Introduction

Mastering 0DTE Options: A Quick Guide for Traders

Zero Days to Expiration (0DTE) options are exactly what they sound like—options that expire on the same day they are bought. A robust 0DTE options strategy can provide traders with a unique chance to capitalize on market movements within just a few hours, making them a thrilling yet high-stakes playground.

The attraction lies in the potential for rapid profits, but this is balanced by significant risks. Understanding how 0DTE options work is crucial for anyone looking to employ strategies that capitalize on time decay and market volatility. In this article, we'll dive into the mechanics of 0DTE options, explore effective strategies such as iron condors and vertical spreads, and pinpoint key considerations for managing risk and maximizing returns. Ready to uncover the secrets behind these high-octane trading instruments? Let's get started.

How do 0DTE options work?

Zero Days to Expiration (0DTE) options, as the name implies, are options that expire on the same day they are traded. They provide a unique opportunity for traders to speculate on short-term market movements without the commitment of a long-term position. By leveraging time decay, these options can offer significant profit potential within just a few hours but also harbor substantial risk due to their inherent volatility. Imagine trying to catch a falling knife—you might catch the handle and win big, or you might get cut.One of the fascinating aspects of 0DTE options is their sensitivity to market fluctuations. Because they have such a short lifespan, even a minor movement in the underlying asset can lead to substantial changes in the option’s price. This makes them a favorite among day traders who thrive on rapid changes and quick decisions. However, it’s crucial to recognize the peril of time decay, which erodes the value of the option as the clock ticks toward the close of the trading day. If the market doesn’t move in your favor, the option can quickly become worthless, turning what seemed like a golden opportunity into a zero-sum game.For example, let’s say you’re trading 0DTE options on the S&P 500 index. If the index sees a big swing due to a surprise economic report, a well-timed 0DTE call or put option could see an exponential increase in value. But if you misjudge the market’s direction, the same option can lose value just as fast. Therefore, traders often use these options as part of sophisticated strategies such as spreads or hedging to manage risk while seeking profit. The key is to strike a balance between potential gains and the high stakes involved, making 0DTE options a thrilling yet perilous playground for market enthusiasts.

What is the best strategy for 0DTE options?

When it comes to 0DTE (Zero Days to Expiration) options, the best strategy often involves leveraging high-probability trades that capitalize on the rapidly decaying time value. One approach is the use of iron condors, which are neutral multi-leg options strategies. By selling both an OTM (outside-the-money) call and put, while simultaneously buying further OTM options as protection, you can create a wide profit range that benefits from theta decay. The short options will diminish in value quickly as they near the expiration, given minimal price movement, which allows you to buy them back at a lower price or let them expire worthless.Alternatively, traders may favor using vertical spreads, particularly credit spreads such as a bull put spread or bear call spread. These strategies can provide a defined risk and reward, making it easier to manage positions intraday. For instance, if you’re slightly bullish on a stock heading into the final trading day, selling a bull put spread involves selling a put with a higher strike price and buying another put with a lower strike. The aim here is to profit from the position’s time decay while minimizing risk exposure if the underlying asset unexpectedly moves against you.Engaging in 0DTE options requires keen attention to intraday volatility and a robust risk management plan. Always remain aware of economic events or earnings reports that could drastically affect market movements within a short timeframe. It’s like betting on a horse race; you have to understand the terrain and the competitors to ensure your wager is not just a gamble but a calculated move. Can you handle the fast-paced nature of 0DTE options, or will you let the race’s twists and turns throw you off course?

What are the risks associated with 0DTE options trading?

Diving into the world of 0DTE options trading, the risks are manifold and worth considering seriously. **0DTE**stands for zero days to expiration, meaning these options expire the same day they are traded. With such a narrow window, the potential for significant gains can be enticing, but it also means one is walking a financial tightrope. The hyper-volatile nature of these options can lead to oversized losses in mere minutes, especially if the underlying asset experiences any sudden price swings. Imagine playing soccer on a cliff’s edge; one false move, and you’re over the side.Moreover, 0DTE options trading demands constant vigilance and rapid decision-making. There’s no room for stepping away from your screen or hesitating as market conditions can shift dramatically in an instant. Traders must possess not only quick reflexes but also impeccable timing to navigate these treacherous waters. Unlike 30-day or even weekly options, 0DTE trades offer no margin for error. If you’re wrong, you’re not just out of the game; you’re out of the money. This level of intensity isn’t just stressful—it can lead to burnout or emotional decision-making, further amplifying risks. Would you trust yourself to perform under such pressure? The stakes couldn’t be higher.

Are 0DTE options profitable?

