Options Profit Calculator

This Option Profit Calculator Excel is a user contributed template will provide you with the ability to find out your profit or loss quickly, given the stock’s price moves a certain way. Browse hundreds of option contracts and order flow summary data streaming in your Excel.

Can It Be Made Simpler?

Options trading gives you high leverage while trading where you can control many more shares for your investment than if you were to invest in stocks. However, this leverage comes a lot more risk, as well.

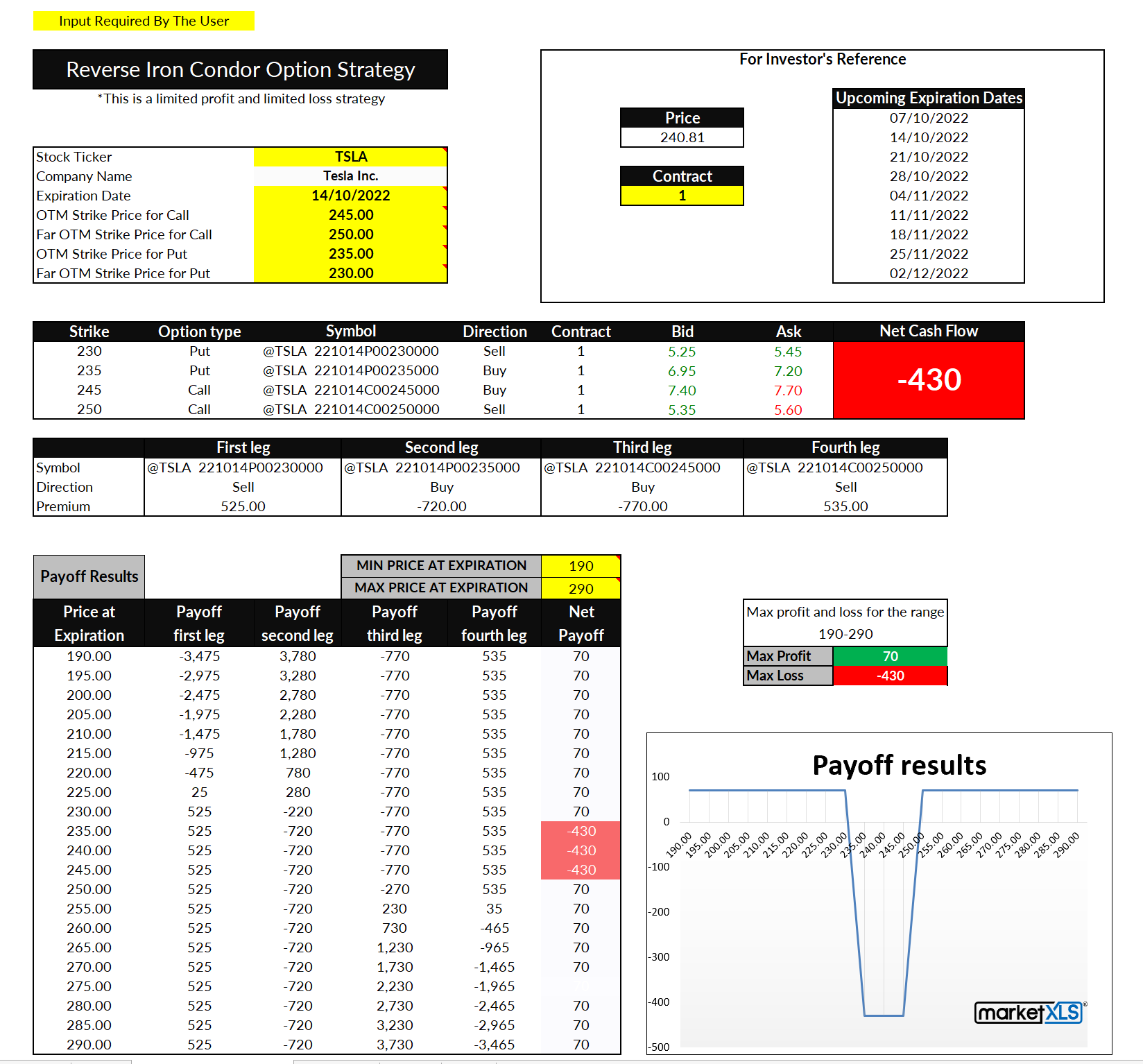

This Option Profit Calculator Excel is a user contributed template will provide you with the ability to find out your profit or loss quickly, given the stock’s price moves a certain way. It also calculates your payoffs at the expiry and every day until the expiry.

