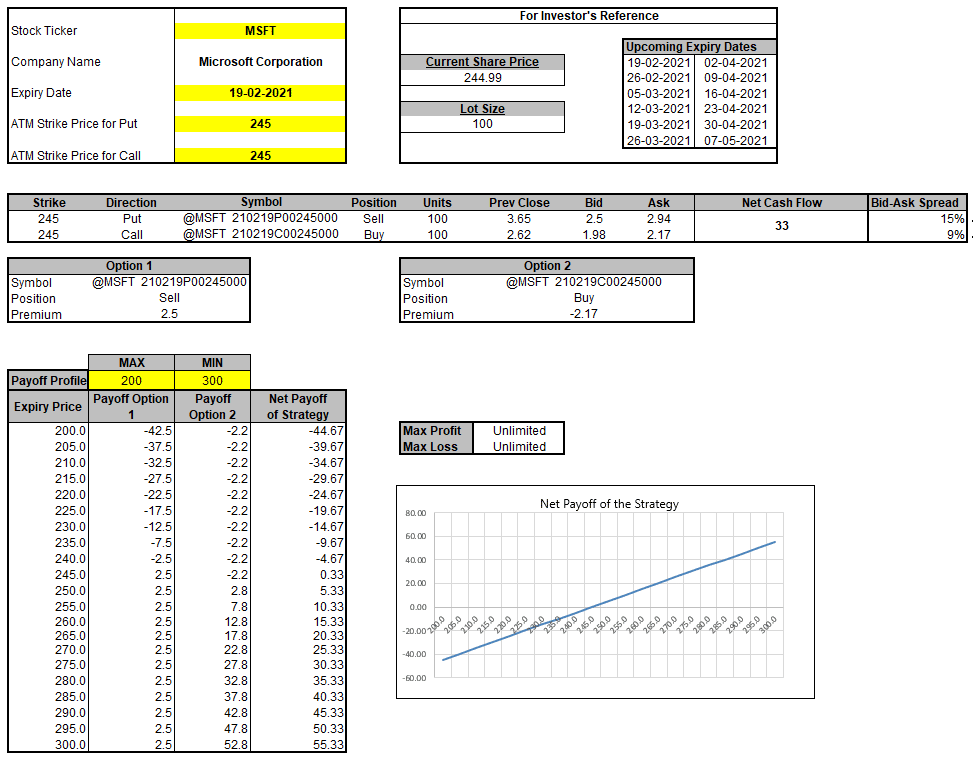

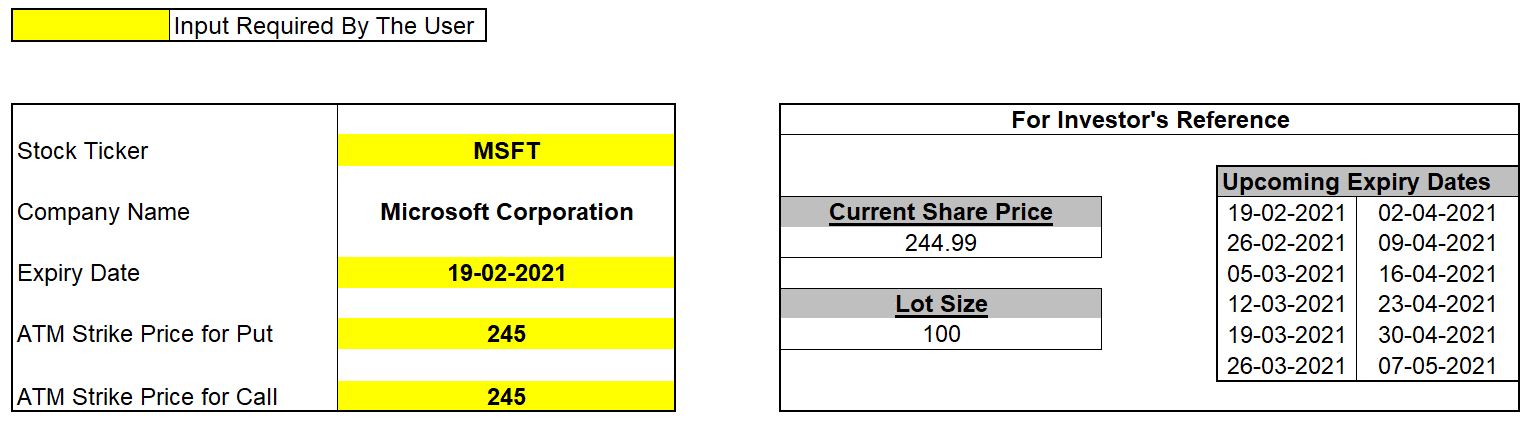

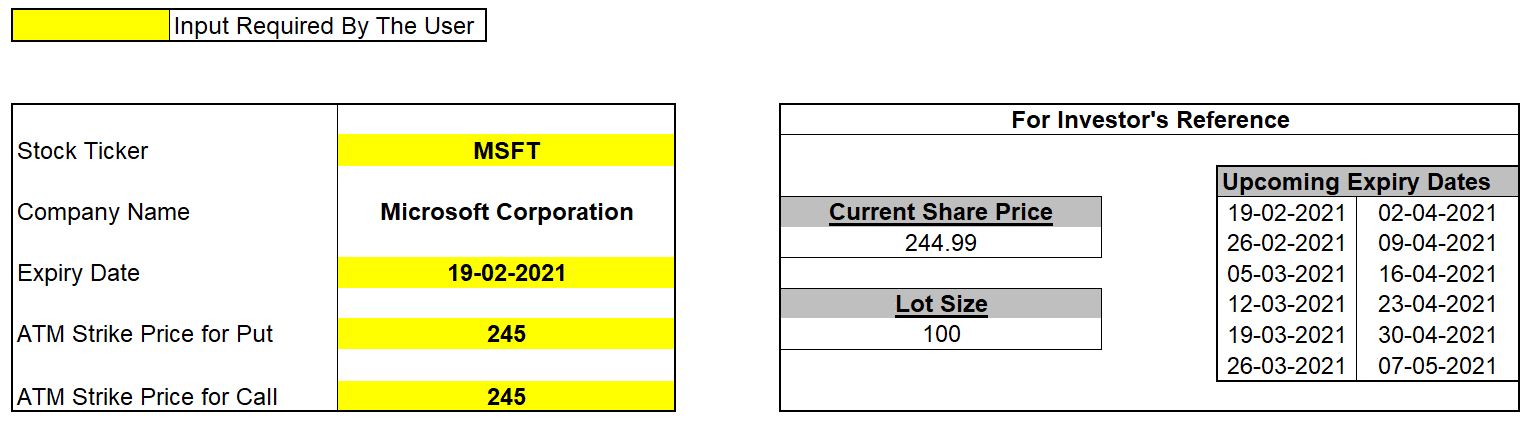

Step-1: provide the inputs for the strategy

Provide the Stock Ticker, Expiry Date, ATM strike price for a put option, and ATM strike price for a call option. Upcoming expiry dates are available for reference.

Here, we have built a synthetic long position on MSFT. Currently, MSFT is trading at $249.99. We have selected an ATM strike of $245 for our put and call option contracts. Both the contracts will expire on 19-02-2021.

