#1 Excel Solution for Investors

Get Market data in Excel easy to use formulas

- Real-time Live Streaming Option Prices & Greeks in your Excel

- Historical (intraday) Options data in your Excel

- All US Stocks and Index options are included

- Real-time Option Order Flow

- Real-time prices and data on underlying stocks and indices

- Works on Windows, MAC or even online

- Implement MarketXLS formulas in your Excel sheets and make them come alive

- Save hours of time, streamline your option trading workflows

- Easy to use with formulas and pre-made templates

Get Real time Option Prices in Excel

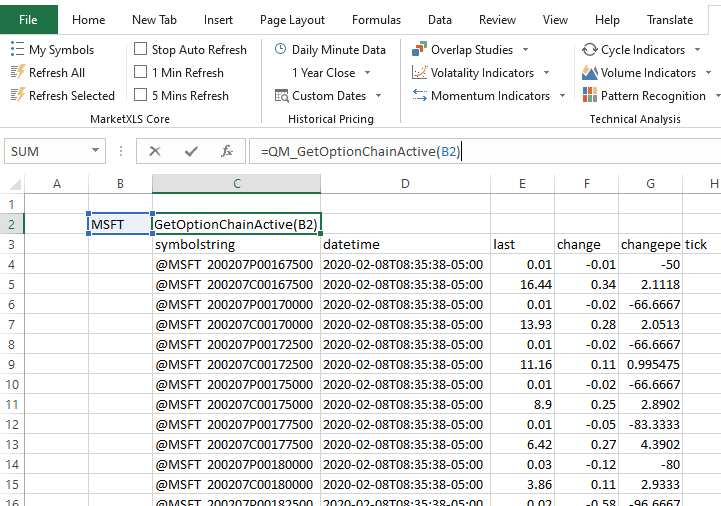

Get Option Chains in Excel

Make smart investment decisions utilizing our numerous functions to obtain option chains. Advanced filters allow you to scan by popular metrics such as Greeks, strike prices, expiry dates, call or put and much more.

Rollover Options Trading with MarketXLS

See how a user uses MarketXLS to choose and roll over their positions in options and trade directly from Excel with our partner, Tradier. This allows investors to minimize their errors by reducing data entry.

Market Trend Analysis with MarketXLS

Learn how to use MarketXLS Trend functions to analyze current market conditions and predict potential future movements. This video demonstrates how to assess market trends by examining the percentage of stocks advancing or declining.

Options Trading: Iron Condor Strategy with MarketXLS

Discover how to monitor call positions using MarketXLS templates. This video guides you through the process of setting up and analyzing options strategies directly in Excel.

Step 1 - Utilize MarketXLS options strategy templates to get started.

| # | Template name | Download link |

|---|---|---|

| 1 | Covered Call Options Strategy | Covered Call Option Strategy Flat File |

| 2 | Iron Condor Options Strategy | Iron Condor Options Strategy Flat File |

| 3 | Strap Strangle Strategy | Strap Strangle Strategy Flat File |

| 4 | Short Put Options Strategy | Short Put Options Strategy Flat File |

| 5 | Reverse Iron Condor Spread | Reverse Iron Condor Spread Flat File |

Step 2 - Create your own options template by utilizing MarketXLS functions.

| # | Use case | MarketXLS function |

|---|---|---|

| 1 | Get a specifc option symbol | =OptionSymbol(“stocksymbol”,”YYYY-MM-DD″,”CallorPut”,”StrikePrice”) |

| 2 | Get all available weekly options | =QM_GetOptionChainWeekly(“Stock Symbol”) |

| 3 | Get all available 'in the money' option contracts | =QM_GetOptionChainInTheMoney(“Stock Symbol”) |

| 4 | Get all available expiring most near term | =QM_GetOptionNearTerm(“Stock Symbol”) |

| 5 | Get all the option contracts | =QM_List(“getOptionChain”,”Symbol”,”FDX”,”money”,”In”) |