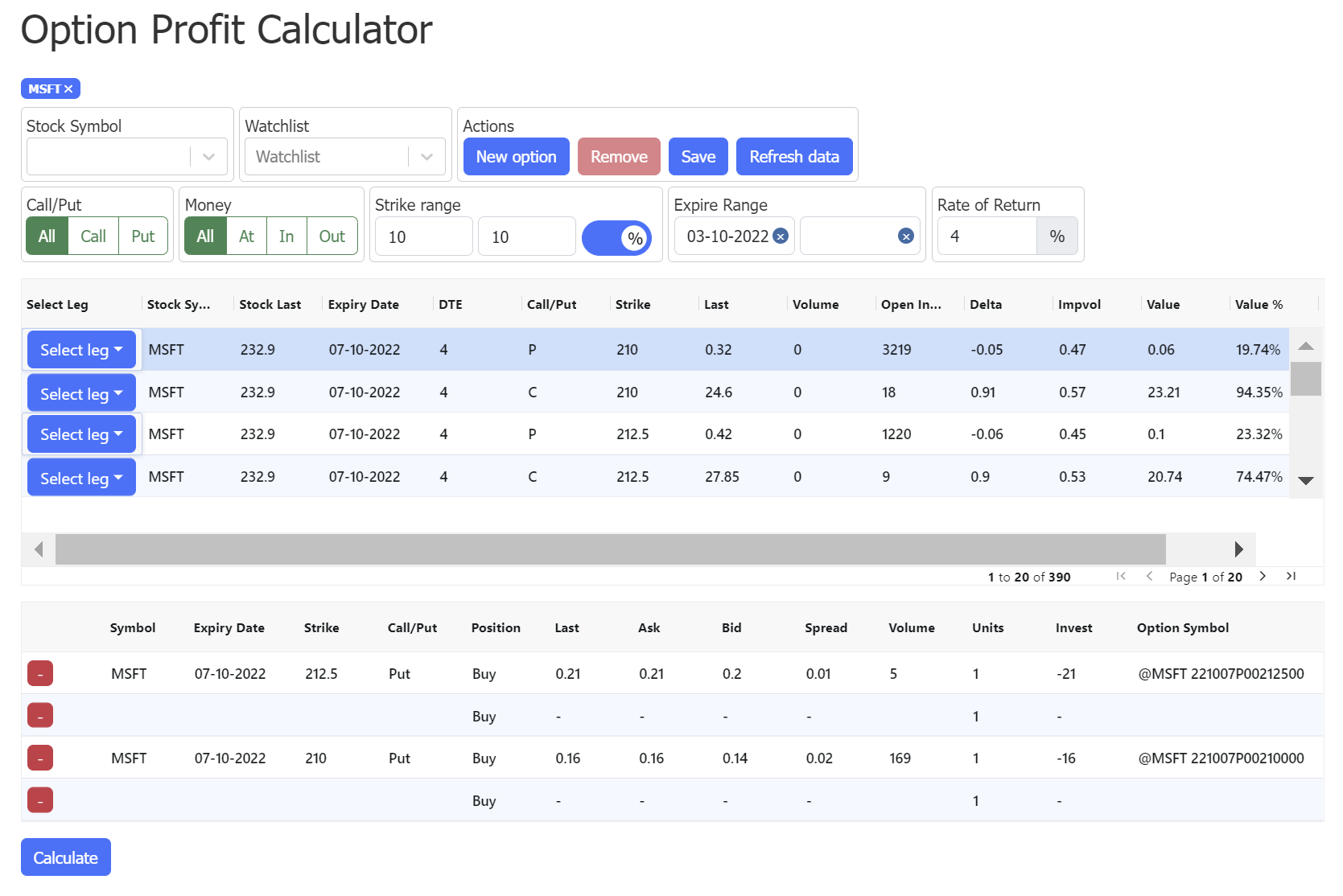

Browse hundreds of option contracts by simply clicking on the Expiry dates with real-time option data streaming in your Excel

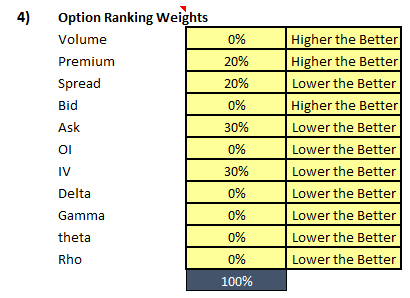

