Better Research, Faster Decisions, More Profits

The ultimate Excel solution for Investors

Real-time

Real-time data updates to your models, provides insights, and enhances portfolio status. Advanced security and optimized data streaming in Excel.

Enterprise-grade

Leading data in Excel service for Investment Managers, RIAs, Asset Managers, Financial Analysts, and Individual Investors.

Premium

AI and automatic spreadsheet builder jumpstart your journey. Access billions of data points with premium support via phone, chat, or email.

13,574+ Stocks3,119+ ETFs26,802 Mutual FundsMillions of Options9,600 Crypto symbols300+ Economic Datasets75+ Forex Pairs

MarketXLS is a complete Excel stock solution

I have used lots of stock and option information services. This is the only one which gives me what I need inside Excel

MarketXLS is a data junkie’s dream. It gives me the flexibility to mine for hidden treasures.

I like to access historical closing prices on a particular date. That makes tracking performance easy.

Partners and Integrations

.svg)

See how MarketXLS can help you invest with an Excel App from start to finish

13,574+

Stocks

3,119+

ETFs

26,802

Mutual Funds

Millions

Options

9,600

Crypto symbols

Fanatical Personal Service & Community Support

12 hours

Less than 12 hours for our support to reply and we are always online

5,000+

Cherished community of customers and partners

97 Videos

And more online knowledge-base and documentation

Some of our users are a part of these organizations

Our Clients

I use MarketXLS to manage my personal portfolio. I can easily pull in stock quotes, betas, and dividends. I also like to access historical closing prices on a particular date. That makes tracking performance easy.

Patrick Cusatis, Ph.D., CFA

Associate Professor of Finance - Penn State University

I’m pretty happy with MarketXLS. I can now concentrate on manipulating financial data, valuing stocks and making investment decisions, rather than hacking around with VBA or copying/pasting data from websites.

Samir Khan

InvestExcel.net

MarketXLS greatly expanded my ability to analyze investments. MSN Stock Quotes was limited in the number of stock quotes it would handle in one spreadsheet and in the number of variables available. Many of them were worthless.

Jim Grant

Uses MarketXLS for personal money management

MarketXLS is a data junkie’s dream. Having access to infinite data points stored within the confines of your spreadsheet with the flexibility to scientifically manipulate and mine for hidden treasures.

Dave

Part-time day trader and swing trader since 2011

MarketXLS is a one stop solution for technical and fundamental analysis. With MarketXLS I can do research (technical, fundamental, and options) the way I like, in Excel. In addition to the ever evolving software, the support has been stellar

MarketXLS User

Call: 1-877-778-8358

Welcome! I'm Ankur, the founder and CEO of MarketXLS. With more than ten years of experience, I have assisted over 2,500 customers in developing personalized investment research strategies and monitoring systems using Excel.

I invite you to book a demo with me or my team to save time, enhance your investment research, and streamline your workflows.

I invite you to book a demo with me or my team to save time, enhance your investment research, and streamline your workflows.

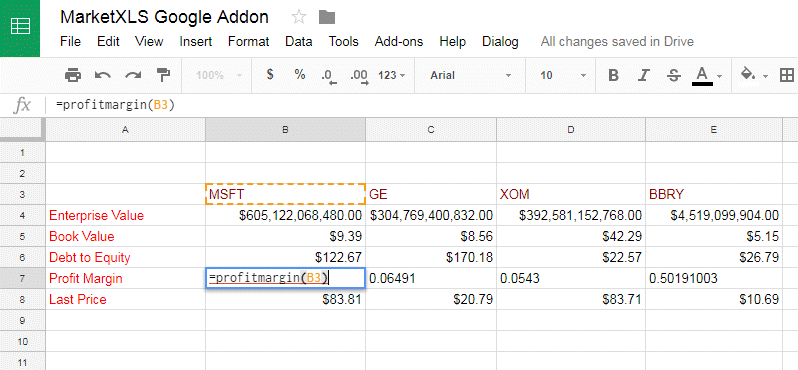

Implement “your own” investment strategies in Excel with thousands of MarketXLS functions and templates.

