Introduction

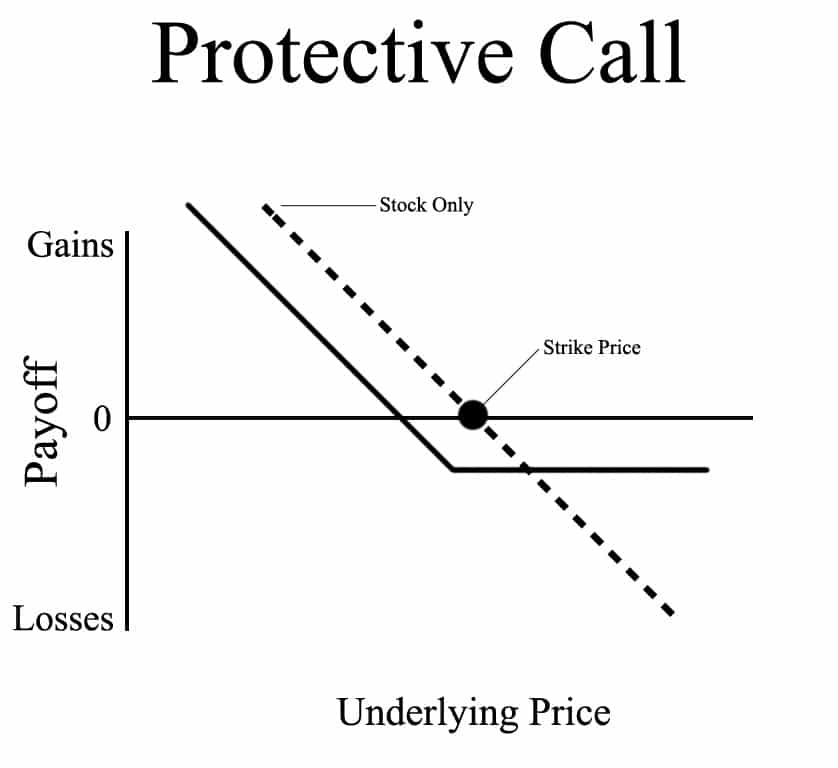

The Protective Call is a hedging strategy wherein the trader, who is having an existing short position in the underlying security, buys a Call option to hedge against an increase in the price of the underlying security.

In this strategy, a trader sells a position in the underlying asset (shorts shares or shorts futures) and buys an ATM Call Option to protect against the rise in the price of the security.

This strategy is exactly the opposite of the Synthetic Call strategy. The Protective Call is used when the trader is bearish on the underlying security and would like to protect against the ‘rise in price’ of the underlying asset. Premium needs to be paid for buying the Call option, however, the danger of price movement gets curtailed.

The risk is limited while the rewards are unlimited. Thus, the Protective Call works like an insurance policy as it provides protection against price reversal. The profits speculated can be retained and losses can be prevented with the right use of a Protective Call.

Protective Call Construction

A Protective Call strategy is executed when the trader is bearish on the underlying security but cautious of uncertainties in the near term. The call option is thus bought to protect unrealized gains on the current short position in the underlying. To execute the strategy, the trader needs to:

- Short 100 Shares (or whatever number of shares according to the strategy of trader)

- Buy 1 ATM Call

Profit Potential

The Protective Call is also known as a synthetic Long put as its reward/risk profile is like that of a Long Put. Like the Long put strategy, there is no limit to the maximum profit attainable using this strategy.

The formula for calculating profit is:

- Profit Achieved When Price of Underlying < Sale Price of Underlying – Premium Paid

- Profit = Sale Price of Underlying – Price of Underlying – Premium Paid

- Maximum Profit = Unlimited

The maximum profit from the strategy is equal to the difference between the sale price of the underlying asset and the current price of the underlying, minus the premium paid for the Call option. As the price of the underlying keeps going down, the profit earned keeps going up.

Limited Loss

The maximum loss for this strategy is limited and is equal to the premium paid for purchasing the call option.

The formula for calculating maximum loss is:

- Max Loss = Call Strike Price – Sale Price of Underlying + Premium Paid + Commissions Paid

If the price of the underlying goes up, against the expectation of the bearish trader, the Call option will get exercised and the only loss that the trader will make is equal to the amount of the premium paid for buying the Call option.

Breakeven Point

The price at which break-even is achieved for the protective call option can be calculated using the following formula:

- Breakeven Point = Sale Price of Underlying + Premium Paid

So it is achieved when the price of the underlying asset is equal to the total of the sale price and premium paid.

Applying Protective Call Strategy Using MarketXLS Template With an Example:

MarketXLS software is a one-stop solution for the analysis of your entire investments. It provides a host of functions like EPS, various ratios, key fundamentals, historical data, options pricing and much more to assess the value of your investments. It provides a variety of templates for various options trading strategies and also to compare your portfolio stocks for doing better analysis of your investments.

