Short straddle

A short straddle is an options strategy comprised of selling both an ATM call option and an ATM put option with the same strike price and expiration date. It is used when a trader believes the underlying asset will not move significantly higher or lower over the lives of the options contracts. The maximum profit is the amount of premium collected by writing the options. The potential loss can be unlimited, so it is typically a strategy for more advanced traders. Since a trader sells two option contracts in this strategy, there is a net inflow of cash in the form of premiums. Unlike long straddle, a trader would not want the underlying to move significantly. Let’s understand this strategy with an MS excel template from marketXLS.

Trading with MS excel

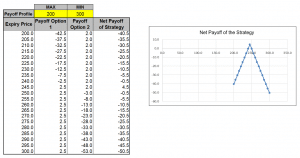

Below is a screenshot of the complete excel template that marketXLS provides for this strategy. This template has five major components. Let’s break them down one by one.

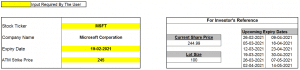

Input by user

In this section, you put the stock ticker and the expiry for the option of that underlying. You can select the expiry from section 2. Here, we have taken the example of MSFT (Microsoft Corporation) with an expiry of 19 Feb 2021.

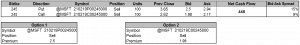

Execution

A short straddle involves selling an ATM call and an ATM put at the same strike and expiry. That’s exactly what the template shows—two legs of MSFT at $245 with an expiry of 19 Feb 2021. As a result, a net credit spread of $448 is created, which means you get paid upfront to open this trade. This is the maximum profit you would incur in this trade. This is the exact opposite of a long-straddle.

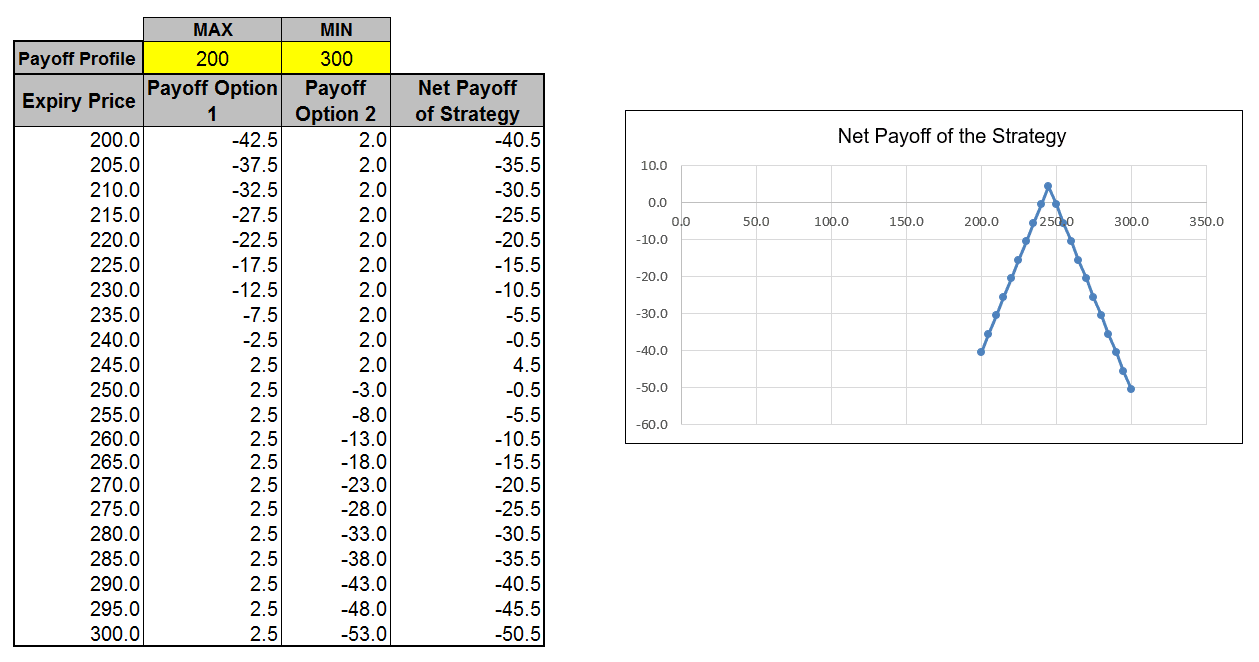

Profit, loss, breakeven

Normally traders calculate this manually based on various possible scenarios or the price of the underlying. The maximum profit earned in this strategy is the premiums, which in this case is $448 and the loss is unlimited as it will keep piling up as the price moves away from the strike on either direction. The template has a column for net payoff which tells the change in profit with respect to price of the underlying. The maximum profit is when the stock doesn’t make any movement. The breakeven point is around $5 away from the strike price on either direction, which is $240 on the bearish side and $250 on the bullish side.

Key takeaways

• Short straddle is a low volatility strategy. It is preferred when a trader expects the price of a stock to stay around the strike price. This is when a trader gains the most from this strategy.

Disclaimer

None of the content published on marketxls.com constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person.

The author is not offering any professional advice of any kind. The reader should consult a professional financial advisor to determine their suitability for any strategies discussed herein.

the article is written for helping users collect the required information from various sources deemed to be an authority in their content. The trademarks if any are the property of their owners and no representations are made.

References

Learn more about short straddle here.