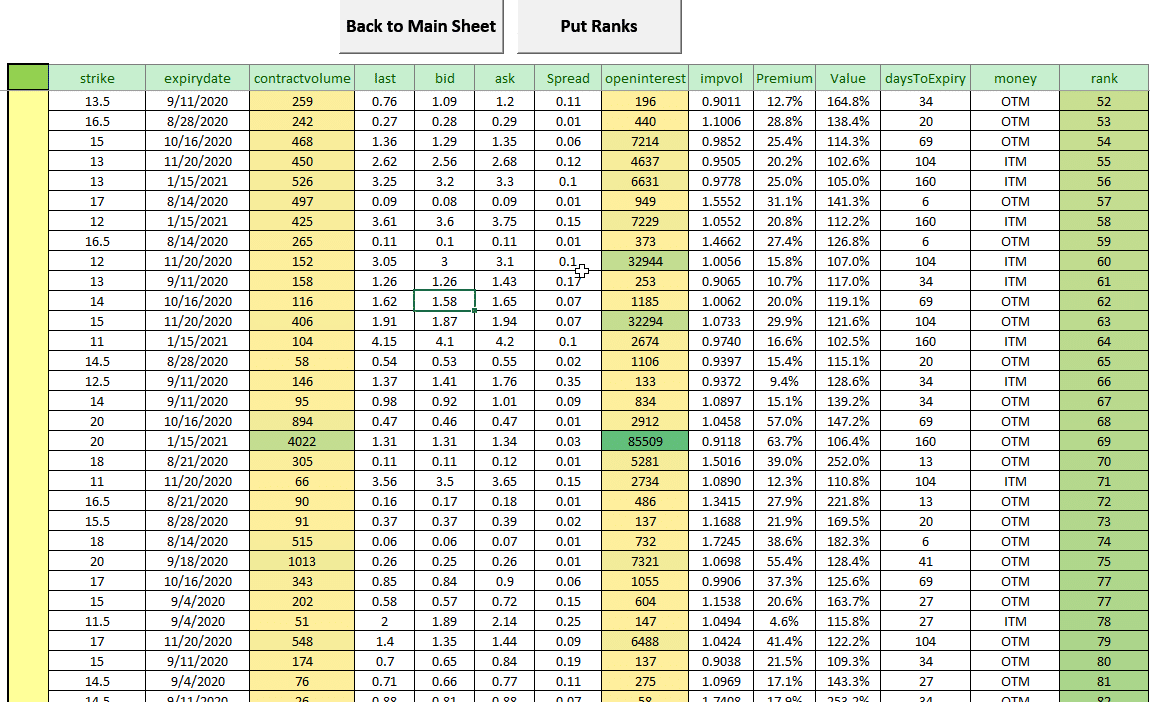

Get the Ranks of the filtered option contracts by your criteria and ranking weights like Low Premium, High Volume, Low Spreads, and more.