The profitability of 0DTE options, or zero days to expiration options, largely hinges on their high potential for significant returns due to their extreme sensitivity to underlying asset price movements. These options can appeal to traders seeking to capitalize on short-term market movements. For instance, if a trader accurately predicts a sharp price movement in a stock or index within the same day, the corresponding 0DTE options could deliver outsized gains. However, this high probability of profit comes with equally high risk. A wrong market bet means that the value of these options can plunge to zero by the close of the day, making them a double-edged sword.Evaluating the profitability of 0DTE options requires understanding the balance of risk and reward. Traders often employ strategies like buying call or put options, which can provide large upside potential, or selling options to capitalize on the rapid time decay, known as theta decay. For example, selling 0DTE options can benefit from the swift erosion of option premiums, but this strategy involves substantial risks if the market moves sharply against the position. To navigate these risks, seasoned traders might utilize tools such as technical analysis, historical data, and implied volatility indicators to make more informed decisions. Ultimately, while 0DTE options can be highly profitable under the right market conditions, they demand a nuanced approach and robust risk management strategies to be consistently successful.

What is the most consistently profitable option strategy? 0 DTE?

When it comes to consistently profitable option strategies, one popular approach is the 0 DTE (zero days to expiration) strategy. This method involves trading options that expire within the same day. At a glance, this might seem like a high-stress, high-risk play due to the compressed time frame. However, it leverages the rapid time decay of options premiums, potentially turning a profit with less market movement. By focusing on 0 DTE trades, traders can exploit inefficiencies caused by market volatility and take advantage of the premium decay to maximize returns. For instance, selling covered calls or cash-secured puts allows traders to collect premiums quickly, often within hours.However, success with 0 DTE strategies requires meticulous planning and a keen understanding of market movements. While it’s true that these short-term trades can yield immediate profits, the risk of substantial losses is also significant due to the reduced reaction time. One must be adept at technical analysis and have a solid grasp of risk management techniques. Strategies like iron condors and butterfly spreads can be particularly useful in a 0 DTE scenario, as they offer well-defined risk and profit zones. It’s worth noting that while the allure of quick gains is strong, 0 DTE strategies aren’t for the faint-hearted and demand constant monitoring and swift decision-making.

Is 0DTE a zero loss option strategy?

The term “0DTE” (Zero Days to Expiration) is often appealing to traders due to the potential for rapid gains. However, labeling 0DTE as a “zero loss option strategy” is a misnomer. While it’s true that the strategy can deliver significant returns close to expiration, the risks are equally pronounced. For instance, consider the inherent volatility of options on expiration day. Prices swing dramatically within hours, amplifying both profit and potential for loss. A trader might make a substantial gain in the morning but lose it all by the afternoon due to a sudden market shift. Moreover, the use of 0DTE involves precision and a deep understanding of market movements. Seasoned traders might mitigate risks by employing strategies like straddles or strangles, which hedge against unexpected shifts. However, even with hedging, the market’s unpredictability means that no strategy— including 0DTE— is entirely risk-free. Drawing an analogy, it’s like sailing in high seas: expert navigators can steer through the waves effectively, but there’s always the chance of being caught in a sudden storm. In conclusion, while 0DTE is intriguing for its high-reward potential, it’s far from a zero-loss strategy and requires careful consideration, skill, and risk management.

What tools can help in analyzing 0DTE options?

For analyzing 0DTE (zero-days-to-expiration) options using MarketXLS, you can leverage several tools and functions that facilitate comprehensive options analysis and scanning. Here are the tools identified from the provided document:

1. Enhanced Options Analysis Functions

– Total Volume & Open Interest Functions: Functions like =@TotalVolumeOptions("Symbol","P",ExpirationNext("Symbol")) can be used to understand the complete volume of options traded for an underlying with functionalities tailored to retrieve total volume based on specific criteria like option type and specific expiry.

– Put/Call Ratios: These ratios gauge market sentiment with precise ratios, whether you're looking for volume-based ratios or open interest ones. Historical ratios can also aid in trend analysis.

– Historical Option Data Retrieval: Functions such as =@ImpliedVolatilityHistorical("Symbol","2023-09-01") allow you to analyze past data points from bid prices to implied volatility of an option on a specific past date.

– Option Utility Functions: Create your own real-time option chain with strikes and expirations using utility functions like =@StrikeNext("Symbol",2,ExpirationNext("Symbol")).

2. Options Order Flow Summary Functions

– Include functions that provide insights into order flow data of options, such as assessing average volume, total volume, and open interest for specific underlyings.

3. Scan Functions

– Unusual Option Open Interest (OI) Scan: The function =UnusualOptionOIScanEOD(10) identifies underlyings with significant deviations in their open interest.

– Unusual Option Volume Scan: =UnusualOptionVolScanEOD(10) finds underlyings with the highest trading volumes.

