What is DCF Valuation and How to Perform it with Excel?

DCF Valuation (Discounted Cash Flow Valuation) is a common method of evaluating the intrinsic value of a business. It is used by many financial analysts, investors, and business owners to determine the fair price of a business or a stock. DCF Valuation is based on the assumption that the value of a business is the present value of its expected future cash flows. This article will focus on how to use Excel and financial modeling to perform DCF Valuation.

What is Excel Modeling?

Excel Modeling is the process of analyzing data and financial numbers within Microsoft Excel to create a better understanding of various components of a business. Financial Modeling allows professionals to produce detailed and accurate financial models in Excel. Excel Modeling also allows professionals to quickly perform ‘what-if’ analysis and simulate different scenarios that can help in the decision-making process.

Components of DCF Valuation

DCF Valuation consists of three major components:

- Cash Flow forecasting: Forecasting the future cash flows of a business by making assumptions about how the company will perform.

- Discounting: Discounting the future cash flows to today’s worth using the weighted average cost of capital (WACC).

- Calculating Terminal Value: Estimating the company’s value beyond the forecasted period by using the Terminal Value.

Performing DCF Valuation with Excel

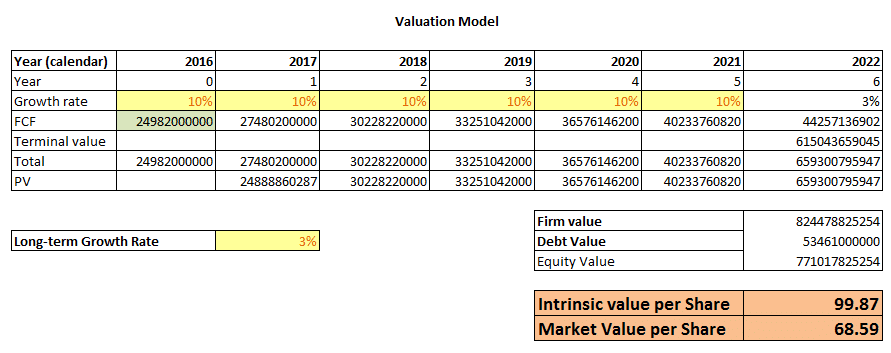

The process of performing DCF Valuation with Excel is straightforward. Depending on the assumptions made and the information you have, it’s possible to create a Financial Model which can generate an accurate valuation of a business. Here are the necessary steps to perform the DCF Valuation:

- Create Financial Projections: The first step is to create a set of financial projections that would be used as the basis for the DCF Valuation. This requires assumptions about the future performance of the business.

- Calculate Free Cash Flow: Using the financial projections created in the first step, you would need to calculate the company’s Free Cash Flow (FCF) for the period under consideration. It is calculated by deducting expenses from income.

- Calculate WACC: The Weighted Average Cost of Capital (WACC) is the basis for discounting the future cash flows in DCF Valuation. WACC is used to calculate the ‘expected rate of return’ investors should expect from investing in a company’s stock.

- Calculate Terminal Value: The terminal value of a company is used to calculate the value after the forecasted period. It is typically calculated by multiplying the last years’ free cash flow with a certain percentage.

- Discount Cash Flows: Using the WACC, you would need to discount the future cash flows to calculate the present value of the cash flows. You can use the Internal Rate of Return (IRR) function in Excel to calculate the present value.

A DCF model can be created in Excel to accurately value a company. The model should include cash flow projections, WACC and Terminal Value calculations, and discounting of cash flows. Financial Modeling and understanding of DCF Valuation are essential to create an accurate and reliable model.

MarketXLS provides a comprehensive suite of financial analysis and stock tracking tools, including DCF Valuation in Excel. With MarketXLS, users can easily perform the DCF Valuation by simply inputting the data into an Excel spreadsheet. MarketXLS makes it easy to calculate the various components of the DCF Valuation and produce accurate results quickly.

With MarketXLS, users can save time and effort by automating financial analysis and financial modeling. MarketXLS can help professionals, investors, and business owners soon accurately analyze businesses and make informed decisions.

Here are some templates that you can use to create your own models

Search for all Templates here: https://marketxls.com/templates/

Relevant blogs that you can read to learn more about the topic

Value Stocks With Dcf Model In Excel