A Short Strangle Option Strategy involves selling both OTM call and OTM put options in the same underlying asset with the same expiry date but with different strike prices. The investor needs to sell the OTM Call Option and OTM Put Option under this strategy. This strategy is useful when markets or the asset show less volatility and lie in a specific range.

**Key features of the Short Strangle Option Strategy **Some of the critical aspects of a Short Strangle Option Strategy are as follows: –

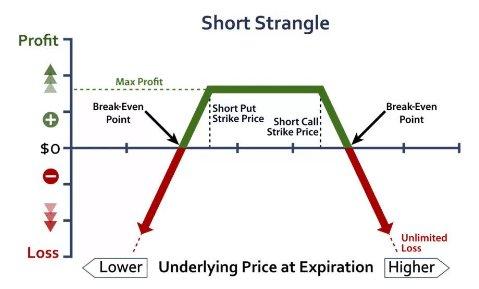

-Limited profit and unlimited riskA Short Strangle Option Strategy clearly defines the upper and lower-level limits with the OTM call and put options. The net premium received by the investor is his maximum profit under this strategy. The investor would earn a profit only when the stock remains within the two strike prices.

Investors should note that any high volatility and sharp change in options price beyond the given limit would expose them to unlimited risk. Thus, when using this strategy, investors should take the decision carefully after proper analysis.

Short Strangle Option Strategy

-Market neutral strategyMarket Neutral Strategy involves the investors profiting from both fall and rise in prices, thereby reducing the risk exposure. Short Strangle is a market-neutral strategy as it consists of placing both OTM call and OTM put options.

-Options of the same asset with the same expiry date in the same ratioThe options for which the investors enter an OTM position of buy and call for this strategy should be of the same asset and same expiry date. For example, the Investor is planning to use Short Strangle Option Strategy with the option of Microsoft. Here, the OTM Call and Put options should be both of Microsoft having the same expiry date.

The same ratio means that it can be 1:1, meaning that the investor sells 1 lot of Microsoft call option and 1 lot of Microsoft pull option. A ratio of 2:2 means selling 2 lots of Microsoft call option and 2 lot of Microsoft put option. Any uneven ratio such as 2:3 or 3:1 cannot be considered part of the Short Strangle Option Strategy.

###** Why should you use a Short Strangle Option Strategy?Various reasons are influencing the decision for an investor to go for a Short Strangle Option Strategy. Some of the reasons are as follows:a. Out of the Money (OTM) OptionsOTM or Out of the Money Option refers to having a strike price higher than the market price of the underlying asset when entering a call position and vice versa for a put position. These options are less expensive than at-the-money (ATM) or in-the-money (ITM) options, making them cheaper for the investors. b. Expectations of Low Volatility**An investor can use the short strangle strategy when an option is expected to remain within a pre-defined range. As any movement beyond the pre-defined range will expose the investor to unlimited risk, the option should have low volatility.c. Hedging market risk to a certain extentA Short Strangle Strategy is a market-neutral strategy that consists of both OTM call and OTM put options. As a result, the risk for the investor is low as he is trading in both call and put positions.

###** Let us understand the entire concept of Short Strangle Option Strategy with a detailed example.**Person A is using a Short Strangle Option Strategy. The current share price of Microsoft is $245. So, Person A will use a short strangle strategy by selling OTM put option with a strike price of $240 and an OTM call option of $250.

The opposite party, i.e., the buyer of put and call option, will exercise the option when the spot price of Microsoft share goes beyond $250 in case of a call option and below $240 in case of a put option.

*/}(https://marketxls.com/blog/wp-content/uploads/2021/03/SSOS.png)

Person A will benefit when the stock price remains between 240 and 250 and thus, the option will remain unexercised by the buyer of sell and put option. Person A will receive his premium, and the option would expire

###** How to use Short Strangle Options Strategy using MarketXLS?**

MarketXLS is an excel based platform with 600+ functions for stock and options analysis. Using a Short Strangle Option Strategy with the help of MarketXLS is quite simple. The user only needs to take the following steps in the template provided by MarketXLS:

-

Mention Stock ticker

-

Enter the Expiry date of the option. MarketXLS would provide a list of upcoming expiry dates adjacent to the input.

-

Enter the OTM Strike price for the put and call option

*/}(https://marketxls.com/blog/wp-content/uploads/2021/03/SSOS2.png)**Disclaimer**None of the content published on marketxls.com constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person.

The author is not offering any professional advice of any kind. The reader should consult a professional financial advisor to determine their suitability for any strategies discussed herein.

The article is written for helping users collect the required information from various sources deemed to be an authority in their content. The trademarks if any are the property of their owners and no representations are made.

###** References**