A short put option strategy is executed when a trader sells or writes a put option. The trader who buys the put option is “long,” and the trader writing the option is “short” and receives the premium or the option cost of the trade. The short put option is also called the “naked” put or “uncovered” put.

This strategy is used when the investor is bullish towards the market and expects the prices to go up. If the prices do go up as predicted, then the investor can sell the put option and make a profit. However, if prices go down, the buyer of the put option exercises his option, and the investor incurs losses.

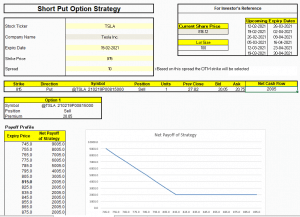

Let us see how we can use the MarketXLS Template for short put options tracking:

• Mention the stock ticker

• Enter the expiry date of the option. A list of upcoming expiry dates has been provided adjacent to the input.

• Enter the strike price you are looking to buy

• Enter the spread (the difference between higher and lower strike price)

Here is an example using Tesla Inc., which is currently trading for $816.12 per share. The investor decides upon the strike price of $815. The option premium is $20.5, which is the maximum profit that can be realised.

Profit and Loss

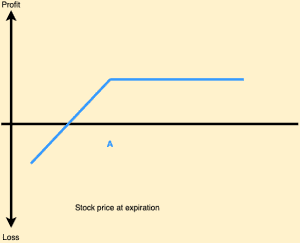

A short put option is an excellent strategy to use when you are confident about the market’s direction. As an investor, you don’t need to buy or own the securities before putting a put option on them. As an investor, your intention must be to let the option expire without being exercised. During this period, the investor earns the option cost or the premium and makes a profit. It is important to note that the maximum profit is limited to the premium received.

However, if your market prediction is wrong, then you may incur large losses. If the asset price goes down and the buyer exercises the option, then the investor is obligated to buy the shares at the higher price (strike price) and sell at the lower current price.

When to use this strategy?

The idea behind the short put strategy is to earn a profit from a rise in a stock’s price by earning the premium associated with the sale in a short put. The right time to use this strategy is when the investor is strongly bullish towards the market and expects the price of the underlying asset to rise sharply. The short put strategy gives limited rewards, but the risk involved is unlimited. The traders who use this strategy mostly take up many different positions to keep earning premiums from various sources. Occasional losses in one trade are easily compensated by premiums earned from others.

In case the writer of the option starts incurring losses from a trade, they can get away from the arrangement by buying the same option from someone else at a premium lower than the one he sold it.

Advantages and disadvantages

The short put strategy provides a steady source of income in the form of premiums, unlike other strategies that only offer a one-time payment.

On the other hand, this strategy has a high-risk potential that keeps increasing as the price of the underlying asset decreases. The accompanying profit potential, however, is capped at the premium received for the option.

Key Takeaways

The short put option strategy is relatively high on the risk potential, and traders must use it cautiously and only when they are very confident about their market predictions. The MarketXLS Template for short put options can be handy and help you track the performance of your chosen stock.

A short put option is still beneficial if the price of the underlying asset remains at the same level because the time decay factor will always be in your favor as the time value of put will reduce over some time as you reach near to expiry. This is a good options trading strategy because it gives you upfront credit, which will help offset the margin somewhat.

Disclaimer

None of the content published on marketxls.com constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person.

The author is not offering any professional advice of any kind. The reader should consult a professional financial advisor to determine their suitability for any strategies discussed herein.

the article is written to help users collect the required information from various sources deemed an authority in their content. The trademarks, if any, are the property of their owners, and no representations are made.