Technical indicators

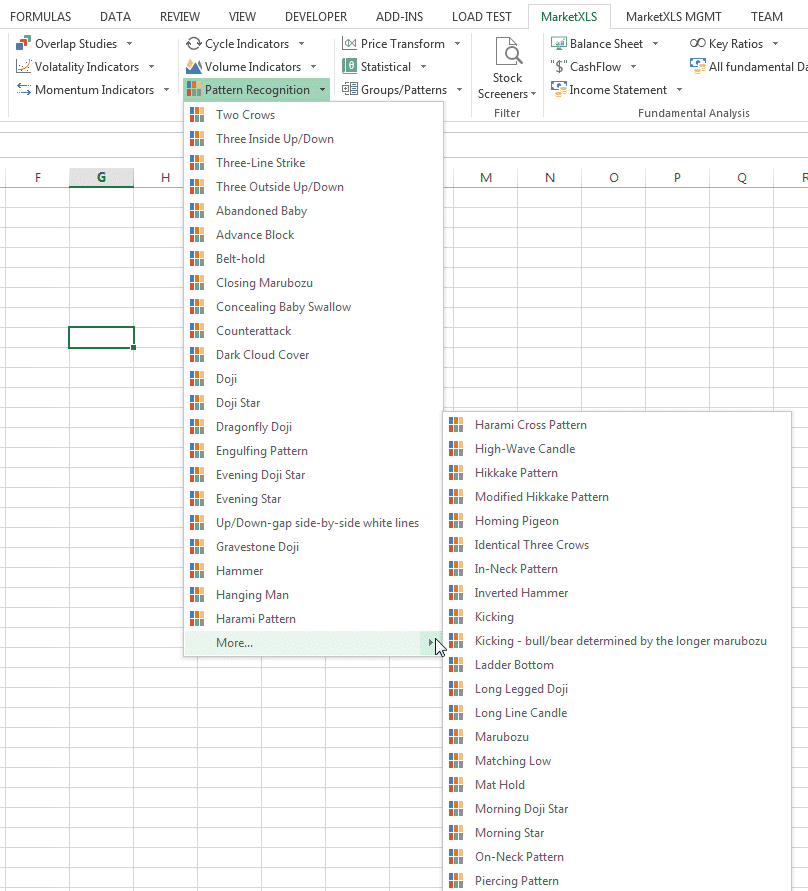

You can use MarketXLS to calculate more than 120 Technical Indicators with a few clicks in Excel. Scan your data for Candlestick Patterns

Get Access to 1 Billion Usable Market data points IN YOUR EXCEL SHEETS WITH EASY TO USE EXCEL FUNCTIONS

Get started today

MarketXLS does all mentioned below plus much more

Perform Technical Analysis in Excel with 120+ Technical Indicators.

Run groups of indicators on your data.

Customize everything including time period, Moving Average types etc.

Option to runs with default inputs without prompting.

Discover patterns in your data and analyze its impact.

Annotate patterns on Candle Stick Charts with a few clicks.

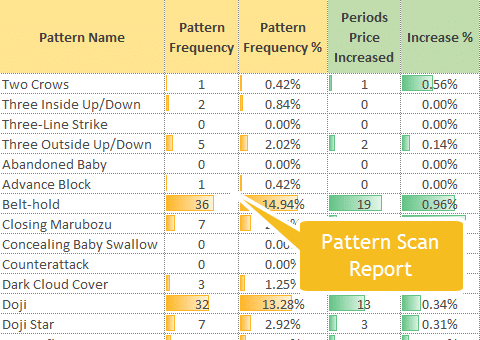

Scan for patterns with our Pattern-Scan Report - for actionable insights with technical analysis in Excel sheets.

Run with default inputs like 14 days for RSI or input your own parameters.

