What is the iron butterfly strategy?

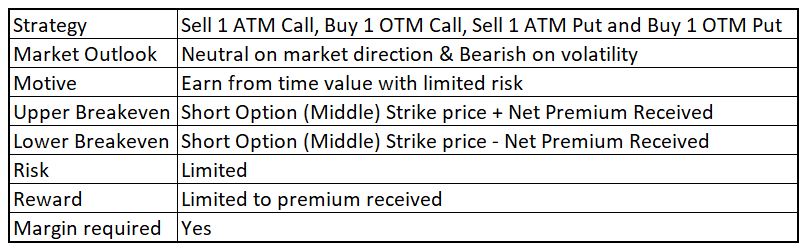

The short iron butterfly is an options trading strategy that involves the use of both call options and put options. The strategy is created by combining a bear call spread with a bull put spread with an identical expiration date that converges at a middle strike price.

Ideally, you want all of the options in this spread to expire worthless, with the stock at strike B. However, the odds of this happening are fairly low, so you’ll probably have to pay something to close your position.

It basically revolves around four options, each with the same date of expiry, just like the iron condor strategy. To execute an iron butterfly strategy, here are the four trades that you need to execute.

- But a put option at strike price A

- Sell a put option at strike price B

- Sell a call option at strike price B

- Buy a call option at strike price C

Here, all the three strike prices are equidistant and are in order of increasing value: A, B, C.

How to Use the Iron Butterfly?

Iron butterflies limit both possible gains and losses. They are designed to allow traders to keep at least a portion of the net premium that is initially paid, which happens when the price of the underlying security or index closes between the upper and lower strike prices. Market players use this strategy during times of lower volatility when they believe the underlying instrument will stay within a given price range through the options’ expiration date.

The nearer to the middle strike price the underlying closes at expiration, the higher the profit. The trader will incur a loss if the price closes either above the strike price of the upper call or below the strike price of the lower put. The breakeven point can be determined by adding and subtracting the premium received from the middle strike price.

Trading with MS excel

Let’s build short iron butterfly strategy in excel using the MarketXLS template.

