Investing In The Information Technology Sector

Meet The Ultimate Excel Solution for Investors

- Live Streaming Prices Prices in your Excel

- All historical (intraday) data in your Excel

- Real time option greeks and analytics in your Excel

- Leading data in Excel service for Investment Managers, RIAs, Asset Managers, Financial Analysts, and Individual Investors.

- Easy to use with formulas and pre-made sheets

Importance of Technology

Technology has become very much advanced in today’s world. It is an important support activity of all sectors. It is the backbone of all the sectors. We are so much dependent on technology that we derive our necessities from it. Hence investing in the technology sector should be profitable as well as risky. Though technology has advanced rapidly in the past few decades, it is still in its beginner’s stage, and the best is yet to come. Thus, it will still boom in the future, making people and sectors more dependent on it. Since the coronavirus pandemic, most companies are running into losses, but the companies in the technology sector are making sky-high profits. This is because whether we work from the office or work from home, we will be dependent on technology for all the activities.

Why Invest in the IT sector?

The most important reason for investing in technology sector is that the technology sector is ever booming and is yet to achieve great heights. Hence, we can expect stocks to give huge returns in the long term.

The companies in the technology sector are at their all-time high. They have been performing exceptionally well since the pandemic has started.

Investing in the technology sector would make your portfolio diversified. It will prevent your portfolio from running into adverse losses during an unexpected market crash.

Tech stocks are growth stocks. This means that these stocks provide a good amount of return in the long term. Usually, they are valued at a high price, and investors have to pay a premium for these stocks because of the value and the returns they offer when the investors buy them.

It is the largest sector in the S&P 500, occupying a weightage of 27.60% in the index.

The sector contains opportunities for all types of investors, whether growth or value investors. Many stocks in this sector pay dividends regularly and provide growth as well. This ensures a guaranteed income for all the value investors.

Participants in the Information Technology Sector

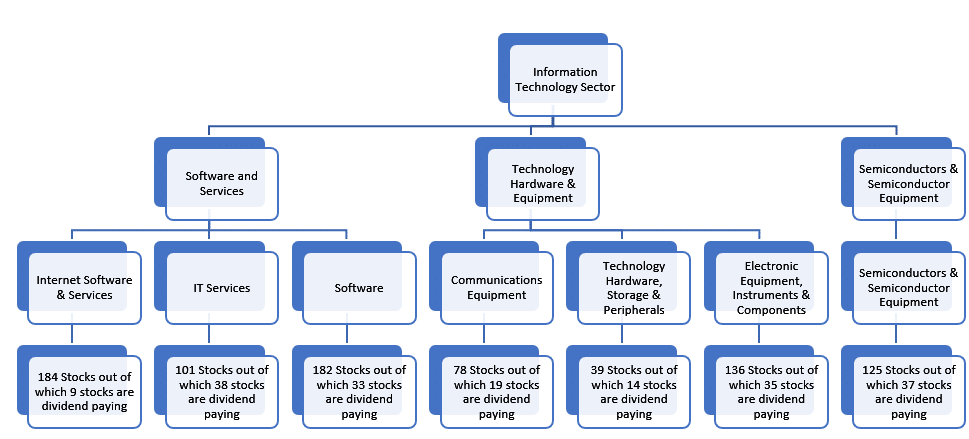

There are a massive number of participants in the technology sector. This makes the sector a diversified one. There are 845 stocks in the information technology sector. These stocks range from companies in internet software and services to companies in semiconductors and equipment.

Let us first understand what the companies of these two sub-sectors do:

Before investing in a particular sector, we need to do research about the primary participants. The major components of the sectors are hardware and software. Both are interrelated and interdependent. The growth of software will result in the growth of hardware.

Let us have a look at the overview of the sector.

Tech Stocks to Look Out For

In the past decade, we have seen considerable expansion and innovation in the technology sector. As a result, many stocks are showing good growth potential. I have listed a few exciting tech stocks that would fascinate you.

• Alphabet Inc. (NASDAQ: GOOGL)

Whenever anyone discusses about stocks in the technology sector, the first name that pops up in our minds is GOOGLE. It needs no introduction due to the brand reputation it has created, which is the biggest strength of the company. Its market cap is $1.54 trillion. It isn’t a dividend-paying stock.

• Apple (NASDAQ: AAPL)

It manufactures and sells electronic devices like iPhone, iPad, MacBook, etc. One of the biggest strengths of this Silicon Valley giant is its brand reputation and loyalty of its customers. The market capitalization of the company is $2.09 trillion, and it is a dividend-paying stock. The dividend yield of the company is 0.6%.