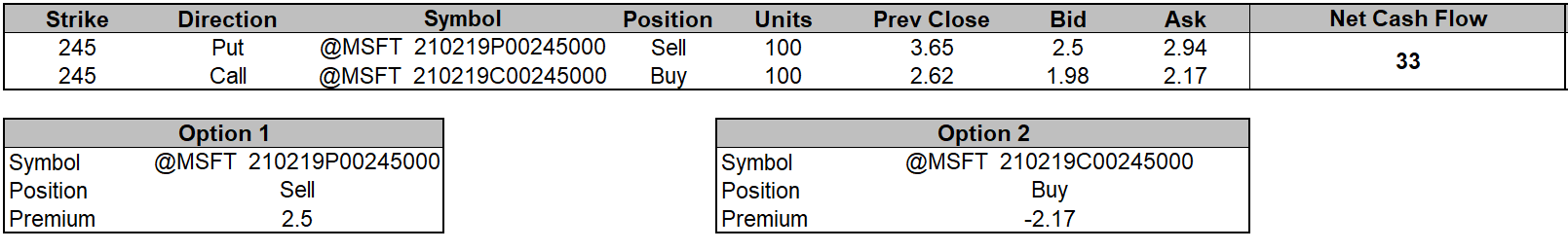

Step-2: Setup of the Synthetic Long Stock strategy

Sold 1 OTM $245 put option contract of MSFT at $250 (2.5*100).

Bought 1 ATM $245 call option contract of MSFT at $217 (2.17*100).

Net Premium received = $33 ($250 – $217).

We have built the net credit strategy and received $33 upfront on the trade. But since the strategy involves unlimited risk, your broker will block some capital margin to execute the transaction.