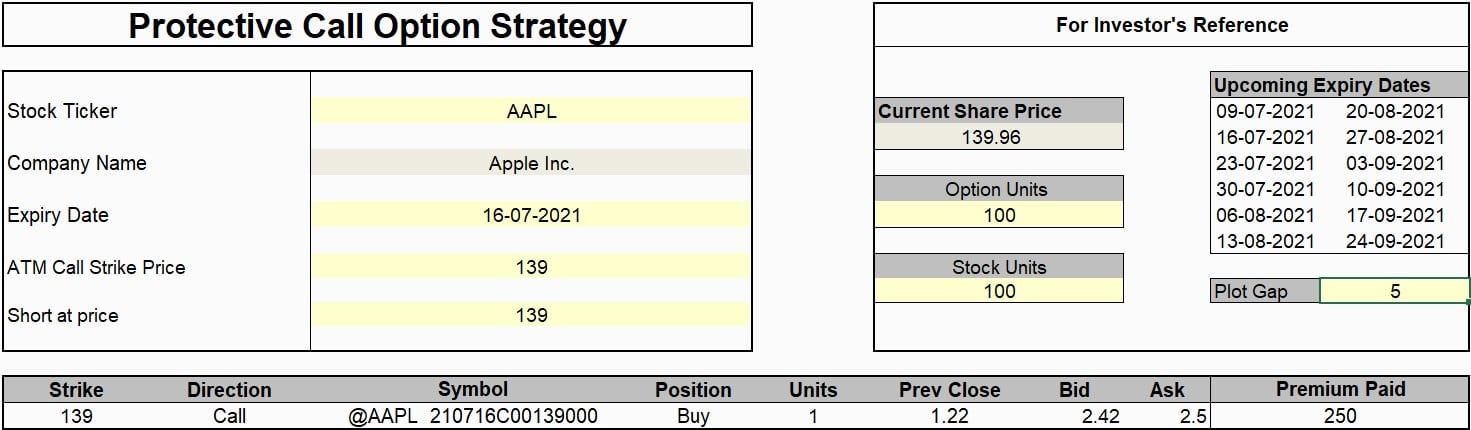

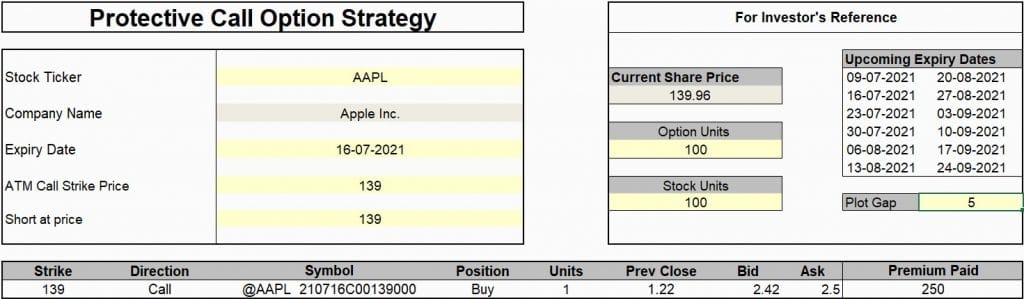

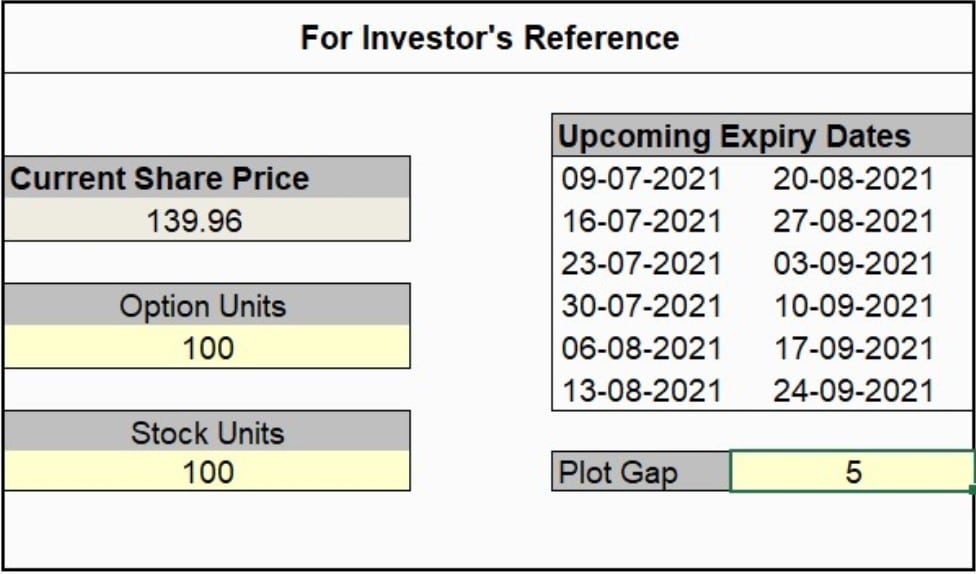

Step 1: Enter the stock ticker in cell D5 and press enter. The template will provide the upcoming expiry dates for the stock and the current market price. Select any one of the expiry dates.