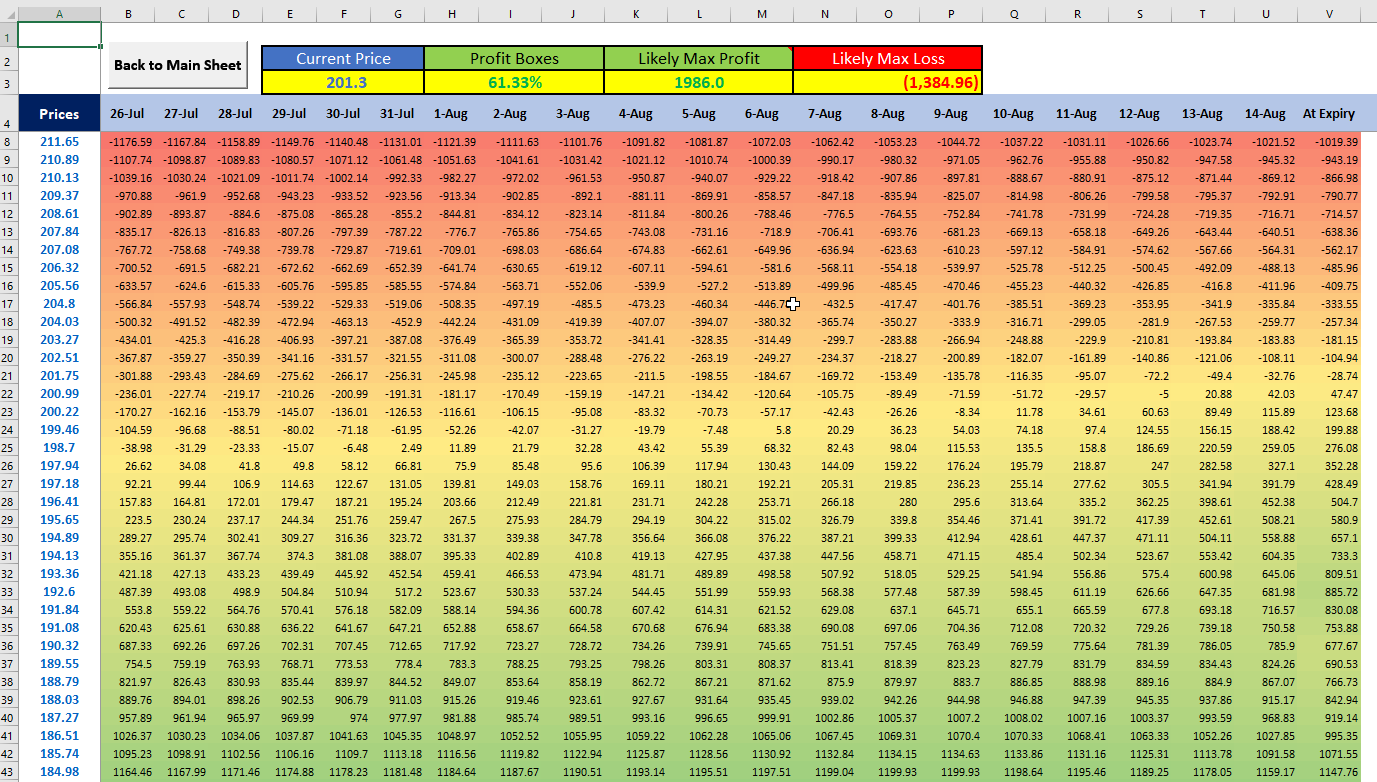

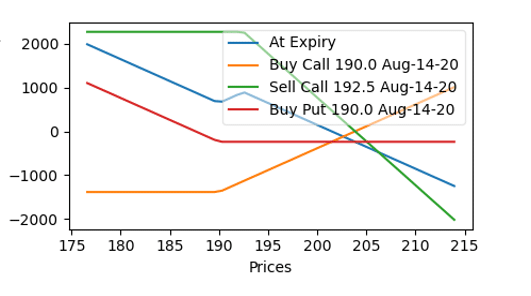

See Option Strategy pay off results until the day of the expiry, taking into account the time decay with Black Scholes Options Model.