MarketXLS is a complete Excel stock solution

I have used lots of stock and option information services. This is the only one which gives me what I need inside Excel

MarketXLS is a data junkie’s dream. It gives me the flexibility to mine for hidden treasures.

I like to access historical closing prices on a particular date. That makes tracking performance easy.

See what else MarketXLS has to offer

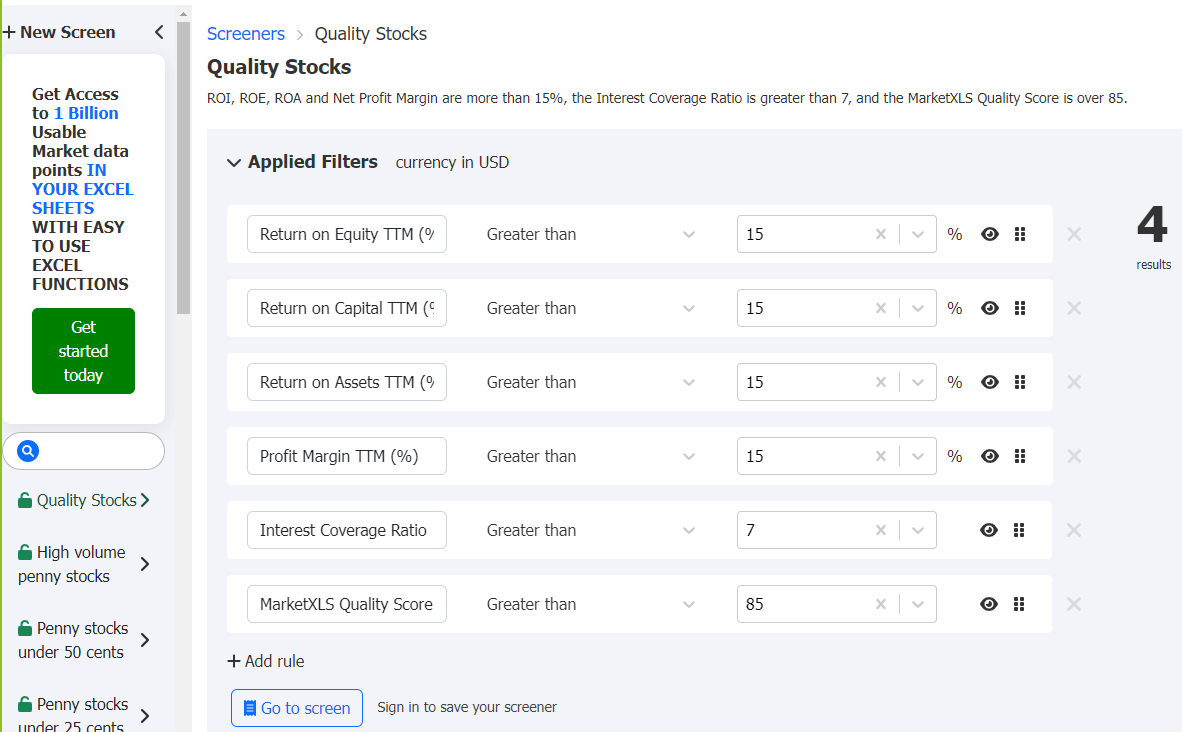

Filter out stocks that meet your criteria

Scan stocks on different fundamental, technical and price indicators like revenue, returns, dividends, earnings, SMA, RSI, price, volume etc.

Learn moreScan the option chain and track the payoff for the selected option

Scan thousands of options across multiple tickers and filter them quickly with relative filters with Real-time Streaming prices and greeks.Configure Option Trades with multiple options and analyze them.

Learn moreGet access to all information on a stock at one place

Everything you need to analyse a stock at one place.Fudamental, technical and price indicators, along with trend and MarketXLS Ranks

Learn moreSelect the metrics and get a ready to use spreadsheet

Just select the metrics and symbols you need in your spreadsheet, and we will create a ready to use excel file for you

Learn more