Cash Conversion Cycle

Meet The Ultimate Excel Solution for Investors

- Live Streaming Prices Prices in your Excel

- All historical (intraday) data in your Excel

- Real time option greeks and analytics in your Excel

- Leading data in Excel service for Investment Managers, RIAs, Asset Managers, Financial Analysts, and Individual Investors.

- Easy to use with formulas and pre-made sheets

What is Cash Conversion Cycle?

The cash conversion cycle (CCC) is an inventory efficiency and cash flow metric. Companies use CCC to determine the number of days that it takes to convert resources inputs into cash flows. The purpose of the CCC is to measure the length of time each dollar, put into the business, is tied up in the production, marketing, and sales process before converting into cash revenue from sales. This efficiency metrics tracks the amount of time it takes a business to sell its inventory, collect its receivables, and liabilities.

The cash cycle is pretty basic when looking at it from a general premise. The full cycle is the time between issuing money for inventory, and cash receiving it. The process starts with a company acquiring inventory through accounts payable via credit. Then customers will either pay by credit or cash. When the company finally pays off the accounts payable, and converts its accounts receivable into cash, the cycle is complete.

How to calculate Cash Conversion Cycle?

In a time metric, the calculation requires an ideal period. The use of financial statements will be the source for the criteria, as a result, shows either annual or quarterly results.

The formula is as follows: CCC = DIO + DSO – DPO

DIO – Days Inventory Outstanding – the number of days it takes to sell the full inventory

DSO – Days Sales Outstanding – the number of days it takes to collect accounts receivable

DPO – Days Payable Outstanding – the number of days it takes the company to pay its bills

The fewer days it takes to sell inventory and collect the accounts receivables from the sales, the better its cycle period will be. It may sound counterproductive, but a longer period of payables outstanding is positive because it allows a company to hold onto cash longer. Using the cash for any investment opportunities that may present themselves prior to payables being due.

How to interpret Cash Conversion Cycle

Similar to return on assets and equity measurements, the cash conversion cycle is a management effectiveness evaluator. At the same time a sound performance standard for the financial health of a company. The CCC demonstrates the aptitude of management to turn short term, non-cash assets into cash for either shareholders or investments. Cash allows businesses to expand through other means of financing while the current assets of cash keep the company afloat during that period.

Companies experience liquidity risk during the cash conversion cycle, if cash is being held up in investments or resources. This period of growth is immensely important to a company’s success in the future. Converting tangible resources into cash, in an efficient manner, is the difference between staying a solvent business and a shut down business. Investors will use the CCC from two competing companies to see who has the lower cycle. Investors use the comparison of CCC to find the potentially better-managed company.

Which industries can be best analyzed with Cash Conversion Cycle?

The cash conversion cycle is not a universal metric for all industries. The CCC, is better suited for retail businesses or companies in the business of selling products directly to consumers. As retailers are leveraged with inventory and must use their inventory to sell to customers for revenue, the CCC is the ideal performance measure for the industry. Financial industries or services are driven to not fit these criteria; therefore, the conversion cycle is not an effective tool.

There is no one performance measure that explains how financially healthy a company is today, and will be in the future. Other performance measures involve combining the cash conversion cycle ratio. The CCC should evaluated on a multi-year basis. Tracking multiple periods can display times of weakening execution or a positive trend of consistent performance. Comparing the CCC of industry competitors is important to gauge which company is completing their business process more competently.

Companies lower the time cash is held up in the operations, to minimize the conversion cycle. The faster a company can turn the product into cash, the more opportunity the company has to turn more products into cash. Sensibly speaking there could be an obvious demand for this product. Available cash presents the ability to expand a business. There are a few companies who desire to remain the same size forever. In those instances they create quicker cash conversion cycles, and the higher the success rate.

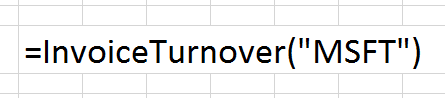

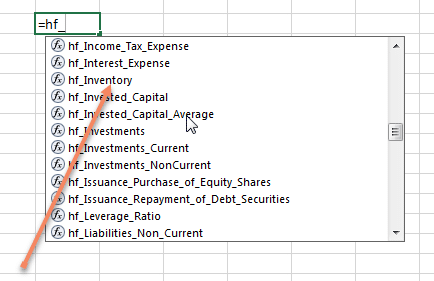

Various formulas in MarketXLS, like below, can be used to measure the effectiveness with the cash conversion cycle. The formula below indicates the “Days Payable Outstanding”. Inventory historical data for all US stocks can be calculated using the marketXLS formula shown below…

I invite you to book a demo with me or my team to save time, enhance your investment research, and streamline your workflows.