Unlock the Potential Profits of Collars Trading

Investing in options trading has become increasingly popular over the past few years with many investors seeking to take advantage of the higher leveraged returns that it can potentially provide. A collar options strategy is an interesting combination of a bullish and bearish options strategy that can help investors enhance their returns and reduce the risk of the underlying position. In this article, we will explore collar options trading and the key considerations that investors need to look at while pursuing this strategy.

What is a Collar Options Strategy?

A collar strategy involves the simultaneous purchase of a protective put and the sale of a covered call, where investors purchase the corresponding stocks for their call and put options. Typically, the strike price of the put and call option are set equal to the underlying stock. This allows investors to receive the premium from the sold call which helps defray the cost of the protective put. In addition, the profits received from a collar strategy are typically lower than those of other leveraged strategies, but the risk associated with the underlying stock is usually reduced as a result of using two options contracts to create an overall neutral market outlook.

What Are the Benefits of Collar Options Trading?

There are several key benefits associated with collar options trading. Firstly, it helps manage risk and enables investors to largely avoid losses in down or volatile markets. Secondly, collars allow for less movement in the underlying stock for investors to potentially generate returns. Lastly, the use of multiple options contracts helps to generate income from selling covered calls against the purchased protective puts.

What are the Key Considerations for Collar Options Trading?

Investors need to consider a few key factors when engaging in collar options trading. Firstly, investors should consider their market outlook and understand their risk appetite, as leverage can provide investors with both positive and negative effects on their profits. Secondly, volatility strategies must be considered as investors need to decide whether they wish to benefit from increasing volatility or not. Lastly, it is important to understand the transaction costs associated with options trading as this can have an effect on potential profits.

How Can MarketXLS Help?

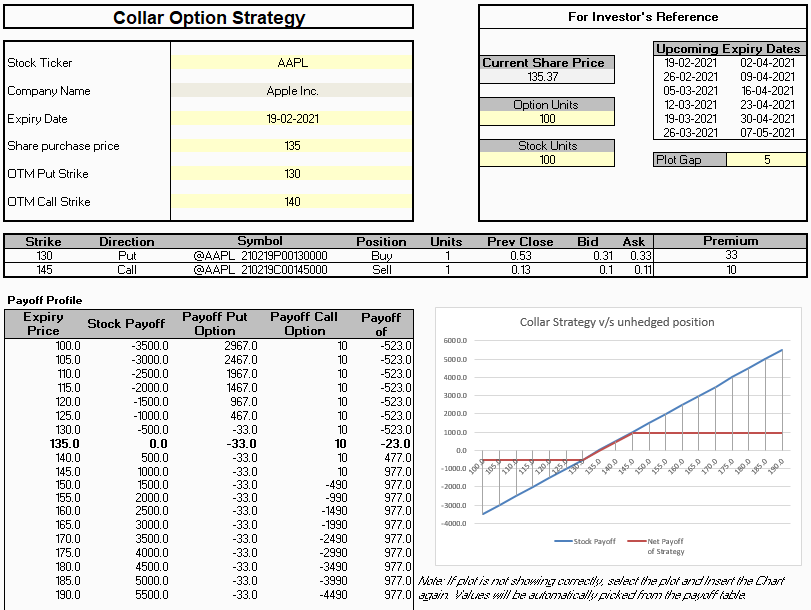

MarketXLS provides easy-to-use options trading calculators and powerful analytics tools designed to help investors assess their market outlook and make better trading decisions. Its Binomial Option Pricing Model Excel Calculator helps investors measure their expected returns and risk levels when entering option trades. Furthermore, through its Collar Option Strategy Calculator, investors can customize their collars to match their desired risk/return profile.

Overall, the use of collar strategies can help investors maximize their returns and minimize overall risk when trading stocks. When used properly, these strategies can help investors leverage their investments and hopefully generate greater returns. To get started, investors should check out MarketXLS’s Binomial Option Pricing Model Excel and Collar Option Strategy calculators which can help kick start their journey into one of the most popular options trading strategies.

Here are some templates that you can use to create your own models

Search for all Templates here: https://marketxls.com/templates/

Relevant blogs that you can read to learn more about the topic

Options Trading (Strategies)