Beat Market Rates By Measuring Correlation of Stock Holdings and Employee Options

Meet The Ultimate Excel Solution for Investors

- Live Streaming Prices Prices in your Excel

- All historical (intraday) data in your Excel

- Real time option greeks and analytics in your Excel

- Leading data in Excel service for Investment Managers, RIAs, Asset Managers, Financial Analysts, and Individual Investors.

- Easy to use with formulas and pre-made sheets

Understanding Correlation in Portfolio Management

Correlation is a statistical measure of how two stocks have moved together over a specific period, indicating the degree to which they move in the same or opposite direction. Investors use correlation analysis to build a diversified portfolio that balances risk and reward. In addition, a perfect positive correlation has a coefficient of 1, indicating that the two stocks move in the same direction with the same magnitude. On the other hand, a perfect negative correlation has a coefficient of -1, meaning that the two stocks move in opposite directions with the same magnitude, and a coefficient of 0 means that the two stocks are not related. It is also important to consider the covariance among stock investments and employee stock options when developing portfolio diversification strategies.

The Impact of Investing in Stocks Highly Uncorrelated with Employee Stock Options

To build a well-diversified portfolio, investors should consider investing in stocks that are uncorrelated with employee stock options. Unlike highly correlated stocks, investing in uncorrelated stocks can help reduce portfolio risk and increase returns. This strategy provides diversification and helps balance risk and reward, which can lead to more stable returns over time. Additionally, understanding the covariance among stock investments and employee stock options is important in creating a diversified portfolio. By investing in uncorrelated stocks, investors can mitigate the risks associated with concentrated stock positions and reduce the impact of their employer’s stock on their portfolio. Overall, investing in stocks that are highly uncorrelated with employee stock options can increase returns while minimizing risk.