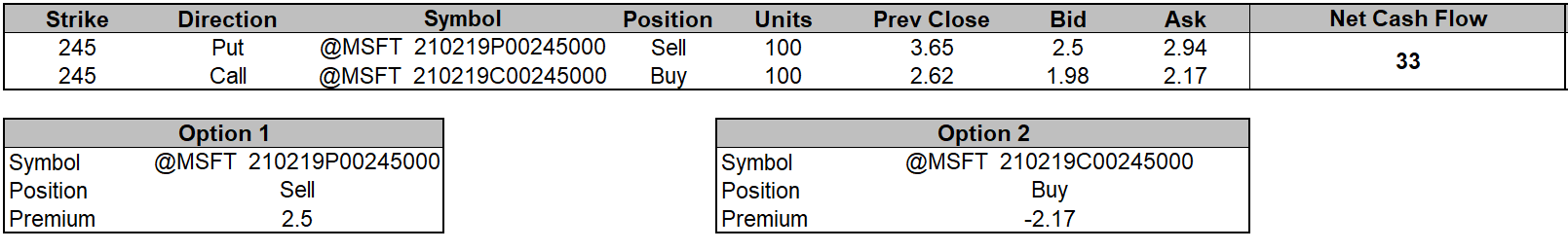

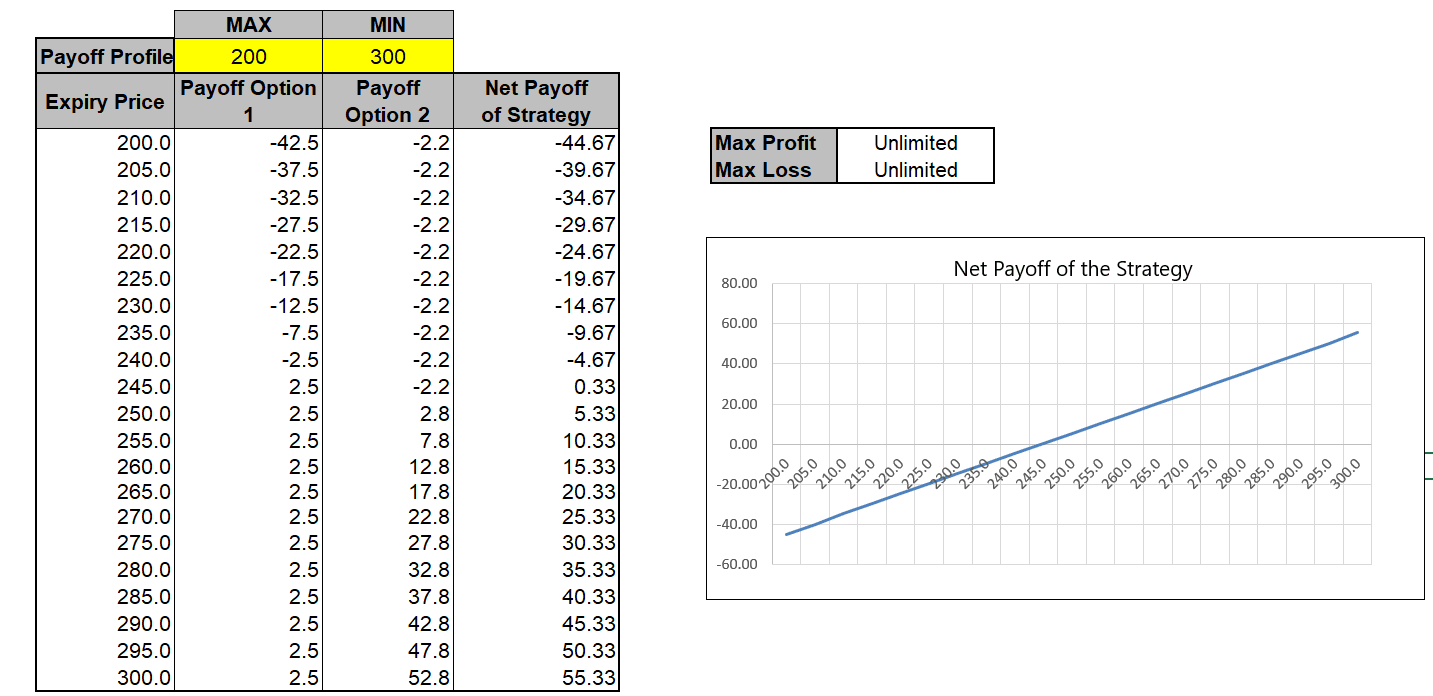

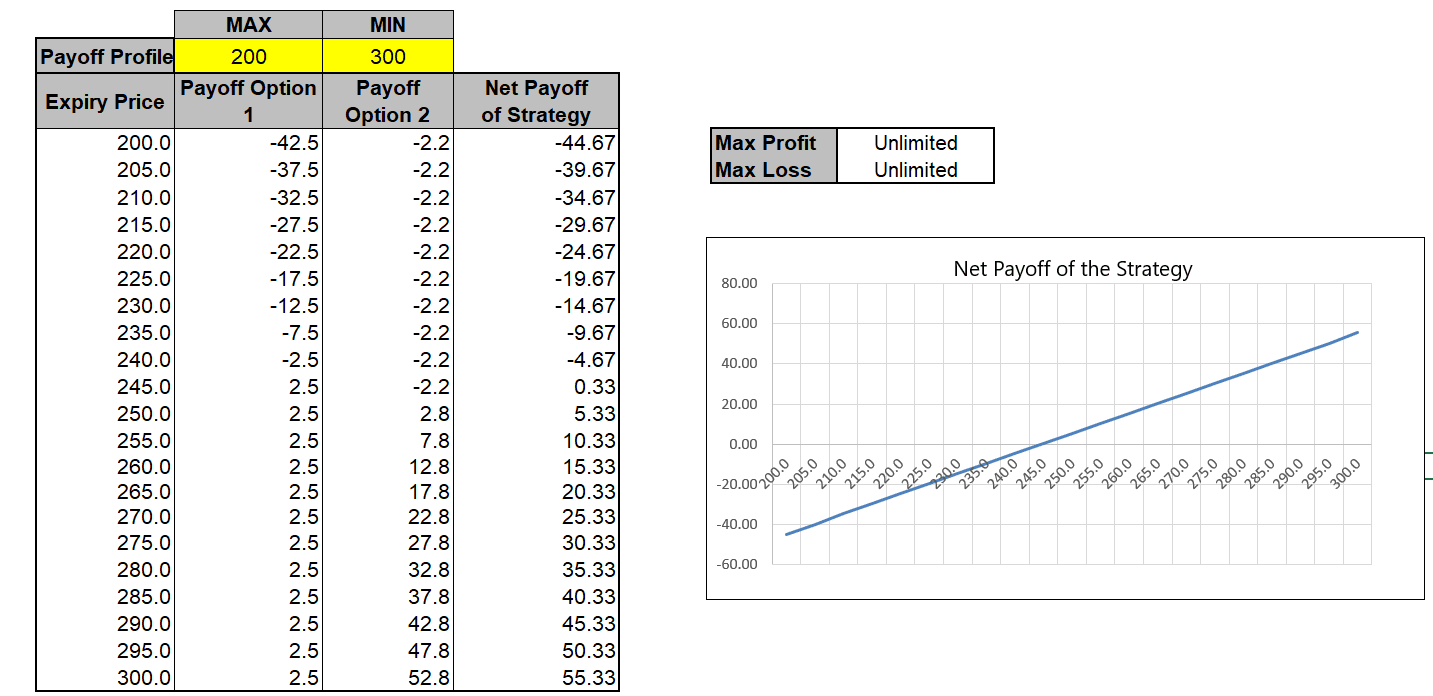

Step-3: Payoff Schedule and diagram at the expiration date

Here you will find the payoff schedule and payoff diagram alongside. Both contracts will expire worthless if the underlying stock closes at $245 (ATM strike). At the ATM strike price, we will gain or incur losses depends upon whether the strategy builds on the net debit or net credit. Since we have created the net credit strategy (premium received > premium paid), the profit is equal to the net premium that is $33. If the underlying stocks remain above the $245, we will gain on the trade; else, we will suffer a loss.

Unlimited Profit

There is no fixed profit. As long as the underlying stock remains above the strike price we have entered, we will enjoy the profit. We generate income to the extent underlying stock stays above $245, plus the net credit earned. For example, if the underlying stock reaches $250, we will gain $5.33, which includes $5 because of the upward movement of stock and $0.33 on the net premium received.

- If the strategy built on credit-

Profit = spot price – strike price + net premium received.

- If the strategy built on debit-

Profit = spot price – strike price – net premium paid.

Unlimited Risk

The extent of loss is also uncertain. If the underlying stock goes below $245 (ATM strike), both of our contracts generate losses. While the long call’s risk is limited, equal to the premium paid, the short put’s risk is unlimited. Hence below $245, the long call loses the entire premium amount that is $2.2. And the loss on the short put depends on the extent underlying closes below $245.

- If the trade built on the net credit-

Loss = Strike price – Spot price – net premium received.

- If the trade built on the net debit-

Loss = Strike price – Spot price + net premium paid.

Break-even

Breakeven is the point of zero profit and zero loss. If the strategy builds on the net credit, break-even will achieve at a long call strike – net premium received. In the above example, break-even is at $244.67 ($245-$0.33). In the case of net debit, break-even will be at long call strike + net premium paid.

Bottomline

Synthetic long stock option strategy replicates the exact impact of a long stock position. With the low capital requirement, we enjoy the same benefit of holding shares. As it involves the same ATM strike for the long call and the short put contract, the impact of gamma, theta, and volatility offset with each other. And the profit and loss move at the same pace as the underlying stock.

Disclaimer

None of the content published on marketxls.com constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person.

The author is not offering any professional advice of any kind. The reader should consult a professional financial advisor to determine their suitability for any strategies discussed herein.

The article is written for helping users collect the required information from various sources deemed to be an authority in their content. The trademarks if any are the property of their owners and no representations are made.

Reference

To know more about options trading, click here.

To know more about the Synthetic long option, click here.