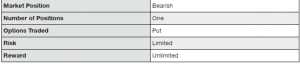

The long put option strategy involves buying a put option, which is the choice to sell the option purchased at a predetermined price at the time of expiry. A trader typically invests in a long-put option when he or she anticipates a fall in the price of the underlying asset. Thus, the long put is used when the trader is bearish about the market. If the trader is correct in his prediction and the price goes down, he can exercise his option and profit. A long put can be exercised before its expiry if it’s an American option. If it is a European option, then it can only be exercised on the expiration date.

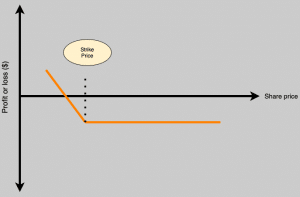

A long-put option has a strike price, which is the price at which the put option’s buyer has the right to sell the underlying asset.

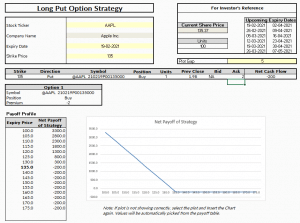

Let us see how we can understand a long put option using a MarketXLS Template:

In the active template:

* Mention stock ticker

* Enter the expiry date of the option. A list of upcoming expiry dates has been provided adjacent to the input.

* Enter the strike price you are looking to buy

* Enter the spread (the difference between the higher and lower strike price)

Let us take an example to understand better

Consider an investor who wants to invest in Apple Inc. The strike price for the put option is $135 having an expiry date of 19-02-2021. Using the template, we can look at the payoff profile and decide whether it will be a profitable venture for us or not.

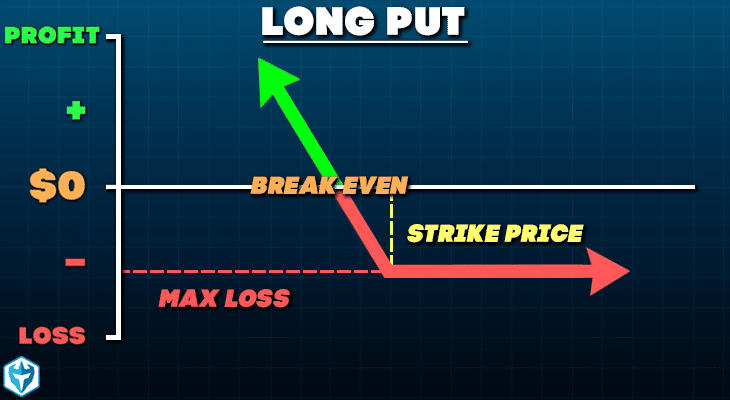

Profit and loss

A long put option strategy is the opposite of the long call option strategy because in the latter case, the trader has a bullish view of the market, while in the former case, the trader has a bearish outlook. It is easy to confuse the long-put strategy with the short-selling of stocks. However, compared to short selling, the long put option is less risky because the risk involved is not unlimited (as in the case of short selling), and it is limited to the amount of premium paid.

The maximum loss is capped at the amount of premium paid for the option. Loss is realised when the price of the underlying asset is more than the strike price of the long put at the time of expiration.

On the other hand, the maximum profit is unlimited. It is calculated by deducting the amount of premium paid from the strike price of the put option. The maximum profit is realised when the price of the underlying asset reaches zero.

When to use this strategy?

The best time to use this strategy is when the trader is highly bearish towards the market and expects the underlying asset’s price to go down sharply. If he is correct in his prediction, and the price does go down, he makes profits. However, if the prices rise instead, the trader can choose not to exercise his put option, and he can exit the trade by paying the premium. This contrasts with the short selling of options because the trader is not required to make an initial investment, and his losses are capped. The long-put strategy is highly compatible with bearish or neutral markets and is highly incompatible with bullish markets.

The long put option can also be used to hedge against unfavourable moves in a long stock position. If the price of the underlying asset falls, then the put option increases in value, thus offsetting the loss due to a fall in the stock price. This kind of hedging strategy is called the protective put or the married put.

Key takeaways

The long put option strategy is easy to understand and useful. This strategy is suitable for beginners because losses are capped, and players can take advantage of a bearish market. The most important advantage of this strategy is that the trader has the right but not the obligation to exercise the option. However, as with other techniques, it is crucial to study the market thoroughly before making a prediction. In a long put strategy, timing is of the essence. The MarketXLS Template for long put options can be handy and help you track your chosen stock’s performance.

Disclaimer

None of the content published on marketxls.com constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The author is not offering any professional advice of any kind. The reader should consult a professional financial advisor to determine their suitability for any strategies discussed herein. The article is written for helping users collect the required information from various sources deemed to be an authority in their content. The trademarks if any are the property of their owners and no representations are made.

References