– Vol/OI Scan: =UnusualOptionVolOIScanEOD(10) showcases underlyings with the highest Volume/OI ratio.

– Options OI Change Leaders: This function identifies options with the most significant open interest changes from the previous day.

– Options Volume Leaders: Quickly spots options with the highest trading volumes.

– Options Volume Change Leaders: Highlights options with substantial volume changes from the past day.

4. Backtesting with Historical Data

– Historical Option Chains Retrieval: Using function =opt_HistoricalOptionChain("Ticker","Date"), you can retrieve the entire option chain for historical dates, which is invaluable for backtesting.

5. Options Profit Calculator (Web-based)

– A tool available on the MarketXLS website to estimate the potential profits and losses of options trades. Key features include options chain filtering, Black-Scholes value calculation, configuring multi-leg options strategies, and viewing payoffs and results.

By employing these tools and functions, traders can effectively analyze 0DTE options and gain insights into trading volumes, open interest changes, and market sentiment, assisting in informed decision-making and strategy development.

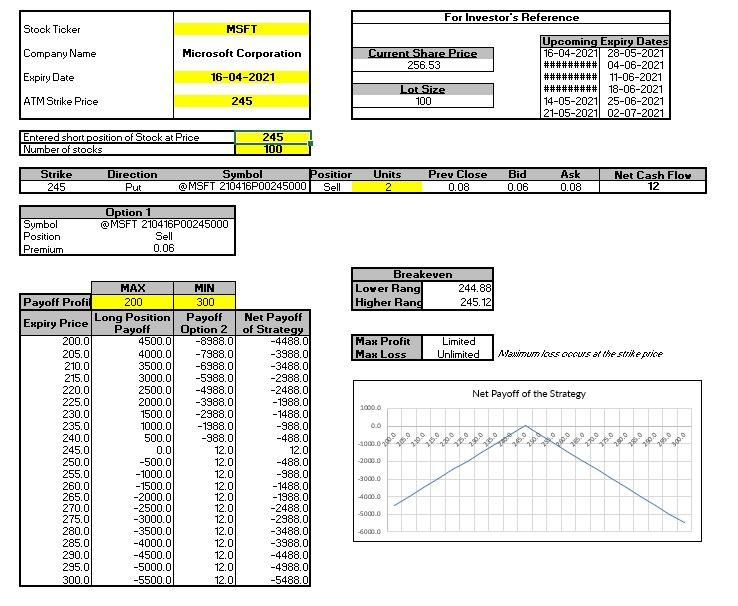

Here is the template you might want to checkout and MarketXLS has 100s of templates to get you started easily and save you time:

NDX100 Options Matrix

How does time decay impact 0DTE options?

Time decay, the gradual erosion of an option’s value as it approaches expiration, plays a critical role in 0DTE (Zero Days to Expiration) options. Unlike traditional options with weeks or months until expiration, 0DTE options grapple with extreme time decay. This exponential decay creates a palpable sense of urgency. Imagine an ice cube melting faster under a scorching sun; the option’s premium dwindles rapidly as the clock ticks. Traders need to be nimble and decisive. They may use this rapid time decay to their advantage, capturing small price movements and turning them into quick profits. Conversely, the margin for error is razor-thin. A slight move against their position can lead to substantial losses in a matter of minutes.Consider a scenario where a stock is trading around $100, and a trader buys a 0DTE call option with a strike price of $102.5. As the stock hovers just below the strike price, the option’s value decays swiftly. If the stock doesn’t rally past $102.5, the call option will expire worthless by the end of the trading day. This characteristic snag poses both opportunities and risks. Bulls might view a dip as a buying opportunity, aiming for a quick uptick. But timing is everything, because the option’s value shrinks with each passing moment. Likewise, traders selling 0DTE options might capitalize on this; they could sell high premiums knowing that even minor time decay can greatly benefit them by the end of day.

What are the key indicators to watch for in 0DTE options?

When it comes to trading 0DTE options, there are several key indicators that traders should watch closely. First and foremost, **implied volatility (IV)** is a critical factor, as it reflects market expectations of future price movements. High IV typically suggests that the underlying asset may experience significant price swings, providing traders with lucrative opportunities for profits but also presenting higher risks. Conversely, low IV indicates a more stable market, potentially limiting profit but lowering risk. Understanding the nuances of IV can help traders make more informed decisions about whether to enter or exit a position.Another essential indicator is **price action and volume**. Monitoring the underlying asset’s price movements alongside trading volume can reveal crucial insights into market sentiment. For example, a sudden spike in volume accompanied by a sharp price increase might signal a breakout, providing a ripe opportunity for short-term gains. Conversely, low volume and erratic price action could indicate indecision or lack of interest, warning traders to stay cautious. Additionally, evaluating **the Greeks**—especially delta, theta, and gamma—provides a nuanced view of the option’s sensitivity to various factors like price changes and time decay. Keeping an eye on these indicators can help traders optimize their strategies, manage risk more effectively, and potentially capitalize on the fast-moving nature of 0DTE options. By paying attention to these indicators, traders can better navigate the complexities and volatility inherent in 0DTE options, ensuring a more strategic approach in seizing or avoiding opportunities.

