Investors who generally follow a buy and hold strategy can make an extra income by adding options to their portfolio. In this article, we will learn about the covered call income generation strategy and how investors who are long underlying stocks can generate additional income with minimal risk. At the end of the article, you will also find an Options Strategies Excel Template. The excel template allows you to create any options strategy, view its profit and loss, and it also creates the payoff diagram of the strategy.

What is an Options Strategy?

An options strategy refers to buying and selling a combination of options along with the underlying assets to create a certain payoff. Any option strategy will involve the investor going long/short the stock and buying or writing call or put option contracts. The option strategies are generally classified as covered strategies, spread strategies and combined strategies. Covered strategies involve taking the position in the underlying stock and the option. Spread strategies involve taking positions in two or more call options of the same type to take advantage of the spread. In this article we will look at the covered call strategy.

Covered Call Income Generation Strategy

A covered call strategy involves being long on a stock and short on a call option of the same stock. In a call option, the writer (short) of the call option grants the buyer of the option the write to buy the underlying stock at the exercise price (which is fixed at the time of selling the option. There are two key components of a call option: 1) The exercise price (also called the strike price) which is the price on which the call option buyer has the right to buy the underlying stock. 2) The expiration date (the date on which an option expires and becomes worthless).

While building a covered call strategy, the holder of the stock is writing a call option on the same stock, i.e., he is granting the buyer the right to purchase the underlying stock at the pre-decided strike price. Selling the option earns the writer a small income called the premium. This is a conservative strategy because the seller of the option is taking only a limited risk as he already holds the underlying stock. The long position in the stock acts as a cover for the short position in the call option. Thereby, it protects the option seller from the market price of the stock. If the option buyer decides to exercise the option, the option seller that the option seller holds can be delivered.

Salient Features

Let’s review the salient features of a covered call income generation strategy:

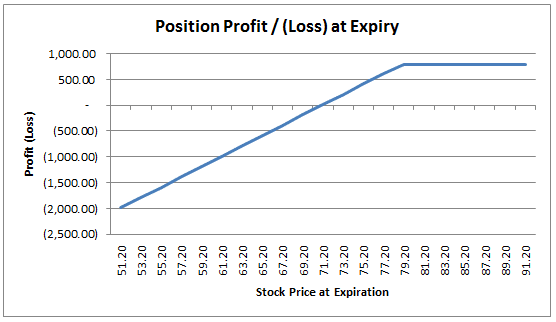

Strategy: Long 100 stocks + Short call option

When to use: Investor should consider this strategy if he is neutral to slightly bullish about the market.

Reward: Reward is limited in the form of the premium received. There is also a notional gain equivalent to the price rise upto the strike price.

Risk: Risk is limited from the short call but can significantly affect you if the stock prices fall.

Covered Call Example

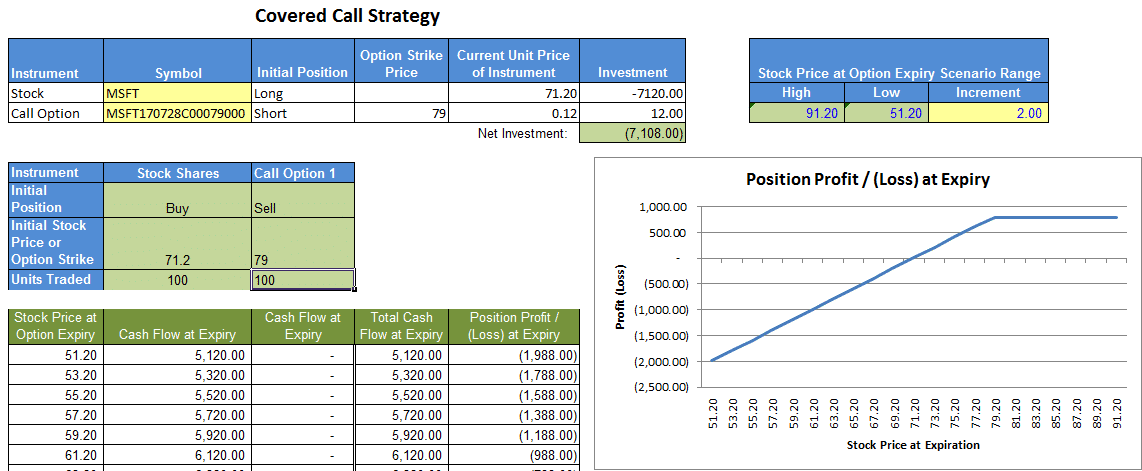

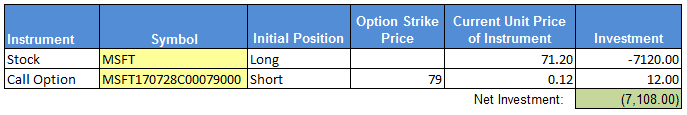

Let’s say an investor creates a covered call with the following details:

The payoff diagram for this covered call will look as follows:

Option Strategies Excel Template

You can download the attached Covered Call Strategy excel template that you can use to form a “covered call” strategy for any stock. The template allows you specify a stock and an options contract for that stock. Once you specify these details, the template will perform all calculations and plot the payoff diagram. Furthermore, the template uses MarketXLS functions to fetch real-time data for both stocks and options.