Step 2: Enter the ATM Call Strike price and the short price at which the investor took a short position. Also, enter the number of stock and option units according to the positions you are short on.

Step 3: The template might ask you to refresh. Go to the MarketXLS tab in the ribbon > Refresh All. Click on Refresh All.

The template uses the bid price for sells and ask price for buys to calculate the amount of premium to be paid by you.

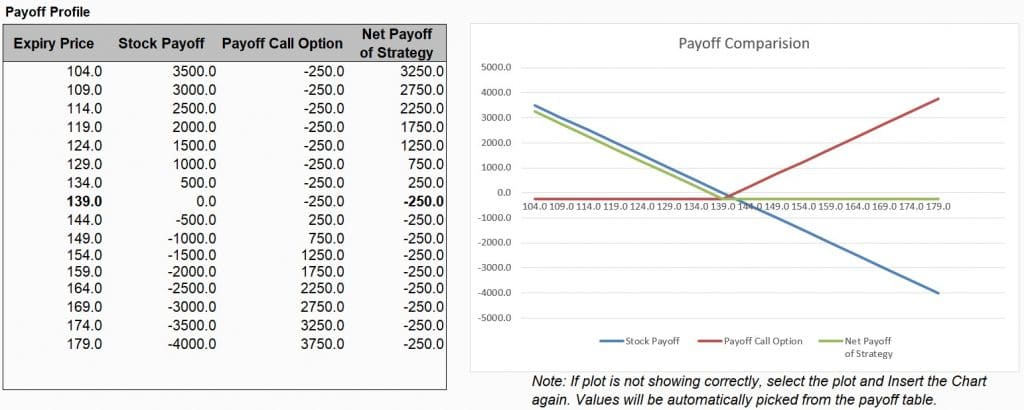

Step 4: The template also provides the Net Payoff Profile of the strategy. Set the plot Gap to adjust the plot x-axis in cell L12. It will calculate the net profit or net loss for all the levels of expiry prices and present it graphically. In the example below, I have set it at $5.

Apple Inc. (AAPL) as an example in the above template:

AAPL stock is trading at levels of $140 on 5th July, 2021. I have selected the upcoming expiry of 16th July, 2021 to enter the trade. I have a bearish outlook towards the stock so I am selling 100 shares @$139. Though, at the same time, I am uncertain about a rise in the price of the stock. So I am executing a Protective Call Options Strategy by buying an ATM Call Option @$139 for which a premium will have to be paid.

The template will calculate the premium amount for entering the trade, which is $250 in this case.

[2.5*100 ($139 strike) = $250}

The maximum loss will occur when the stock price is $139 or higher at expiration. Even if the stock rallies to $170 on expiration, my maximum loss would be $250. Let’s see how this works out.

At $170, my short position will suffer a loss of $3100. However, my Call option will also have an intrinsic value of $3100 and can be sold for that amount. Including the initial $250 paid to buy the call option, my net loss will be $3100 – $3100 + $250 = $250.

At the same time, there is no limit to the profits attainable if the stock price slips down. Suppose the stock price crashes to $104, my short position will gain $3500. Excluding the $250 paid for the protective call, my net profit will be $3250. This profit will even be greater if the stock price goes down any further.

Here is a video explaining Protective Call Options Strategy using MarketXLS: https://youtu.be/UUcXj8tO0YA

Bottom Line

The Protective Call is used when you have an existing short position that is in profit. Also, it is very simple to execute and just one transaction is involved.

The biggest merit of this strategy is that it allows you to keep a profitable position open so you can possibly make further profits, while also ensuring that you don’t lose the profits already made from that position.

The biggest demerit of this protection is that there is a cost involved in using it, and this cost can reduce your profit margin. It is ultimately down to you to decide whether the cost is worth it for the protection offered.

This isn’t an options trading strategy in the sense that is used for speculating on the market, but it is a brilliant hedging tool and a great example of how dynamic options contracts are. Therefore, by using this hedging strategy correctly it is possible to have the best of both situations (protection against a reversal and potential for further profits) against a comparably cheap premium.

Disclaimer

All trademarks referenced are the property of their respective owners. Other trademarks and trade names may be used in this document to refer to either the entity claiming the marks and names or their products. MarketXLS disclaims any proprietary interest in trademarks and trade names other than its own, or affiliation with the trademark owner.

Reference

https://www.theoptionsguide.com/protective-call.aspx