How to identify suitable stocks for 0DTE options?

When it comes to identifying suitable stocks for 0DTE (zero days to expiration) options, start by focusing on stock volatility and liquidity. Highly volatile stocks are crucial because they experience significant price movements within a single day, which is necessary to capitalize on 0DTE options. Stocks like Tesla (TSLA) or Amazon (AMZN) often exhibit such characteristics. High liquidity ensures that you can easily enter and exit trades without significantly affecting the stock price. Stocks included in major indices like the S&P 500 often meet this criterion due to their large volumes of daily trading activity.Additionally, consider the presence of upcoming catalysts such as earnings reports, product launches, or important economic data releases. These events can lead to sudden and significant price changes, creating opportunities for profitable 0DTE options trades. It’s also crucial to monitor the overall market sentiment and the specific sector performance of your chosen stock. For instance, a biotech company might surge following a successful drug trial or fall sharply if results are disappointing. By watching for these triggers and understanding the sector dynamics, you can better gauge the potential for rapid price movements, making your 0DTE strategies more effective. Remember, while the allure of high profits from 0DTE options is strong, it comes with heightened risk. Hence, pair your 0DTE strategy with proper risk management practices, such as setting stop-loss orders and never investing more than you can afford to lose. This balanced approach helps in navigating the tumultuous waters of same-day options trading with a clear, calculated mindset.

How do you manage risk in 0DTE options trading?

Managing risk in 0DTE options trading, where contracts expire within the same day they’re initiated, requires a meticulous and agile approach. One effective way to mitigate risk is through position sizing. Traders should limit the capital allocated to any single trade, often using a small percentage of their overall portfolio. This way, if a trade goes south, the damage to the entire portfolio is minimal. Additionally, having a well-thought-out stop-loss strategy is crucial. Setting predefined exit points helps avoid emotional decision-making and limits potential losses. For example, a trader might decide to exit a position if the loss reaches 20% of the initial investment.Additionally, diversification is a fundamental risk management strategy. Instead of placing all your bets on one type of option or underlying asset, spread your trades across various sectors and asset classes. This reduces the impact of negative market movements on any single investment. Considering the inherent volatility and rapid price fluctuations in 0DTE options, using technical analysis can also be a valuable tool. By leveraging charts and indicators, traders can identify potential entry and exit points more accurately. Though no method guarantees success, combining these strategies creates a robust risk management framework that can adapt to the fast-paced nature of 0DTE options trading.

How does liquidity affect 0DTE options?

Liquidity significantly impacts 0DTE (zero days to expiration) options in several ways, which can be critical given their unique nature. These options often resemble a race against time, and high liquidity ensures tighter bid-ask spreads. Tighter spreads are crucial as they allow traders to enter and exit positions more efficiently, maximizing their potential gains and minimizing losses. Think of it like trying to sell a high-demand product versus a niche item; more buyers and sellers mean you can get closer to your desired price quickly. Conversely, low liquidity can lead to wider spreads and slippage, where your order gets filled at a less favorable price, directly impacting profitability.Moreover, liquidity also plays a vital role in the execution speed of these 0DTE options. When considering the fast-paced nature of the market, quick execution can be a game-changer. High liquidity ensures that large orders can be processed without significantly moving the market, safeguarding against unwanted price movements. This aspect is akin to driving on a busy but orderly highway versus navigating through a crowded, chaotic street. The latter scenario, synonymous with low liquidity, can delay your orders and affect your trading strategy. In addition, liquidity levels can influence the implied volatility embedded within these options. In a highly liquid market, the risk of large, unexpected price swings diminishes, keeping volatility at more reasonable levels. Lower implied volatility often results in cheaper options, enabling more strategic trading without excessive cost. For instance, a well-lubricated machine runs smoothly and efficiently, whereas a poorly maintained one faces frequent breakdowns and costs more to operate effectively.

What are the common mistakes traders make with 0DTE options?