Step 3 - Try the real-time streaming functions to get live options data

| # | Use case | MarketXLS function |

|---|---|---|

| 1 | Get the real-time alpha for an options contract | =qm_stream_alpha(“Option Symbol”) |

| 2 | Get the Ask price | =qm_stream_ask(“Option Symbol”) |

| 3 | Get the Last price | =qm_stream_last(“Option Symbol”) |

| 4 | Get the real-time delta for an options contract | =qm_stream_delta(“Option Symbol”) |

| 5 | Get the Bid price | =qm_stream_bid(“Option Symbol”) |

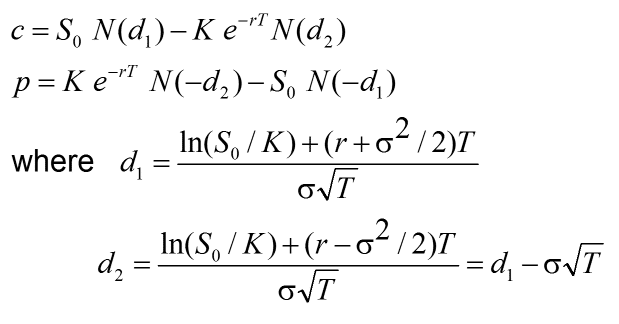

Pricing

Access Real-Time Options Pricing in Excel

Never lose track of your trades with our real-time streaming prices in Excel. The numbers that you see on your Excel will change by themselves and will match your trading platform Bid/Ask prices so you can make profitable decisions in real-time

Learn More

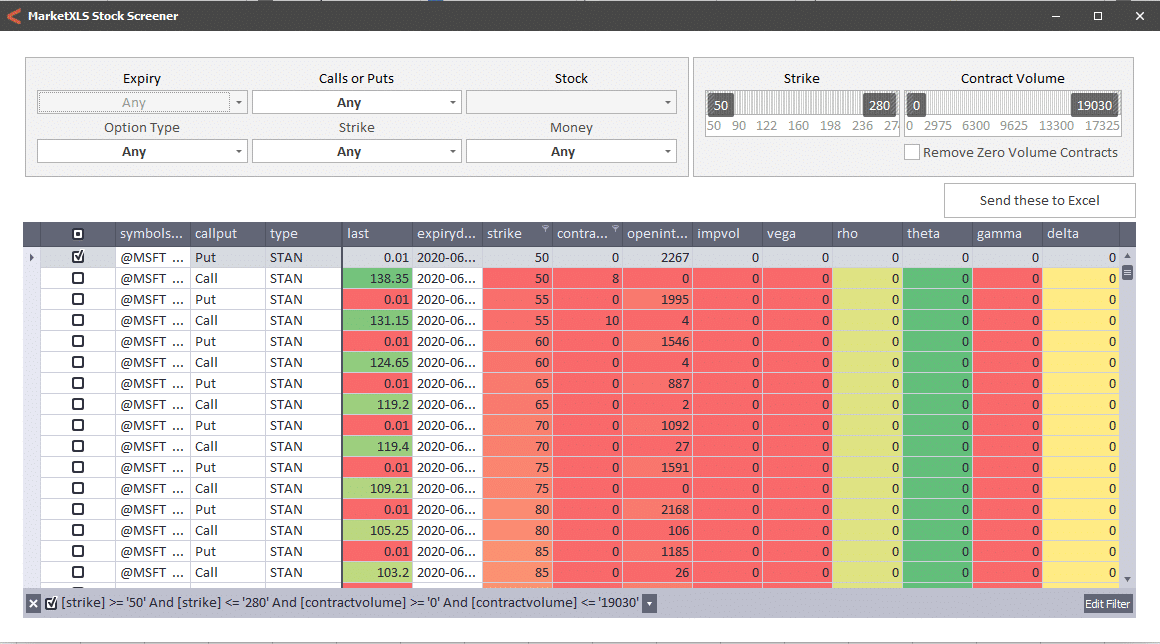

Scanning

Options Scanning

MarketXLS offers an Excel-based Option Scanner that allows you to choose up to 40 stock tickers, get all the option contacts for those stocks, and filter for the best options to trade. Compare different Options values, greeks, volumes, open interests, and more by using our Option Chain functions. Utilize our Options Symbol function to get an option symbol of a specific stock, at a specific date and a specific strike price.

