Calls And Call Ratio Backspread (Explained With Real Time Data)

Meet The Ultimate Excel Solution for Investors

- Live Streaming Prices Prices in your Excel

- All historical (intraday) data in your Excel

- Real time option greeks and analytics in your Excel

- Leading data in Excel service for Investment Managers, RIAs, Asset Managers, Financial Analysts, and Individual Investors.

- Easy to use with formulas and pre-made sheets

Options Trading has intrigued people since its inception. Call Options and Put Options are an integral part of Options Trading. Call Options are financial contracts that offer the buyer the right to buy a stock, asset, bond at a specified price within a specific time period. If an investor buys a call option for $20 while the stock is trading at $20, then it is said to be at-the-money. If the stock rises to $30, the trader makes money otherwise he loses only the premium paid for it. Options have garnered interest over the years because of its limited risk for the buyer and significant profit which stands to be earned through proper knowledge about the various options. Knowledge about options is available publicly on several websites including this one but you have to be careful before following one. This article will be informing you about Call Ratio Backspread, the risks involved in it and the maximum profits one can earn using this strategy.

What is the Call Ratio Backspread Strategy?

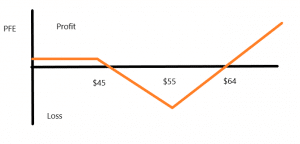

The Call Ratio Backspread Strategy is an options trading strategy that is most commonly used by bullish traders if they believe that the price of a particular stock will rise or grow significantly in the near future. The Call Ratio Backspread strategy involves buying greater call options and selling lesser calls at a different strike on the same expiration date. Using this tactic, the trader stands a chance at an unlimited profit if the market goes up, limited profit if the market goes down and a predefined loss if the market stays within a range. An increase in volatility is good for this strategy when there is more time to expiry, but when there is less time to expiry, the increase in volatility is not really good for this strategy. The most common ratio of long calls to short calls is 2:1.

Important Call Ratio Backspread Strategy Concepts

Spread = Higher Strike Price – Lower Strike Price

Net Credit = Shorter Call Ratio*Premium Received for Shorter Call – Longer Call Ratio*Premium of Longer Call

Max Loss = Spread – Net credit which occurs at Higher Strike Price

Lower Breakeven Price = Lower Strike Price + Net Credit

Upper Breakeven Price = Higher Strike Price + Max Loss

Let’s understand the Call Ratio Backspread Strategy better with the help of a detailed example

Call Ratio Backspread Example

Pfizer Incorporated is currently(December 2020) trading at $50 per share in the New York Stock Exchange. They are responsible for manufacturing and rolling out the COVID-19 Vaccine in the United States of America and other major countries. A rise in demand implies that the stock price might grow. Let’s say you are a bullish investor looking to trade in the Pfizer Stock and earning a handy profit. You decide to employ the Call Ratio Backspread Strategy to invest in this particular stock among your portfolio. You expect the PFE stock price to rise to $70 by February 2021 so you sell one lot of the $45 Call Options for a premium of $9 each and buy two lots of the $55 Call Options for a premium of $4 each. Therefore, the net credit = $9 – 2* $4 = $1

With these transactions, the call ratio backspread is executed. Let us now look at what would happen to the cash flow in different possibilities.

Case 1: The stock expires after two months at $40

Both the call options expire in this scenario and the net credit received will be the net cash flow. Since a contract is generally of 100 stocks, the net cash flow would be restricted just to $100

Case 2: The stock expires at $46 after two months

The short call would be at an intrinsic value of $1 and the net payoff would amount to $9 – $1 = $8. On the other hand, we lose the entire premium on the long call option. The net cash flow would be $8 – 2*$4 = $0. Therefore, $46 is the breakeven price.

Case 3: The market expires in February at $55

The long calls expire at this point and this is the point where the maximum loss in the transaction occurs. The short call premium is $9 and the long call premium expires. The intrinsic value of the short call would be $10. Therefore the net loss would amount to $9 – 2*$4 – $10 = -$9

Case 4: The market expires in February at $64

The intrinsic value of the long call is $9 and the intrinsic value of the short call is $19. The net cash flow would be

Net cashflow = Short call premium – Short call intrinsic value + (2*Long call intrinsic value) – Long call Premium

Net cashflow = $9 – $19 + $18 – $8 = $0

Here we observe another breakeven price. So, call ratio backspread strategy has two breakeven prices, one below the long call price and one above it. If the market expires at a higher price than $64, then the profit will be earned. This strategy is especially useful when investors wish to minimize their risks and losses.

References

Here are a few websites you can visit to read more about the call ratio backspread strategy.

- https://zerodha.com/varsity/chapter/call-ratio-back-spread/

- https://www.investopedia.com/terms/c/callratiobackspread.asp

- https://www.optionsplaybook.com/option-strategies/call-backspread/

You can also read more about other strategies like put ratio spread and call ratios here:-

None of the content published on marketxls.com constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person.

The author is not offering any professional advice of any kind. The reader should consult a professional financial advisor to determine their suitability for any strategies discussed herein.

The article is written for helping users collect the required information from various sources deemed to be an authority in their content. The trademarks if any are the property of their owners and no representations are made

Get Market data in Excel easy to use formulas

- Real-time Live Streaming Option Prices & Greeks in your Excel

- Historical (intraday) Options data in your Excel

- All US Stocks and Index options are included

- Real-time Option Order Flow

- Real-time prices and data on underlying stocks and indices

- Works on Windows, MAC or even online

- Implement MarketXLS formulas in your Excel sheets and make them come alive

- Save hours of time, streamline your option trading workflows

- Easy to use with formulas and pre-made templates

I invite you to book a demo with me or my team to save time, enhance your investment research, and streamline your workflows.