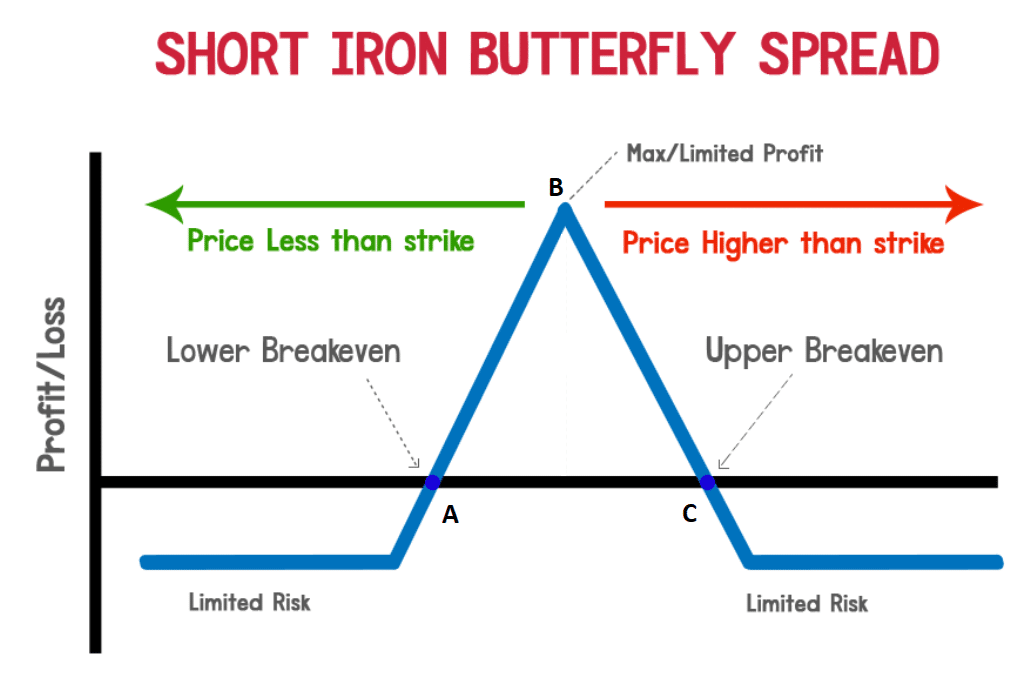

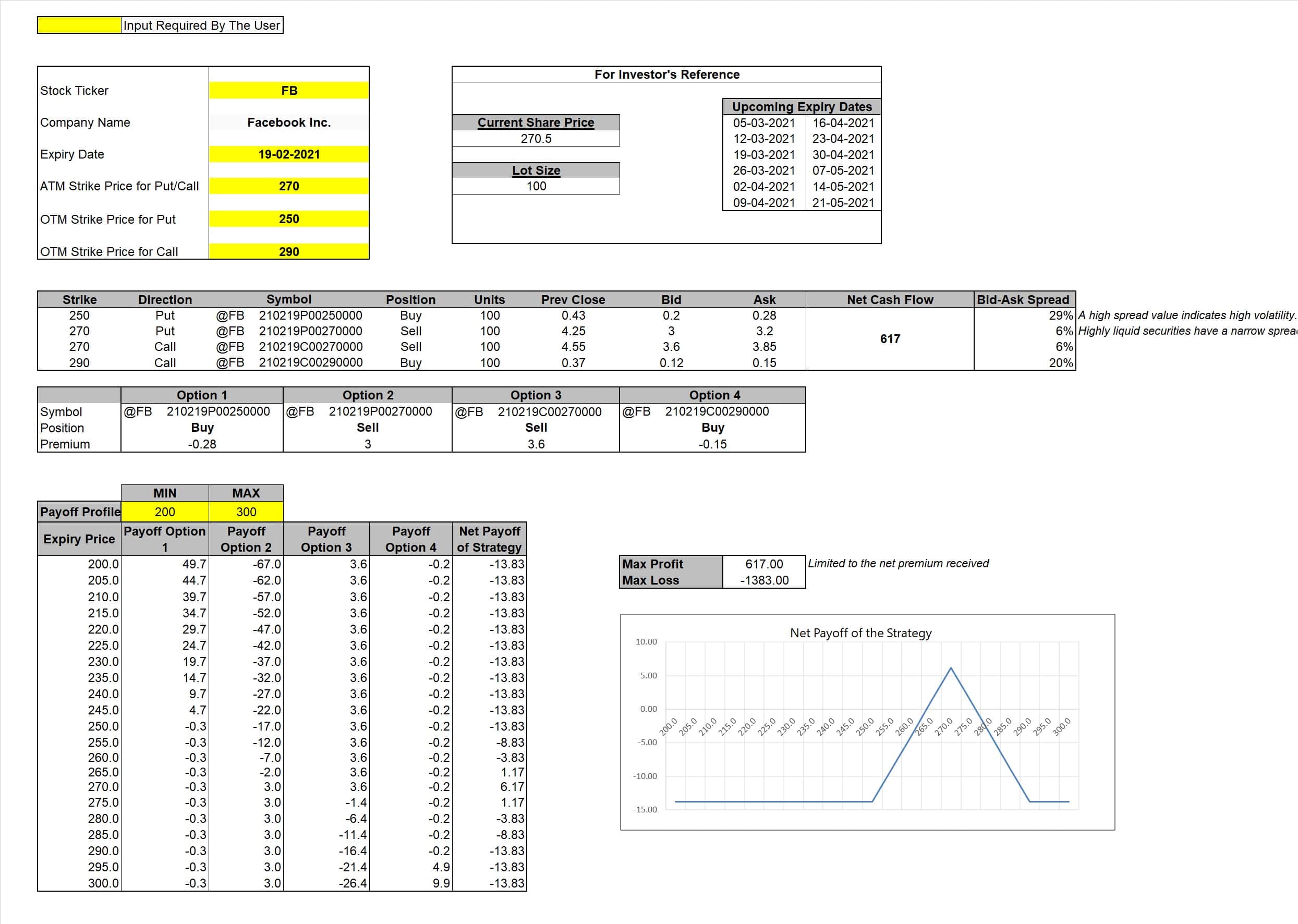

Provide the inputs

Provide the stock symbol, expiry date, ITM strike price, and Spread (higher strike – lower strike) for the strategy. Upcoming expiry dates are available for reference.

Here, we have built a short iron butterfly with FB. Currently, FB is trading at $270.5. We have selected strike prices of A = 250, B = 270 and C = 290. Our options will expire on 19-2-2021.

Strategy setup

- Bought one $245 OTM put option contract of FB at $0.28 (0.28*100).

- Sold one $270 ATM put option contract of FB at $3 (3*100).

- Sold one $270 ATM put option contract of FB at $3.6 (3.6*100).

- Bought one $290 OTM put option contract of FB at $0.15 (0.15*100).

- $300 + $360 – $28 – $15 = $617 initial net premium credit

Profit, loss, breakeven

The maximum profit potential is equal to the net credit received less commissions, and this profit is realized if the stock price is equal to the strike price of the short options (center strike) at expiration. In this outcome, all options expire worthless and the net credit is kept as income. The maximum profit as shown in the excel template is $617.

Maximum loss is equal to the spread’s cost—the amount paid to enter into the trade. Therefore, the maximum risk is limited to the amount you paid upfront while entering into the transaction. In our example, the maximum loss is limited to $1383.

There are two breakeven points. The strategy breaks even if at expiration the underlying stock is either above or below the body of the butterfly by the amount of premium received to initiate the position.

When to use the strategy?

A short iron butterfly spread realizes its maximum profit if the stock price equals the center strike price on the expiration date. The forecast, therefore, can either be “neutral,” “modestly bullish” or “modestly bearish,” depending on the relationship of the stock price to the center strike price when the position is established.

Impact of Options Greeks before the expiry

Impact of delta