With 0DTE (zero days to expiration) options, traders often fall into some common pitfalls, starting with a lack of understanding of the underlying asset’s volatility. Zero-day options are extremely sensitive to price movements because they have no time value left; their premium fluctuates rapidly with the slightest changes in the underlying asset. Traders who fail to account for this volatility might find their positions underwater faster than they can react. For example, a sudden news event or an unexpected market shift can decimate a position’s value in minutes. Moreover, emotional trading often leads to disastrous decisions with 0DTE options. FOMO (Fear of Missing Out) can drive traders to take irrational risks, ignoring their trading strategies and risk management rules. This impulsiveness can lead to chasing bad trades or over-leveraging positions, thinking they can make a quick profit. Experienced traders recommend setting strict entry and exit strategies and adhering to them religiously. Another common mistake is ignoring transaction costs. With frequent trading, commissions and fees can erode profits significantly, yet many fail to factor these into their cost analyses. Therefore, understanding the real cost of trading and maintaining discipline can help mitigate these risks.

How to set realistic profit targets for 0DTE options?

Setting realistic profit targets for 0DTE (Zero Days to Expiration) options involves a blend of strategic planning and market understanding. To start, you should base your profit expectations on historical data and market volatility. Look at similar trades you or others have executed in the past and calculate the average returns. This historical perspective can help set a realistic profit benchmark for your current 0DTE trades. For example, if you notice that past 0DTE trades typically yield around 10-20% ROI, aiming for that range makes practical sense.Another critical aspect is understanding the inherent risks associated with 0DTE options. These trades require precise timing and can be highly volatile. Therefore, it’s essential to use tools like the Greeks (Delta, Gamma, Theta, and Vega) to assess potential outcomes. For instance, high Delta values can lead to significant price swings, which means setting a profit target that’s too high might be unrealistic. Instead, consider the probabilities provided by these metrics: if the Gamma is high, you may want to set more conservative profit targets to reflect the higher risk.Adjusting your profit targets based on real-time market conditions can also be advantageous. Factors like unexpected news events or sudden spikes in trading volume can impact your trade’s performance. Using conditional orders like stop-loss or take-profit orders can help manage your exits more effectively. A practical way to think about this is like surfing; while you may be aiming to ride a big wave (high profit), sometimes the ocean conditions necessitate settling for smaller waves to ensure you stay afloat.By integrating these strategies, you can set more realistic profit targets that are achievable, reducing disappointment and optimizing trading performance. So, look at the history, read the market signs, and adjust in real-time—doing this will give you a better shot at hitting those sweet profit targets consistently in your 0DTE options trading.

What software or platforms are best for 0DTE options trading?

For 0DTE (Zero Days to Expiration) options trading, several software platforms and tools are highly regarded. Based on the data available from the uploaded files, here are some key options platforms and tools that stand out:

1. MarketXLS

– MarketXLS is known for offering a comprehensive suite of tools for options analysis. It includes functions to assess options volume, open interest, put/call ratios, historical data, and much more. For example, options analysis functions include calculating bid, ask, delta, gamma, vega, theta, rho, and implied volatility for various expiries.

– Options Profit Calculator: This tool helps estimate potential profits or losses for specific trades by considering various factors like underlying stock price, strike price, and expiration date. It includes features like options chain filtering, Black-Scholes model for theoretical value calculation, real-time tracking with Greeks, and the ability to configure multi-leg options strategies.

2. ThinkOrSwim (by TD Ameritrade)

– ThinkOrSwim is another popular platform, particularly for placing multi-leg and single-leg options trades. MarketXLS supports integration with ThinkOrSwim for executing complex options strategies directly from an Excel interface.

3. Tradier

– Tradier provides an advanced trading platform with support for complex trading strategies including multi-leg options trades and direct integration with MarketXLS.

4. Orion

– Orion platform also supports integration for single-leg options trades through MarketXLS, which can be beneficial for executing simpler options strategies directly from Excel.

Each of these platforms provides specific functionality tailored for options trading, and combining them with tools like MarketXLS can enhance your trading strategy and execution efficiency, especially for 0DTE options.

For any advanced or specific requirements, demo sessions with these platforms or tools can help in understanding the best fit for your trading needs.

Here is the template you might want to check out, and MarketXLS has hundreds of templates to get you started easily and save you time: Options Trading Template.

Options Trading Template

How do institutional investors approach 0DTE options?