• PayPal Holding Inc. (NASDAQ: PYPL)

An online payment system facilitates online money transfers. Its biggest strength is its Strong Tech Background and its user-friendliness. Its market value is $297.5 billion, but it is not a dividend-paying stock.

• Broadcom (AVGO/”>NASDAQ: AVGO)

It is a firm that composes and designs communication chips used in an extensive range of electronics, which need connectivity via Wi-Fi, Bluetooth, etc. It is a blue-chip stock in the semiconductor sub-sector. Its market capitalization is $184.8 billion, and it is a dividend-paying stock. The dividend yield of the company is 3.24%.

• Salesforce.com (NASDAQ: CRM)

It is an incumbent in the cloud computing industry. It is one of the fastest-growing stocks of the S&P500. Its market capitalization is $199.7 billion. It does not give out dividends.

• Amazon (NASDAQ: AMZN)

Amazon is a blue-chip company in the e-commerce sector. It is a tech giant, which has a massive scope of growth in the future. Its most significant strength is its vast customer base and the value it provides to its customers. Its market capitalization is $166 billion, but it does not pay dividends.

• Qualcomm (NASDAQ: QCOM)

Qualcomm is an MNC with its headquarters in California. It creates and ideates software related to wireless technology. Its market capitalization is $144.8 billion. It is a dividend-paying stock, and its dividend yield is 1.89%.

• Microsoft (NASDAQ: MSFT)

It provides cloud-based internet services and a few mobile-friendly applications. It is one of the few trillion-dollar stocks on Wall Street. Its strength is its vast customer base. Its market value is $1.90 trillion, and its dividend yield is 0.91%.

• Tesla (NASDAQ: TSLA)

Tesla is an automobile manufacturing company having the latest technology. The famous industrialist Elon Musk owns it, and it specializes in manufacturing electric vehicles. Its market capitalization is $647.4 billion, and it does not pay out dividends.

• Alibaba Group (NASDAQ: BABA)

It is the Chinese equivalent of Amazon. It operates in the e-commerce industry and has a vast cloud division. Its market value is $4.62 trillion, and it does not pay out dividends.

(NOTE: These stocks are not recommendations made by us. It is just a list of stocks of few industry leaders that are diversified in different sub-sectors. The author is not offering any professional advice of any kind. The reader should consult a professional financial advisor to determine their suitability for any strategies discussed herein.)

Risks Associated

Until now, we saw the benefits and pros of investing in the IT sector. However, there are always risks associated with investing. We will discuss out the risks of investing in the IT sector.

Inflation risk: No sector is spared from the risks of inflation and changes in the price levels. The tech sector is the most affected due to the inflationary risks.

Headline risk: Headline risk refers to the risks that arise due to price fluctuations caused by stories in the media, which might affect a firm’s reputation. For example, recently, a piece of news flashed in the economy said extraction of lithium from its ores degrades the environment. Due to this, Tesla’s stock price fell by a considerable margin. The reason behind it is that the electric cars, which the tech giant manufactures, run on lithium.

Legislative risk: Changes in the IT sector caused by the changes in the laws and legislation related to the sector result in such risks. One adverse law passed by the government, which would impose some restrictions on all the industries operating in the technology sector, would result in a massive fall in the price of all the stocks in the technology sector.

Key Takeaways

Technology is and always going to be the need of the hour for all industries. It is the base of the operation for all the companies. Without technology, there is no growth for humankind. The pandemic has made everyone realize the importance and the benefits of technology.

This sector has attracted investors since the past few decades, and now it has become a pre-requisite in every investor’s portfolio

MarketXLS provides a ready-to-use template for facilitating comparison between various sectors. This analysis and comparison are made based on various parameters. They include Return on Equity, P/E Ratio, Dividend Yield, etc.

You can click here to go to the template.

For more such exciting content, please visit https://marketxls.com/blog/

Disclaimer

None of the content published on marketxls.com constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person.

The author is not offering any professional advice of any kind. The reader should consult a professional financial advisor to determine their suitability for any strategies discussed herein.

The article is written to help users collect the required information from various sources deemed to be an authority in their content. The trademarks, if any, are the property of their owners, and no representations are made. All trademarks referenced are the property of their respective owners. Other trademarks and trade names may be used in this document to refer to either the entity claiming the marks and names or their products. MarketXLS disclaims any proprietary interest in trademarks and trade names other than its own or affiliation with the trademark owner.

Reference

https://www.fool.com/investing/stock-market/market-sectors/information-technology/

https://www.kiplinger.com/investing/stocks/tech-stocks/602000/the-15-best-tech-stocks-for-2021

Image Source

https://www.fool.com/investing/investing-in-tech-stocks.aspx

I invite you to book a demo with me or my team to save time, enhance your investment research, and streamline your workflows.