OVERLAP STUDIES

MOMENTUM INDICATORS

CYCLE INDICATORS

VOLUME INDICATORS

PATTERN RECOGNITION

STATISTIC FUNCTIONS

PRICE TRANSFORM

- Bollinger Bands

- Double Exponential Moving Average

- Exponential Moving Average

- Hilbert Transform – Instantaneous Trendline

- Kaufman Adaptive Moving Average

- Moving average

- MESA Adaptive Moving Average

- Moving average with variable period

- MidPoint over period

- Midpoint Price over period

- Parabolic SAR

- Parabolic SAR – Extended

- Simple Moving Average

- Triple Exponential Moving Average T3

- Triple Exponential Moving Average

- Triangular Moving Average

- Weighted Moving Average

- Average Directional Movement Index

- Average Directional Movement Index Rating

- Absolute Price Oscillator

- Aroon

- Aroon Oscillator

- Balance Of Power

- Commodity Channel Index

- Chande Momentum Oscillator

- Directional Movement Index

- Moving Average Convergence/Divergence

- MACD with controllable MA type

- Moving Average Convergence/Divergence Fix 12/26

- Money Flow Index

- Minus Directional Indicator

- Minus Directional Movement

- Momentum

- Plus Directional Indicator

- Plus Directional Movement

- Percentage Price Oscillator

- Rate of change : ((price/prevPrice)-1)*100

- Rate of change Percentage: (price-prevPrice)/prevPrice)

- Rate of change ratio: (price/prevPrice)

- Relative Strength Index

- Stochastic

- Stochastic Fast

- Stochastic Relative Strength Index

- 1-day Rate-Of-Change (ROC) of a Triple Smooth EMA

- Ultimate Oscillator

- Williams’ %R

- Hilbert Transform – Dominant Cycle Period

- Hilbert Transform – Dominant Cycle Phase

- Hilbert Transform – Phasor Components

- Hilbert Transform – SineWave

- Hilbert Transform – Trend vs Cycle Mode

- Chaikin A/D Line

- Chaikin A/D Oscillator

- On Balance Volume

- Two Crows

- Three Black Crows

- Three Inside Up/Down

- Three-Line Strike

- Three Outside Up/Down

- Three Stars In The South

- Three Advancing White Soldiers

- Abandoned Baby

- Advance Block

- Belt-hold

- Breakaway

- Closing Marubozu

- Concealing Baby Swallow

- Counterattack

- Dark Cloud Cover

- Doji

- Doji Star

- Dragonfly Doji

- Engulfing Pattern

- Evening Doji Star

- Evening Star

- Up/Down-gap side-by-side white lines

- Gravestone Doji

- Hammer

- Hanging Man

- Harami Pattern

- Harami Cross Pattern

- High-Wave Candle

- Hikkake Pattern

- Modified Hikkake Pattern

- Homing Pigeon

- In-Neck Pattern

- Inverted Hammer

- Kicking

- Ladder Bottom

- Long Legged Doji

- Long Line Candle

- Marubozu

- Matching Low

- Mat Hold

- Morning Doji Star

- Morning Star

- On-Neck Pattern

- Piercing Pattern

- Rickshaw Man

- Rising/Falling Three Methods

- Beta

- Pearson’s Correlation Coefficient

- Linear Regression

- Linear Regression Angle

- Linear Regression Intercept

- Linear Regression Slope

- Standard Deviation

- Time Series Forecast

- Variance

- Average Price

- Median Price

- Typical Price

- Weighted Close Price

Generated in couple of clicks this report scans historical data of stocks for candlestick patterns their impact on closing prices. Following is a sample of a scan of 10 year prices of a popular stock

Call: 1-877-778-8358

Welcome! I'm Ankur, the founder and CEO of MarketXLS. With more than ten years of experience, I have assisted over 2,500 customers in developing personalized investment research strategies and monitoring systems using Excel.

I invite you to book a demo with me or my team to save time, enhance your investment research, and streamline your workflows.

I invite you to book a demo with me or my team to save time, enhance your investment research, and streamline your workflows.

Implement "your own" investment strategies in Excel with thousands of MarketXLS functions and templates.

MarketXLS provides all the tools I need for in-depth stock analysis. It's user-friendly and constantly improving. A must-have for serious investors.

I have been using MarketXLS for the last 6+ years and they really enhanced the product every year and now in the journey of bringing in AI...

MarketXLS is a powerful tool for financial modeling. It integrates seamlessly with Excel and provides real-time data.

I have used lots of stock and option information services. This is the only one which gives me what I need inside Excel.