!

In most of the situations, it’s always better to trade options that are highly liquid and active. In this article, I will show you how you can use MarketXLS’s inbuilt option scanner to quickly find out the most active options from the list of all option contracts of stocks in your list.

In very simple terms, options are standardized contract to exchange assets/cash at a certain price up to and including a certain contract end date.

Select a group of symbols in your Sheet that is the target group of all options you are looking to filter.

Click on Utilities>>Options Scanner on the MarketXLS Menu.

!

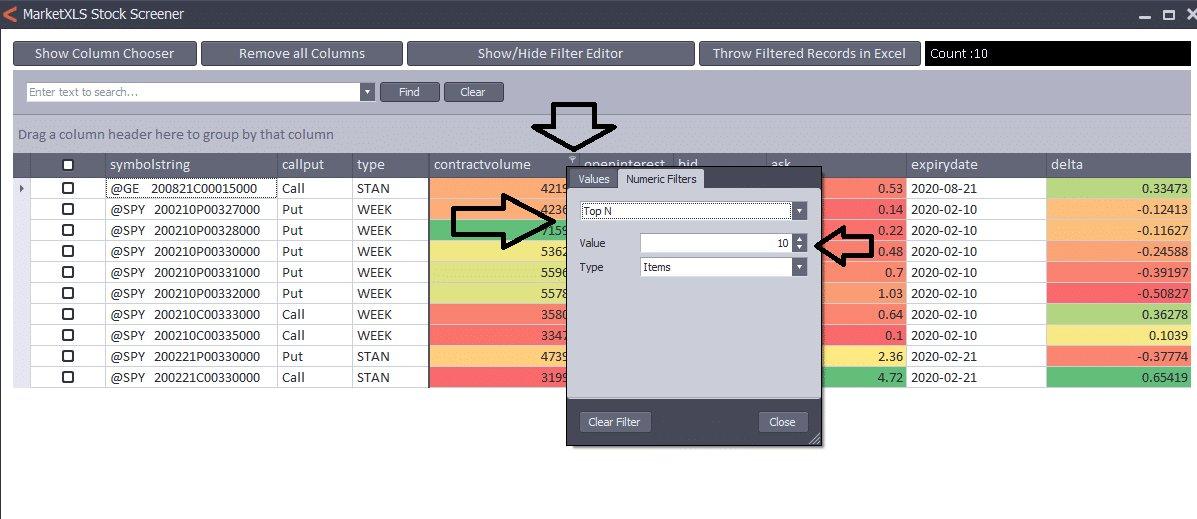

A new form will load all the options chains on those stocks. Click on the Column chooser and select the Contract Volume as the column you want to filter. The higher the liquidity the tighter the spreads are likely to be. The spread is the difference between bid and ask. The lower the spread the stock has to move less in the direction of your trade before you start gaining from the trade.

Find most active Options

Then choose the Top 10 filter options from the option Contract Volume column. Once you setup this filter, you will be left with the most active real-time option contracts and prices to analyze further with MarketXLS. So, these are the most active options in all the option contracts in the symbols you selected. These are the contracts that are most bought or sold during the day.

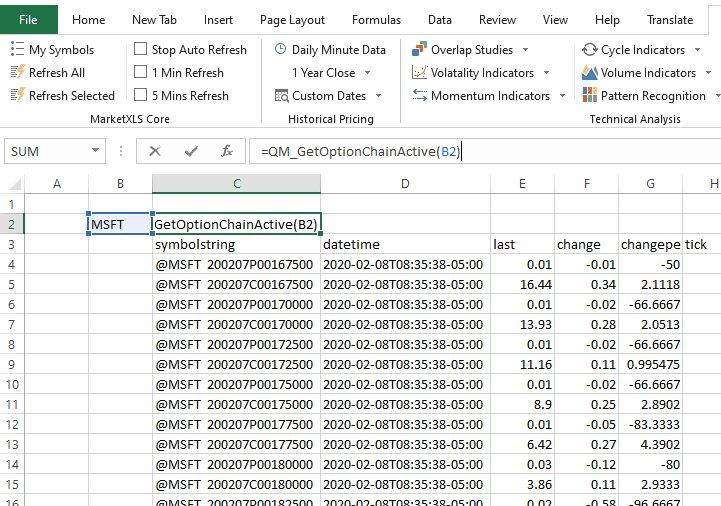

In MarketXLS, we also have a function called =QM_GetOptionChainActive(“MSFT“) this will already filter out all the inactive option contracts from your option chain.

Most Active Options

With MarketXLS, you can automate the process of finding most active options so you have a list of these contracts available every day for your further analysis.