Institutional investors approach 0DTE (zero days to expiration) options with a highly strategic mindset, considering their high-risk, high-reward nature. These options, which expire on the same day they are purchased, require precise timing and accurate market predictions. Institutions leverage sophisticated modeling techniques and real-time data analytics to make informed decisions, aiming to exploit short-term volatility. The short duration of 0DTE options makes them ideal for hedging against abrupt market moves or capitalizing on specific events like earnings reports or economic announcements. For instance, a hedge fund might employ 0DTE options to hedge positions in their portfolio against unexpected market downturns, providing a buffer without a prolonged commitment.Moreover, institutional investors often have access to extensive research and proprietary trading algorithms that offer an edge in predicting market behavior. They also benefit from economies of scale and lower transaction costs, which can significantly impact the profitability of rapid trades inherent in 0DTE strategies. Additionally, risk management is paramount, with strict limits and sophisticated tools being used to monitor and mitigate potential losses. This careful balance of risk and reward demonstrates how institutional investors can harness 0DTE options effectively, turning the inherent volatility into an opportunity rather than a liability. It’s this nuanced approach that sets them apart from the average retail investor, who might not possess the same level of resources or expertise.

How can hedging be used with 0DTE options?

When it comes to hedging with 0DTE options, the allure lies in balancing the incredible potential for rapid gains with the inherent risks of near-expiration trades. Imagine the market as a high-stakes poker game where the clock is ticking down. You wouldn’t want to go all-in without hedging your bets, right? One popular method for mitigating these risks is through the use of spreads. For instance, entering into a simple call spread on a 0DTE option allows you to cap potential losses while still leaving room for upside gains. This works by buying a call at a lower strike price and simultaneously selling another call at a higher strike price. You pay a net premium, but should the underlying asset surge, your gains from the long call can substantially outweigh the limited loss incurred by the short call.Another intriguing approach involves the incorporation of protective puts to safeguard against any drastic downturns in the market. Suppose you hold long positions that you fear might nosedive by the end of the day. A safeguard here would be to purchase put options that expire on the same day. This can be particularly useful for day traders playing in the fast-moving options market. Think of protective puts as insurance you can cash in if the market crashes before the bell rings. Yes, they come at a cost, but this small price effectively limits your downside risk while allowing you to ride out the storm. By using hedging strategies like these, traders can navigate the unpredictable landscape of 0DTE options with a level of finesse comparable to a tightrope walker using a balancing pole. These hedging tactics show that with the right strategies in place, the often turbulent 0DTE options market can be harnessed effectively, transforming nerve-wracking trades into calculated risks.

What is the role of implied volatility in 0DTE options?

Implied volatility plays a pivotal role in 0DTE (zero days to expiration) options, serving as a key indicator of market sentiment and potential price movement. Given the extremely short lifespan of these options, implied volatility becomes even more critical as it reflects the market’s anticipation of price fluctuations within a day. When implied volatility rises, it usually suggests heightened uncertainty or expected market events, leading to higher premiums for 0DTE options. Traders might see this as an opportunity or a risk, depending on their strategies. For instance, a surge in implied volatility could mean a lucrative potential for sellers who benefit from the inflated premiums, provided the predicted price swings don’t materialize.However, navigating 0DTE options isn’t without its intricacies. Traders often keep a keen eye on the “Greeks,” especially Vega, which measures sensitivity to volatility. Given that time decay (Theta) accelerates as expiration nears, the impact of implied volatility becomes a double-edged sword. A trader betting on large moves might capitalize on high volatility by purchasing options, but if the anticipated moves don’t happen, they face a rapid erosion of value due to Theta decay. Essentially, implied volatility in 0DTE options can amplify both profits and losses, making it a tool that requires precise timing and a thorough understanding of market dynamics. Would you take advantage of high implied volatility, reaping potential rewards, or play it cautiously, knowing the risks of rapid value decay? There’s no one-size-fits-all answer, making the role of implied volatility in 0DTE options a fascinating yet complex aspect of trading.

What are the differences between trading indices and individual stocks with 0DTE options?

Trading indices and individual stocks with 0DTE (Zero Days to Expiration) options presents distinct opportunities and challenges. With indices, you’re essentially betting on the overall movement of a market segment. For instance, trading options on the S&P 500 index means you’re speculating on the collective performance of 500 large-cap stocks. This market-wide approach offers built-in diversification, reducing the impact of single-stock volatility. On the other hand, 0DTE options on individual stocks are more of a concentrated bet. These trades allow you to leverage big news events, earnings reports, or market sentiment directly tied to a specific company, potentially yielding significant, albeit riskier, profits.When considering liquidity and bid-ask spreads, indices generally have an edge. Indices like the S&P 500 often exhibit higher trading volumes, translating to tighter bid-ask spreads and improved price execution. Individual stocks, especially those with lower market capitalizations, might present less liquidity, resulting in wider spreads that could eat into your gains. Furthermore, the volatility profile differs significantly. Indices tend to display less extreme price swings compared to individual stocks. With 0DTE options, the less impulsive nature of indices can translate to a more stable, albeit potentially less lucrative, trading environment. Are you more of a market “surfer” riding broader waves, or do you prefer the thrilling but risky dynamics of riding the “big waves” inherent in single-stock trades?

