How To Manage Risk When Trading Options For Income

Meet The Ultimate Excel Solution for Investors

- Live Streaming Prices Prices in your Excel

- All historical (intraday) data in your Excel

- Real time option greeks and analytics in your Excel

- Leading data in Excel service for Investment Managers, RIAs, Asset Managers, Financial Analysts, and Individual Investors.

- Easy to use with formulas and pre-made sheets

Experience and knowledge of all the trading strategies are irrelevant if a trader cannot control risk and manage money. Hence, learning how to manage risk when trading options is of paramount importance. In this article, we are going to learn how to manage risk when trading Options for Income.

Options are generally considered risky investments as without managing the risk properly one can lose the entire capital. However, options can be used to hedge positions and minimize risk while making directional bets.

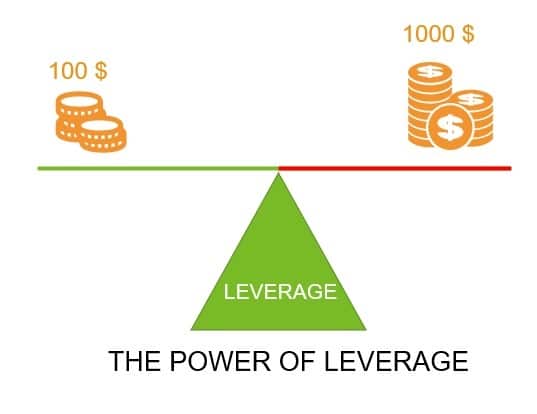

Understanding leverage

The above image depicts how leverage can be used to control the same quantity of shares with a lesser amount of money.

To understand further let us consider a trader having $10,000 and willing to invest in a $100 stock. The trader has two options-

1. Use $1000 to buy 100 stocks

2. Use $1000 to buy 10 options contracts ($10 each), each contract comprising of 100 shares of stocks.

At the first look, the 2nd option looks tempting. Using the power of leverage provided by options we can essentially control 1000 shares. Let us look at these two options from the risk perspective.

Even though in the 1st case we may the loose entire amount if the stock price reduces to 0, it is almost impossible. If the strike price reaches below the stock price upon expiry, we will end up losing the entire investment.

To manage the risk, we can buy just 1 option contract (100 shares) for $100 and invest the remaining amount seeking other investing opportunities. This will result in more diversification and will in turn reduce risk.

Methods to reduce risk

Now, let us look at some methods that can be employed to reduce risk exposure.

• Using Options spread

All options trading strategies involve the use of spreads, and these spreads represent a very useful way to manage risk. You can use them to reduce the upfront costs of entering a position and to minimize how much money you stand to lose, as with the bull call spread example given above. This means that you potentially reduce the profits you would make, but it reduces the overall risk.

• Diversification

Diversification is used by investors to build a portfolio comprising of different companies and sectors in order to reduce the risk. The underlying idea is the same in options trading, i.e., not to commit too much investment amount in any one investment.

• Position sizing

Position sizing refers to the amount you are willing to enter any particular position. By using 1-2 % of total trading capital per trade, you should have much impact even after a few successive losses.

• Exit Strategy

Do not put on option plays with open risk or undefined risk. It is very dangerous to expose yourself to uncapped and unlimited risk selling options short, the odds are that eventually you will be ruined on one outsized move. Always have an exit strategy when you sell options contracts. Option hedges are insurance that will pay for themselves over the long term.

Disclaimer

None of the content published on marketxls.com constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The author is not offering any professional advice of any kind. The reader should consult a professional financial advisor to determine their suitability for any strategies discussed herein.

References

Learn more about risk control and money management by clicking here and here

Get Market data in Excel easy to use formulas

- Real-time Live Streaming Option Prices & Greeks in your Excel

- Historical (intraday) Options data in your Excel

- All US Stocks and Index options are included

- Real-time Option Order Flow

- Real-time prices and data on underlying stocks and indices

- Works on Windows, MAC or even online

- Implement MarketXLS formulas in your Excel sheets and make them come alive

- Save hours of time, streamline your option trading workflows

- Easy to use with formulas and pre-made templates

I invite you to book a demo with me or my team to save time, enhance your investment research, and streamline your workflows.