Why protect against Implied volatility?

In February 2018 Goldman Sachs reportedly made a whopping $200 million on a single day trading volatility. There are also instances when traders lost millions of dollars on a single day. While implied Volatility may look appealing to someone who is just starting out, it comes with its own set of risks. Fluctuations are good as they can ensure maximum profits but the problem lies in predicting the direction. However, the implied volatility is often more on the downside. Because the fear factor comes into play when the market is moving downwards. Also, the fact that most market participants are long and they are looking to short their positions to hedge against a potential fall makes it more volatile in the downtrend. In an uptrend, the participants are rather complacent with the gains they have made.

How to protect against implied volatility?

The volatility surface can give a rough idea about the implied volatility depending on the strike price and expiry date. But it doesn’t give out any clue about the direction an option is going to move. While sellers may often stay away from volatility, volatility surface can also help them as rising implied volatility mean rising premiums. Premiums can often make up for the losses if any option goes rogue and becomes too volatile. Many strategies have been developed so far to trade implied volatility, the most popular ones being the straddles and strangles. Among them, a long straddle is the simplest one to use. The main concept behind IV strategies is a combination of numerous put and call strategies to minimize risk and maximize profits.

Long straddle

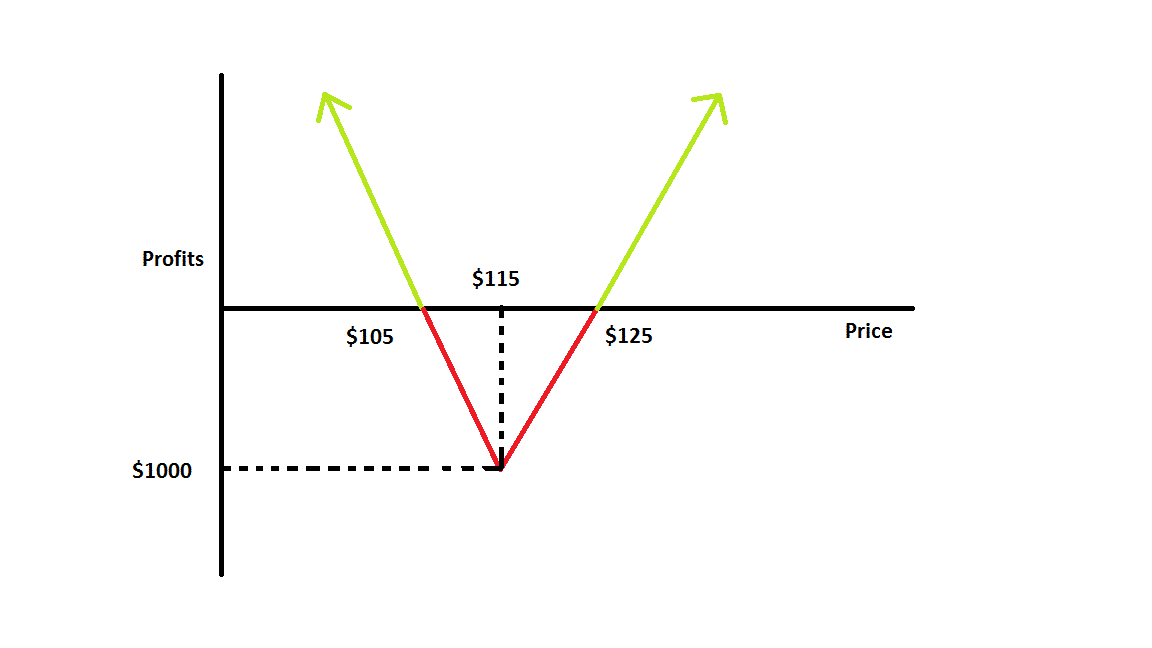

With this strategy, an options trader can gain maximum profits by trading implied volatility irrespective of the direction. However, the losses are limited when the trade doesn’t go according to the plan. The best part, even beginners can make use of this strategy. Let’s take Apple stocks as an example. As I am writing this article, the stock is trading at $115. And suppose, the VIX index is indicating high volatility and the Apple stock is expected to move at least $10 on either side over the next month. According to the strategy, a trader will initiate two positions:

Positions:

• At the money calls of 1 contract (100 shares) at $115 (strike) for a premium of $5. Let’s call it Trade A.

The trader has created a long straddle for a net debit of $1000. This is the maximum amount of loss he has to bear. Now, let’s look at the most probable scenarios and the respective profits associated.

Profits:

• Let’s say, the index was correct and Apple is trading at $125. In this case, trade B will be deemed worthless, however, the profit from trade A would be $1000. It’s the breakeven point.

The bottom line

In a nutshell, a trader is guaranteed profits with this strategy irrespective of the direction of the market. As long as there is volatility and the VIX data is reliable, it is beneficial. The loss is limited only to the premium and the profits are unlimited. There are many strategies for trading volatility, both beginners and advanced. Unlike the one I have explained above, some even use more than 2 positions at the same time. Though option writers worry about volatility, they can at least break even or minimize losses by charging high premiums. This is the reason why option prices rise with implied volatility.

Disclaimer

None of the content published on marketxls.com constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The author is not offering any professional advice of any kind. The reader should consult a professional financial advisor to determine their suitability for any strategies discussed herein.

Reference:

For more about long straddle, click here.

For more option strategies, click here.

For more about straddle, click here.