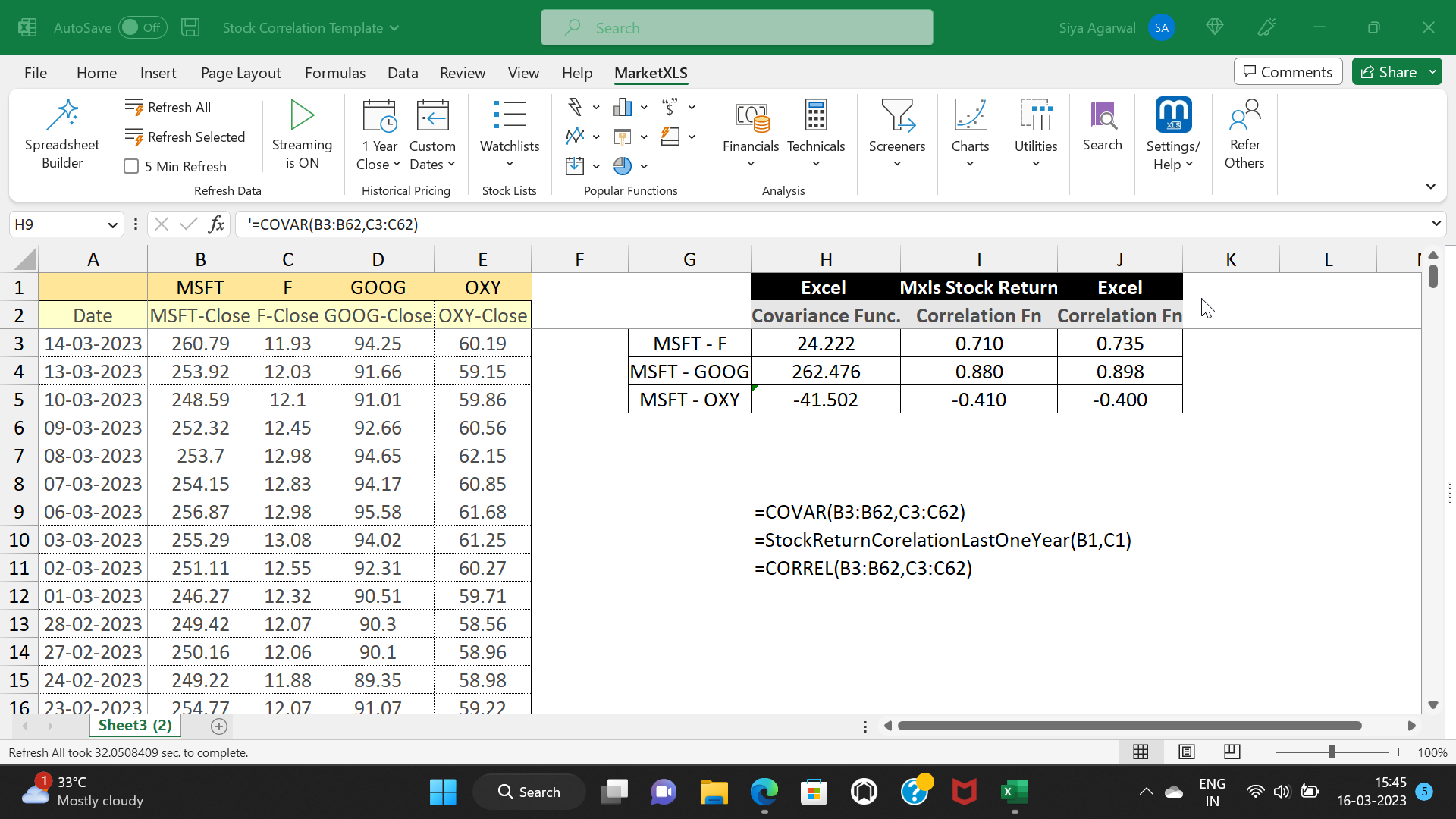

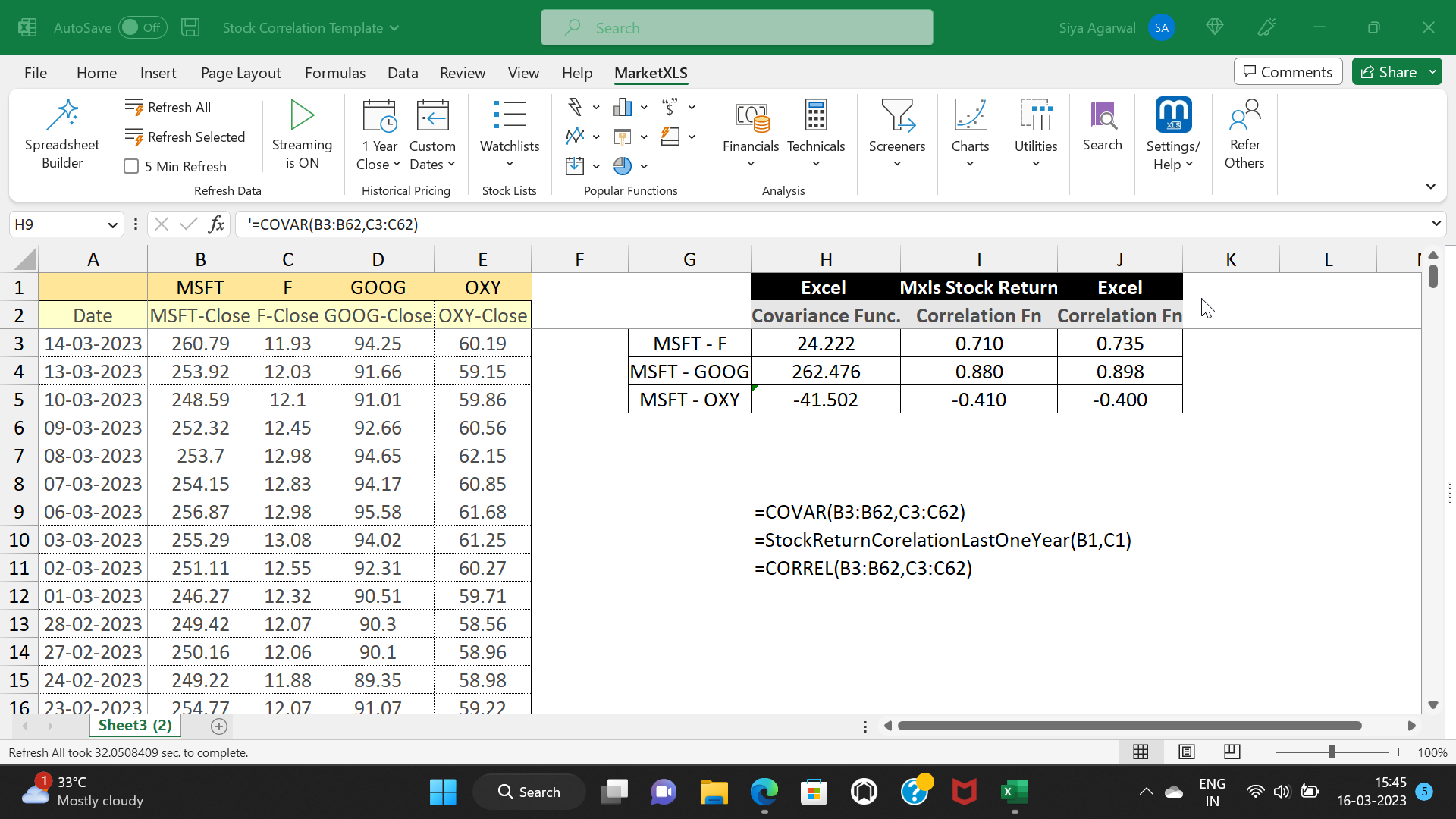

Calculating Covariance Between Stock Investments and Employee Stock Options with MarketXLS

To help investors make informed decisions and diversify their portfolios effectively, MarketXLS provides tools for calculating the correlation between different stocks, including the covariance among stock investments and employee stock options. This Excel-based stock analysis platform makes it easier to identify which stocks are highly correlated and which are not. To perform a correlation analysis with MarketXLS, users simply select the stocks they want to analyze and choose the correlation function. The platform then automatically calculates the correlation coefficient between each pair of stocks and presents the results in an easy-to-understand format.

To help investors make more informed investment decisions and diversify their portfolios effectively, MarketXLS provides a range of functions to make correlation analysis easy and accessible. They are given below:

| Function Title | Function Example | Function Result |

|---|---|---|

| Stock Correlation | =StockReturnCorelationLastOneYear(“MSFT”,”AAPL”) | Returns the stock correlation between two stocks in last one year, using daily returns. |

Additionally, MarketXLS offers an AI-driven search function to easily access all its features: https://marketxls.com/functions

Download from the link below, a sample spreadsheet created with MarketXLS Spreadsheet builder

Note this spreadsheet will pull latest data if you have MarketXLS installed. If you do not have MarketXLS consider subscribing here

https://mxls-templates.s3.us-west-2.amazonaws.com/MarketXLS-Model-ID-ih98uI.xlsx

Conclusion

To summarize, correlation analysis plays a crucial role in building a diversified portfolio that balances risk and reward, and MarketXLS provides a variety of functions and tools that simplify this analysis for investors of all levels. With its user-friendly interface and advanced features, MarketXLS is a great option for those looking to enhance their portfolio performance and make well-informed investment decisions.

Moreover, the mentioned blogs are also an excellent source to learn more about related topics.

Evaluating the Relationships of Two Stocks by Covariance

Create Your Own Excel Stock Tracker

How to Calculate Stock Beta in Excel

Craft Your Own Strategy with Active Options Trading

Options Profit Calculator App

I invite you to book a demo with me or my team to save time, enhance your investment research, and streamline your workflows.