How do you develop a trading plan for 0DTE options?

Crafting a trading plan for 0DTE (Zero Days to Expiration) options necessitates precision, agility, and clear objectives. First, it’s crucial to establish your risk tolerance and financial goals. Ask yourself, “Am I aiming for quick, high-probability gains, or do I prioritize safeguarding my capital?” Setting these boundaries will help you avoid impulsive decisions. Next, identify the market conditions and specific scenarios where 0DTE options can be most lucrative. Market volatility, for instance, often boosts potential premiums but also escalates risk. Thus, tracking the VIX and economic events can provide valuable context for your trading strategy.In the operational phase, define your entry and exit points meticulously. For instance, a structured plan might include placing limit orders to avoid slippage and setting stop losses to manage unforeseen downturns. Use technical indicators like Moving Averages or the Relative Strength Index to time your trades more effectively. Additionally, consider diversifying your options portfolio. Instead of betting all on a single expiry, distribute your capital among various strike prices and expiry times to mitigate risks. Lastly, maintain a trading journal to record each trade’s rationale and outcome. This practice not only sharpens your future strategies but also keeps you honest to your trading plan.Transition smoothly into execution by ensuring that your trading platform is optimized for speed and reliability, especially crucial for 0DTE options where every second counts. Use automated tools or conditional orders to capitalize swiftly on market opportunities without the lag of manual entry.

How to backtest 0DTE options strategies?

To backtest 0DTE (zero days to expiration) options strategies using MarketXLS, follow these steps:

1. Retrieve Historical Option Data

Use the function =opt_HistoricalOptionChain("Ticker","Date") to obtain past option chains for a specific ticker and expiration date. This function provides the complete option chain, necessary for analyzing past market conditions.

Example:

=opt_HistoricalOptionChain("AAPL","2023-01-20")

This will return the entire option chain for AAPL options expiring on January 20, 2023.

2. Analyze Individual Option Metrics

Use various metrics like bid, ask, delta, gamma, vega, theta, rho, and implied volatility to evaluate the historical performance of options. These can help in understanding how the option prices moved and the Greeks’ behavior.

Example Functions:

– =opt_ImpliedVolatilityHistorical("AAPL","2023-01-20")

– =opt_DeltaHistorical("AAPL","2023-01-20")

3. Scan for Unusual Activities

To identify opportunities for your option strategies, you can use MarketXLS’s market scan functions to pinpoint unusual activities:

– Unusual Option OI Scan: =opt_UnusualOptionOIScanEOD(10) for spotting the 10 underlying assets with the most significant open interest change.

– Unusual Option Volume Scan: =opt_UnusualOptionVolScanEOD(10) for identifying the 10 underlying assets with the highest volume.

4. Define Option Strategies

Configure your option strategy using MarketXLS’s options configurations, including up to 8 legs with real-time tracking for Greeks:

Example:

Configure a simple spread strategy:

=opt_Strategy("AAPL","Call","Buy",150,"2023-01-20",-1)

=opt_Strategy("AAPL","Call","Sell",155,"2023-01-20",1)

5. Estimate Payouts and Analyze Scenarios

Use MarketXLS to simulate different market scenarios by adjusting the volatility and returns. This can be achieved by utilising MarketXLS simulation capabilities to test how the strategies would perform under various market conditions.

6. Save and Track Results

Save the configurations and results in CSV files for later analysis to compare if the trade worked as predicted.

=opt_SaveConfiguration("Path\To\Save\strategy.csv")

7. Automate and Reiterate

Finally, save your trade configuration and scanning criteria in MarketXLS to streamline future backtesting processes:

– Public: Anyone can see it.

– Private: Only you can view it.

– Team: Only accessible by your team.

Summary

By following these systematic steps—retrieving historical data, analyzing metrics, scanning unusual activities, configuring and estimating strategies, and saving results—you can effectively backtest and validate your 0DTE options strategies using MarketXLS.

For specific details on functions, you can refer to the documentation or contact support at support@marketxls.com.

Here is the template you might want to check out, and MarketXLS has 100s of templates to get you started easily and save you time:

– Synthetic Short Straddle with Puts

Template Image

How Did I Employ Position Sizing to Enhance My 0DTE Options Strategy?