Regardless of time to expiration and regardless of the stock price, the net delta of a short iron butterfly spread remains close to zero. The short iron butterfly spread does not profit from stock price change; it profits from time decay as long as the stock price is between the highest and lowest strikes.

Impact of time decay

The passage of time, all other things equal, will have a positive effect on this strategy.

Impact of change in volatility

Short iron butterfly spreads have a negative vega. This means that the net credit for establishing a short iron butterfly spread rises when volatility rises (and the spread loses money). When volatility falls, the net credit of a short iron butterfly spread falls (and the spread makes money). Short iron butterfly spreads, therefore, should be established when volatility is “high” and forecast to decline.

Conclusion

Like the iron condor strategy, the iron butterfly is also better suited for experienced traders. Here, when the stock price is exactly at the center strike price, the gains are at their highest. This strategy isn’t the best option in volatile market conditions, since the probability of the options expiring at the right price becomes slimmer when the stock price is fluctuating greatly.

Patience and trading discipline are required when trading short iron butterfly spreads. Patience is required because this strategy profits from time decay, and stock price action can be unsettling as it rises and falls around the center strike price as expiration approaches. Trading discipline is required, because, as expiration approaches, small changes in stock price can have a high percentage impact on the price of a butterfly spread.

Disclaimer

The author is not offering any professional advice of any kind. The reader should consult a professional financial advisor to determine their suitability for any strategies discussed herein.

the article is written for helping users collect the required information from various sources deemed to be an authority in their content. The trademarks if any are the property of their owners and no representations are made.

Reference

To learn more about Iron Butterfly, click here

To know about Iron Condor, click here