Create Option strategy charts, “profit” or “loss” box analysis and other calculations at click of a button

Scan all available options for Real Value and find the Overbought/Oversold Option contracts

Looking for an online version? Check out our new web-based Options Profit Calculator

This simple tool allows you to input the details of your trade, including the underlying stock price, the options strike price, and the number of contracts, to instantly calculate your potential profit or loss. Whether you're a beginner or an experienced options trader, this video will provide you with the information you need to make more informed trading decisions.

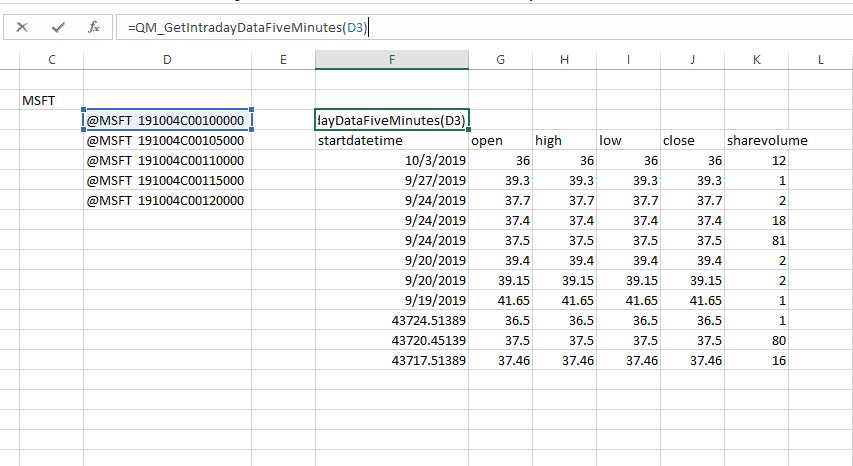

Make your own option analysis models with MarketXLS functions that can get you real-time option chains, options history, intraday, and live real-time prices.

The Bottom Line and Disclaimer

The Excel template has some VBA code in it, which calls MarketXLS functions to pull the option chains automatically. In this Options Profit Calculator all you need to do is enter the symbol of the stock, and the program will download all active options contracts and their details. After getting the option chain for the stock, this program will populate various dropdown, charts, etc. for you to fill the legs of your option strategy.

There are no buttons to click to download the data, all you need to do is change the symbol, and the data is automatically retrieved in the background. The template also creates a chart showing what your P&L position would be at the expiry date of your option strategy

With this Excel template and options data from MarketXLS you instantly know what is likely to be the maximum profit or loss for your options strategies for each day until the expiry.

To get started with this template, you will need to have an active MarketXLS subscription with options data.

Once you can access historical options data and option chain from MarketXLS, you can enter your stock and choose your option strategy legs using pre-populated active options contracts.

This template also can rank the filtered options contracts on specific expiry date. The Assumptions sheet is where you fill in the weight percent that you want to assign to each option contract. For example, you could assign 50% weight to the Option’s premium, 20% volume, and 30% to spread. The template will then rank the option contracts accordingly.

For the ranking algorithm to work, this options profit calculator template uses Python with a couple of data analytics modules installed on your machine.

If you want to know more about MarketXLS, then book a demo with us today. MarketXLS provides you with more than 500 stocks and markets related functions to help your investment research. Note: We only support US options at the moment.

To take advantage of this Option Profit Calculator Excel template, and many other MarketXLS’s option-related functions book a MarketXLS demo today.

I invite you to book a demo with me or my team to save time, enhance your investment research, and streamline your workflows.