Learn More

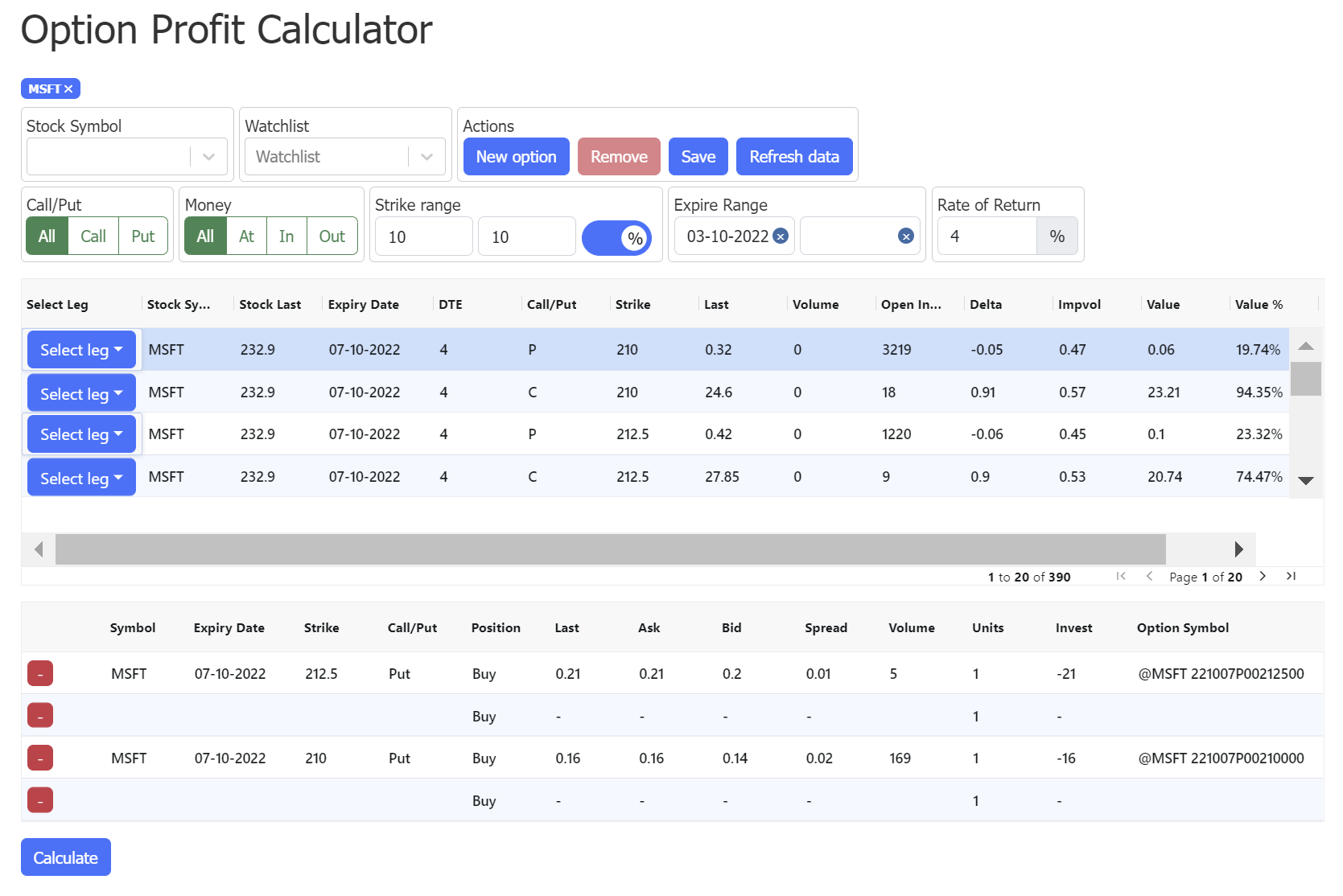

Profit Calculator

Options Profit Calculator

Utilize our real-time options profit calculator to build and analyze numerous options strategies. Get the Ranks of the filtered option contracts by your criteria and ranking weights like Low Premium, High Volume, Low Spreads, and more.

Learn More

Filtering

Options Filtering

Use our innovative easy to use functions to filter option contracts as per your own criteria. For example, find all options for TSLA that expire between x date and y date and those that have strike price between x and y

Learn More

Trading Strategies

Learn all Option Trading Strategies

Interested in Straddles, Strangles, Calls, Spreads, and many other options strategies? You are at the right place! MarketXLS offers numerous pre-built Options Templates in your Excel. All templates are open code, reusable, and can be adjusted quickly for your own requirements. Accompanying these templates, we have a library of videos walking you through the strategies.

Learn More

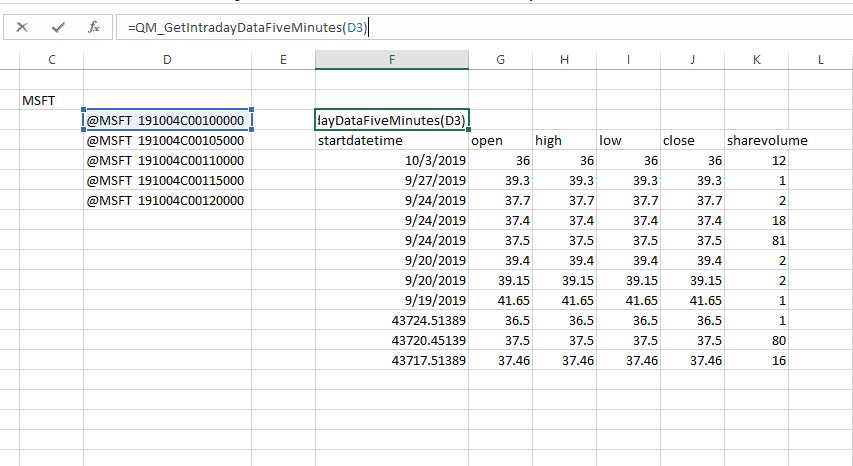

Historical Prices

Get Historical Options Prices

See how your options prices changed over time in History. Get End of the day or Intra-day (minute by minute) history of all recently expired and active contracts.

Learn More

Frequently asked questions

How to track Real-time Options prices?

How to Track Greeks in Real-time?

Symbol limit for options tracking?

How to get Implied Volatility of options?

Can I calculate options profit?

Call: 1-877-778-8358

Welcome! I'm Ankur, the founder and CEO of MarketXLS. With more than ten years of experience, I have assisted over 2,500 customers in developing personalized investment research strategies and monitoring systems using Excel.

I invite you to book a demo with me or my team to save time, enhance your investment research, and streamline your workflows.

I invite you to book a demo with me or my team to save time, enhance your investment research, and streamline your workflows.

Implement "your own" investment strategies in Excel with thousands of MarketXLS functions and templates.

MarketXLS provides all the tools I need for in-depth stock analysis. It's user-friendly and constantly improving. A must-have for serious investors.

I have been using MarketXLS for the last 6+ years and they really enhanced the product every year and now in the journey of bringing in AI...

MarketXLS is a powerful tool for financial modeling. It integrates seamlessly with Excel and provides real-time data.

I have used lots of stock and option information services. This is the only one which gives me what I need inside Excel.