What is a Long Call Option Strategy?

The long call option strategy is a one-leg strategy, which consists of buying call options. A trader buys a call option because he is bullish on the underlying stock. He bets that the underlying security will move above the strike price before the expiry of the contract.

With a long call option contract, a trader gets a right but not an obligation to buy the underlying stock at a pre-determined price. He pays an amount for this right known as premium. The risk of the long call holder is limited to the premium amount.

He can buy in-the-money (ITM), at-the-money (ATM), out-of-the-money (OTM) call options. The OTM calls’ prices are lesser than the ITM and ATM call options because of their higher probability of expiring worthless.

Let’s built the Long Call Option Strategy in Excel using the MarketXLS template

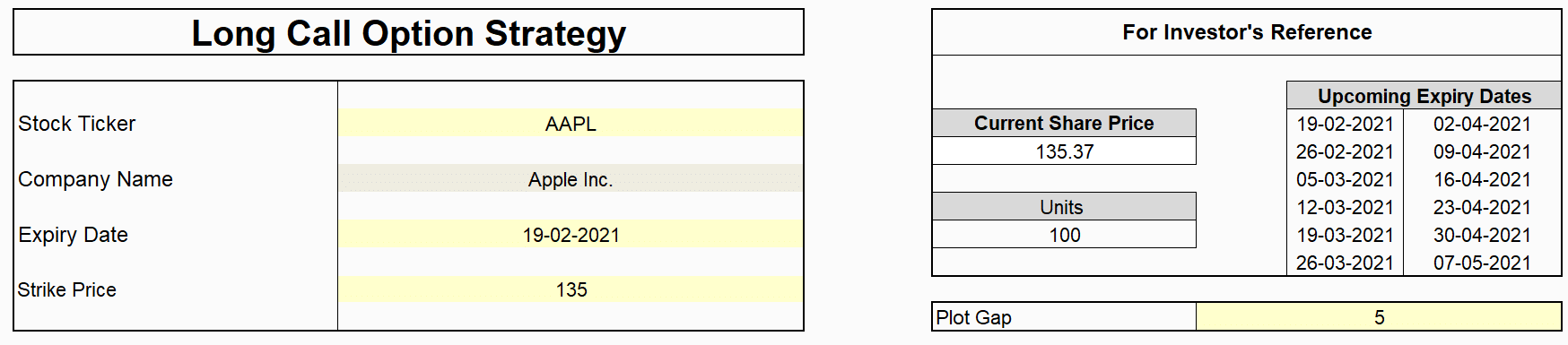

Section:1- Provide the inputs to establish the strategy

- Provide the Stock Ticker in D5 cell

- Expiry Date in D9 cell

- The strike price of a call option in D11.

- You can see the current share price and upcoming expiry dates for reference. Here we have bought the one $135 call option of AAPl stock expiring on 19-02-2021.

Section:2- Setup of the long call option strategy

- Bought 1 $135 call option for $1.85.

- 1 contract = 100 shares.

- Outflow of capital = $185 (1.85*100).

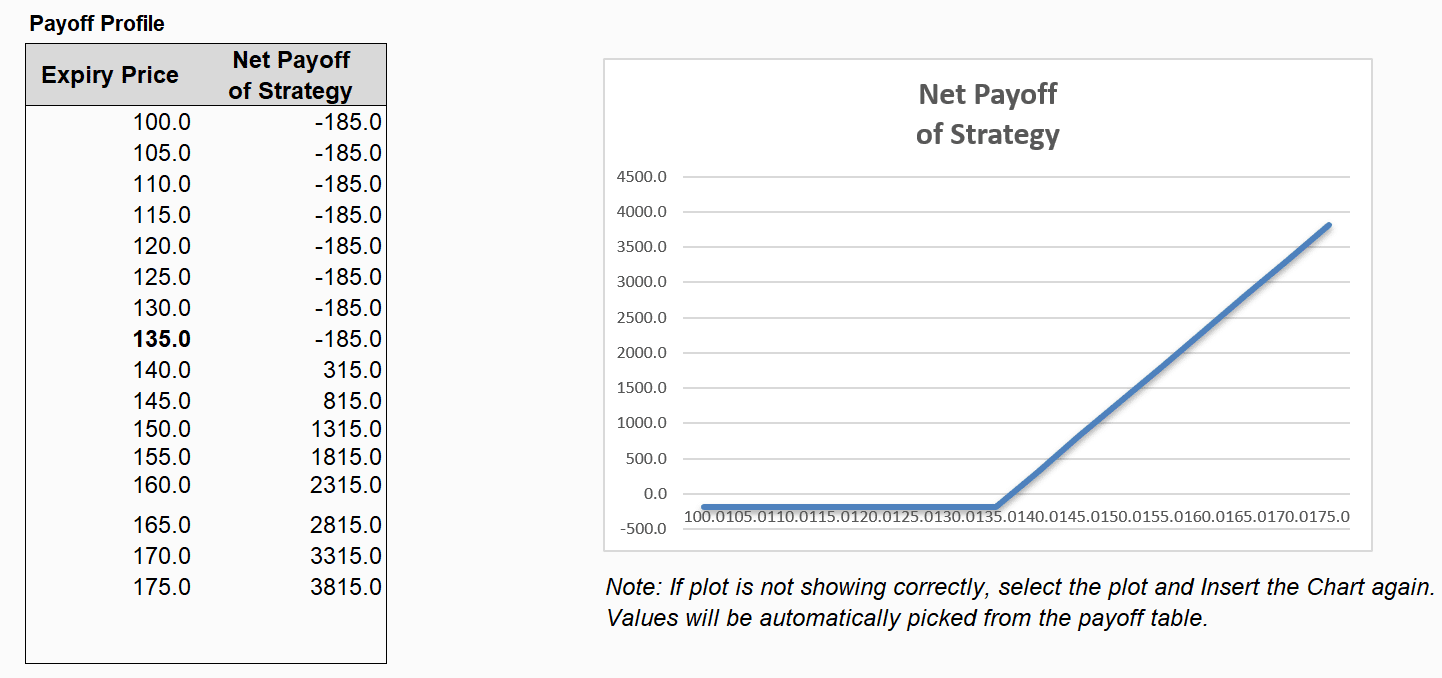

Section:3 – Payoff profile and diagram

Profit Potential

In the above example, let’s suppose the stock reaches $140, the stock moves up by $5, so the buyer will get $5 on each share, but he paid a premium of $1.85 on acquiring the right. So his net gain on each share is $3.15. Therefore, the total income on the contract equals $315.

Limited Risk

Break-even

Impact of Option Greeks

Delta

Theta

Vega

Conclusion

Disclaimer

None of the content published on marketxls.com constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person.

The author is not offering any professional advice of any kind. The reader should consult a professional financial advisor to determine their suitability for any strategies discussed herein.

The article is written to help users collect the required information from various sources deemed authority in their content. The trademarks, if any, are the property of their owners, and no representations are made.

Reference

To know more about options trading, click here.

To know more about Options Greeks, click here.