By employing position sizing to enhance my 0DTE options strategy, I was able to significantly mitigate risks and optimize returns. Position sizing involves allocating a specific portion of my trading capital to individual trades based on their risk profiles. Instead of putting an equal amount of money into each trade, I calculated the maximum risk I was willing to take and adjusted the trade size accordingly. This meant that for riskier trades, I committed a smaller portion of my capital, thereby limiting potential losses. Conversely, for trades with a more favorable risk-to-reward ratio, I felt more comfortable allocating a larger amount.One practical example was when I traded SPX options with only a few hours left until expiration. By recognizing the inherent volatility and potential for rapid price movements, I adjusted my position size to account for this high-risk scenario. Applying a percentage-based approach, such as risking no more than 2% of my total capital on a single 0DTE option, allowed me to maintain a diversified portfolio and protect against outsized losses. Additionally, this disciplined approach also provided me the flexibility to scale into trades gradually, capitalizing on favorable market conditions while staying within my pre-defined risk parameters.

How do I Use Volatility Indicators to Select Better 0DTE Option Contracts?

When selecting 0DTE (Zero Days to Expiration) option contracts, using volatility indicators can be a powerful method to make informed decisions better aligned with your risk tolerance and trading strategies. Here’s a detailed look at how you can leverage MarketXLS functions to utilize volatility indicators effectively:

Identifying High Volume and Open Interest

- Unusual Option Volume Scan:

– Use the function =opt_UnusualOptionVolScanEOD(10) to identify underlyings with the highest volume. This helps in spotting the most actively traded options, providing liquidity and better fills.

- Vol/OI Scan:

– The function =opt_UnusualOptionVolOIScanEOD(10) showcases the top 10 underlyings with the highest Volume/Open Interest (Vol/OI) ratio. This can highlight options that have significant interest and trading activity compared to their open interest .

Market Sentiment and Price Movement Predictions

- Put/Call Ratios:

– Gauge market sentiment by fetching the put-call volume ratio using =opt_PutCallVolRatio("MSFT",ExpirationNext("MSFT")). A higher put/call volume ratio typically indicates a bearish sentiment while a lower ratio suggests a bullish sentiment.

- Implied Volatility (IV) Indicators:

– Utilize implied volatility functions to understand the volatility expectations for the underlying security:

– 10-day IV: =ImpliedVolatility10d("MSFT")

– 20-day IV: =ImpliedVolatility20d("MSFT")

– 30-day IV: =ImpliedVolatility30d("MSFT")

– 1-year IV: =ImpliedVolatility1y("MSFT")

– Higher IV usually forecasts higher expected price movements, which can indicate both opportunities and risks .

- Implied Volatility Rank:

– Measure the current IV against its historical values using =ImpliedVolatilityRank1m("MSFT") and =ImpliedVolatilityRank1y("MSFT"). These metrics show where today's IV stands relative to its historical highs and lows.

Backtesting and Historical Data

- Historical Option Data:

– Analyze historical implied volatility, bid prices, and other metrics to inform your strategies. For example:

– Fetch historical IV: =opt_ImpliedVolatilityHistorical("MSFT","2021-09-01")

– Retrieve complete past option chains: =opt_HistoricalOptionChain("MSFT","2021-09-01")

– Historical data allow for robust backtesting of your strategies under various market scenarios .

Recognizing Unusual Market Activity

7. ** Scans for Market Anomalies**:

– Identify unusual stock options activity using =opt_UnusualStockOptionsActivity(5) to find options with the highest Vol/OI.

– Spot options leading in open interest changes with =opt_OptionsChangeInOILeaders(5).

– Find options with significant volume changes using =opt_OptionsChangeInVolumeLeaders(5) and those leading in volume with =opt_OptionsVolumeLeaders(5) .

By combining these functions and indicators within MarketXLS, you can gain a comprehensive understanding of current market conditions, anticipate price volatility, and recognize unusual trading activities. This holistic approach equips you to select better 0DTE option contracts and align your trades with prevailing market trends and sentiments.

Here is the template you might want to checkout and marketxls has 100s of templates to get you started easily and save you time.

Volatility Calculator – MarketXLS

Summary

The article offers a concise guide on 0DTE (Zero Days to Expiration) options, emphasizing their unique nature and high-risk, high-reward potential. These options expire the same day they are bought, making them appealing for traders seeking rapid market movements within hours. Effective strategies include iron condors and vertical spreads to manage risk and leverage time decay.

Key points:

1. **Mechanics**: 0DTE options are highly sensitive to market changes due to their short lifespan, making them suitable for day traders.

2. **Strategies**: Popular approaches include iron condors and vertical spreads, which help balance potential gains with risk.

3. **Risks**: High volatility can lead to rapid losses, necessitating constant monitoring and quick decision-making.

4. **Profitability**: Potential for significant returns exists but requires careful planning and understanding of market indicators like implied volatility.

5. **Tools**: Utilize platforms like MarketXLS for detailed analysis and backtesting, using indicators such as implied volatility and trading volume.

The article also underscores the importance of risk management, especially position sizing and using technical indicators, to navigate the fast-paced nature of 0DTE options trading.

0dte options strategy

0dte options strategy