Investors with high-risk appetite focus mainly on robust returns by investing in momentum stocks. Momentum investors seek rapidly growing companies, hoping that the continued growth will grab additional investors’ attention, which will further drive the stock price high. Richard Driehaus is one such prominent investor who developed a momentum strategy on the “buy high and sell higher” principle. He believes that earnings growth is the primary driver of stock prices, as sustained earnings growth allows a company to increase cash flows and dividends.

What are momentum stocks?

Momentum is the speed of price changes in stock. It shows the rate of change in price movement over a period of time to help investors determine a trend’s strength. Stocks that tend to move with the strength of these price changes (momentum) are called momentum stocks. Investors usually go long (buy shares) on momentum stocks in an uptrend and short (sell shares) in a downtrend.

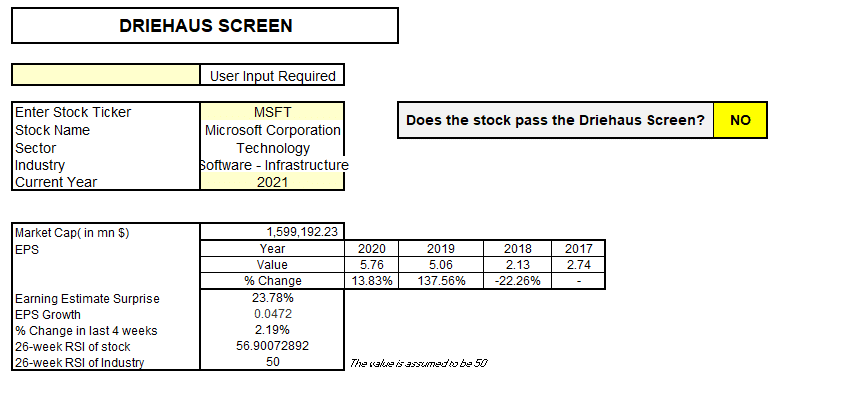

Driehaus Screener using MarketXLS Template

Driehaus Screen helps identify momentum stocks and those companies with improving earnings growth rates and then identify which of them are most likely to continue the trend. It screens for firms that are beating analyst expectations and producing positive earnings surprises.

He focuses on small-cap firms with a market cap of less than $ 500 million and mid-caps with market caps up to $3 billion. It is much easier for a smaller company to post-sales growth of 20% and above than a big company such as Walmart (NYSE: WMT), with annual sales of more than $ 500 billion that have been averaging top-line growth of 1.3% over the last 5 years.

The 26-week relative strength index of the stock greater than the industry (i.e. 50) tips off that the gains are more significant than the losses, and EPS growth ensures improving business. The average daily volume for the last 10 days has to be in the top 50% of all stocks as greater volume indicates the investors’ greater interest.

Besides the quantitative data, the screen also excludes the stocks that trade as American Depository Receipts (ADRs). It checks whether the company has beaten at least three analysts’ estimates for its earnings in the current quarter.

How well does it work?

Driehaus insisted that simply applying momentum as a technical analyst or trader will never be able to sustain. The investor will have to keep faith even if the portfolio value falls significantly. Overall, this approach has outperformed the market several times in the last 20 years. It had generated compound annual returns of 30% during the 12 years after it started in 1980. An interpretation of Driehaus’s methods, produced by AAII, has returned 19.2% and 14.6% over five and ten years, respectively. By comparison, the S&P 500 returned just 4.7% and 3.5% over the same periods.

Factors to look out for

Since the volatility is high for momentum investing, the strategy has a few downsides. The investor may be at risk of timing a buy incorrectly and ending up underwater. As Richard Driehaus rightly said, a stock’s price is rarely the same as its value as the valuations are usually flawed. The price of stocks is highly affected by market sentiments and investors’ dynamics.

As previously seen in 2009, these strategies can crash in extreme market conditions, causing significant losses to the trader. High stock turnover can also be expensive in terms of fees which can be a major concern for most traders. Additionally, it may also need a lot of work and can be time-intensive.

The Bottom Line

This strategy may lead to impressive returns if handled well. The critical aspect is to capitalize on the market volatility right and invest at the correct timings. Over time, the profit potential increase using momentum investing can be staggeringly large. However, it may not be suitable for everyone considering the high-risk factor. For an individual investor, practicing momentum investing will most likely lead to overall portfolio losses. Usually, when the individual investor might be purchasing a rising stock or selling a falling stock, it will most likely be of older news and lag behind the professionals leading to significant losses.

Buying high and selling higher is momentum traders’ desirable goal, but this goal does not come without its fair share of challenges.

Disclaimer

None of the content published on marketxls.com constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The author is not offering any professional advice of any kind. The reader should consult a professional financial advisor to determine their suitability for any strategies discussed herein. The article is written for helping users collect the required information from various sources deemed to be an authority in their content. The trademarks if any are the property of their owners and no representations are made.

References

Momentum Indicates Stock Price Strength. https://www.investopedia.com/articles/technical/081501.asp

Richard Driehaus screen: A momentum strategy focused on earnings growth https://news.yahoo.com/news/richard-driehaus-screen-momentum-strategy-203206758.html

Driehaus Screen https://www.aaii.com/stock-investor-pro/screens/86

Read About Richard here.